tl;dr: Scotland's banks have too much assets for Scotland alone. It needs support by either the British in the Sterling monetary union, or the Eurozone.Secret liquidity and Scottish independence

Yes, it’s hardly a neutral document on the matter.

Still, there are lots of interesting charts in the UK government’s latest report on the finance and economics of Scotland becoming a sovereign state, this time covering the dangers from banks…

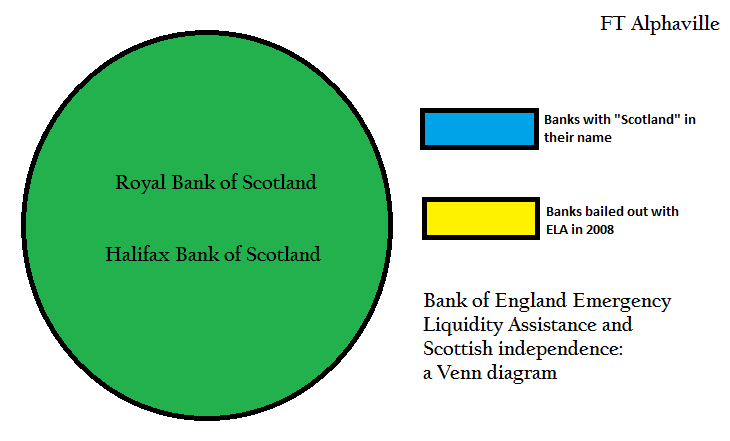

…Although we think they missed one.*

(Click to enlarge)

This is the real problem, isn’t it?

“Total use of ELA across both banks peaked at £61.6bn on 17 October [2008],” according to the Bank of England in November 2009 — when it finally brought these operations out from under their hitherto high degree of secrecy. (Lots more detail here, including the chart at below right.)

Obviously, both banks have been trying to shrink since then, and you also get caught in the game of groups and subsidiaries. Even so, Scotland’s still a roughly £150bn economy, even adding its geographical share of the North Sea oil.

So, sure, the Scottish subsidiaries of RBS Group and Lloyds Banking Group might help to encumber independent Scotland with assets of 1254 per cent of GDP, which sounds like a dangerous, Cyprus-level figure.** It goes well on a headline.

But you also can’t ignore how it could make Scotland the UK’s gimp in any future banking crisis under a sterling monetary union, right?

We’re talking about the scale of — and therefore the conditions upon — emergency liquidity that could be lent to banks in Edinburgh under the gaze of the central bank in London.

It’s a bit like emergency liquidity assistance in the eurozone crisis. It doesn’t just complicate the balance of power between a national central bank (which carries out ELA, supposedly never to insolvent banks which can’t repay) and its government (which guarantees ELA).

It also makes relations between both those parties and the ECB highly fraught. The ECB’s general council could meet by conference call tomorrow and decide that some ELA by a eurozone state has broken the relevant pact, or its interpretation of the conditions. It happened in Cyprus.

Now, back in Edinburgh…

We’re focused on a sterling zone, because it’s one of the monetary arrangements on the table for an independent Scotland. It’s also the arrangement that the Scottish government is sure it can get. After all when it comes to the closest alternative — what small, financial-centre state now would lightly consider heading to the euro, and to the tender mercies of those nice folks in Berlin and Frankfurt, for its liquidity and banking needs?

Well, anyway, even when it comes to sterling union, think very carefully what that might mean when for something like ELA.

A comparison might help here. There’s another section in Monday’s Treasury report that trashes the worth of a Scottish sovereign guarantee of bank deposits. Click the chart to enlarge:

You might find this section either bracing in its realism, or scaremongering, but at the least it is bonkers.

It’s an early sign of how ferocious the debate in 2014 could get that Westminster is willing to bring depositor flight out into the open. “A useful comparison can be drawn with the impact on Ireland’s deposit guarantee scheme… when the capacity of the scheme to meet claims against it was called into question in 2008-2009.” Now that’s trash-talking.

The UK central government’s point here of course is that Scotland will not be allowed to ‘share’ deposit guarantees with the UK, simply as a matter of EU law. That would be annoying for the Scottish government — it contrasts with its position that Scotland and the UK could regulate banks “on a consistent basis across the Sterling Zone”.

The point is, greater stress on the deposit guarantee payouts after a bank failure would make central bank liquidity before that point even more important. So what about ELA? Monday’s report suggests it would also face a major obstacle in EU law:

However, assistance provided by the Bank of England to Scottish firms where the funds were provided by the Scottish state or the Bank was indemnified by the Scottish state are likely to be treated as state aid – because the ultimate financial risk is borne by the Scottish state rather than the central bank. Such aid would need prior approval from the European Commission. Even if approval is given, it is likely to be given subject to conditions including conditions relating to restructuring of and divestments by the firm in question.

But state aid’s not the really big obstacle, surely. Emergency liquidity to Scottish banks in a sterling union would be a shared operation, whether lent directly by the Bank of England or monitored by it, as the union’s overall monetary authority with the ability to inspect what a Scottish central bank was up to.

The politics of that would be terrible, no? It would officially be the Scottish government’s risk to extend a guarantee — but it could be the BoE’s call on whether that guarantee was any good, whether it was being abused, and whether ELA was propping up insolvent banks. It isn’t just that Scotland’s fiscal resources might turn out inadequate for any of this stuff. It’s the humiliation.

Despite the fact that we already went down this road in 2008 — the fiscal arrangements just happened to be unified back then — you could say this has been an unduly speculative post.

After all, the ink is barely dry on the BoE’s post-crisis arrangements for ELA in the UK, as agreed with the fiscal authorities, and which continue to change. It’s difficult to think about how they might work in a still largely-hypothetical sterling union uniting two sovereigns.

But we’ve seen how it works in the eurozone, and it was horrible. A succession of smallish states with vulnerable banks found out the hard way how awkward the risk can be, both for fiscal-monetary relations, and for membership of monetary union. Never mind Cyprus having gone to the brink over its own secret liquidity, Ireland for instance got into ELA only to find it very hard to get out while still pleasing the ECB.

Of course ELA became necessary there because those countries bore the brunt of banking hubris. Scotland would never go in for that again… would it?

______________________________________

*Some might see this chart as unfairly focused on Scotland because we haven’t covered 2007, and the quintessentially English collapse of Northern Rock. It also needed ELA at huge risk to the taxpayer.

We’d argue that this liquidity took a different form to the 2008 ELA — it was public, for a start, without the legal structure that was later developed, and without the foreign-currency ELA that RBS needed. And as a general point, northeastern England isn’t likely to make a bid for independence in the nearish future.

**The Treasury’s definition of Scotland’s GDP here includes its geographical share of the North Sea oil and gas. On the other hand, its definition of banking assets doesn’t assume, whether or how, banking groups might relocate their corporate structure after independence.

Disclaimer: I'm not an opponent of Scottish independence.