Sergio Gabrielli disagrees with you. Here some salient points.Tritonic wrote: Testing aircraft on synthetic fuels which can be domestically produced from biomass waste (or natural gas, or coal) is a sign of progress, and the military is particularly concerned because they need to consider worst-case scenarios up to major wars disrupting oil imports.

- A new Saudi Arabia every three years is required to offset declines.

- Secondary and even extended recovery using NGL or CO2 injection will not offset such declines, which are now seen to be affecting even supergiants such as Khurais and Ghawar. There are now clear indicators the Saudis will experience hard declines.

- The rise in consumption within the KSA, and indeed, many resource exporting nations utilising new found wealth and population growth rates, means exports will take a hit, even without geological decline.

- There are reports that global decline rates, as a cumulative factor, are increasing. Your idea that Hubbert linearisation means multiple sine waves is patently false. It doesn't work that way, and makes me question your understanding of statistical analysis and field modelling.

- Prices have been growing at an increasingly rapid rate for the last decade to reflect the diminishing spare capacity worldwide. Given the precarious economic situation the globe finds itself in, we are finding it harder to remain with the growth paradigm during a time of increasingly expensive energy. Any nation where energy starts taking a larger share of GDP will experience hiccups that make BAU tricky, never mind growth (just look at the growth projections for the UK over the next few years released today).

The CEOs of several very large public and national oil companies disagree with you. Even Rex Tillerson would question your view here, and he's not one to openly praise the peak oil camp.

Look closely at the dark blue part of the prior graph from the IEA:

They *do* expect major declines in old conventional oil fields, many millions of barrels/day seen by 2020. Where they differ from you, though, is that there is also the continuing expansion of the other sources depicted. The industry has been playing this game of depleting one oil field to move onto the next (plus expanding other sources) for a long time, and they are rather good at it. Many local sources peaked and declined decades ago. One actually could have made a similar graph a couple decades ago, since the fields which were producing back in 1990 have often declined greatly. We aren't going to directly currently see the megaprojects of, say, 2025 as much as those scheduled for 2011, since, like in any other field, construction would not begin that far in advance.

It won't utterly last forever. There is, of course, a reason it is so valuable that electric vehicles are greatly improving and headed towards being more mainstream. But it is dragged out over a long period of time. I'm not sure if you fully appreciate how your prediction appears to someone is used to every single decade someone saying this exact year or several years is the turning point of rapid disaster. I half-expect to be here in 2012 watching you make a prediction then about a sharp cliff in 2014 or something.

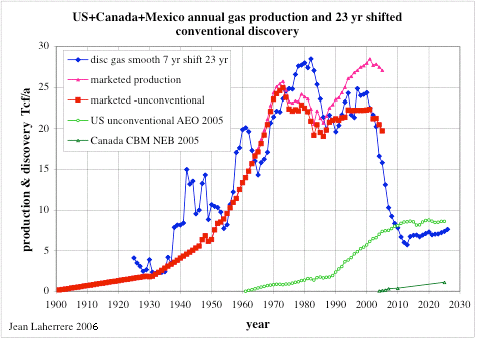

Look at this chart:

Do you see a problem? It should be quite apparent.

Thinking novel sources of oil, such as tar sands or shale, or even CTL, will make up this gap is simply a dream. The costs for tar sands, for instance, even as they are now at $85/bbl. has meant Shell has put all expansions of their project at the Athabasca tar sands on hold. That's one of the largest POCs on Earth, at some of the highest sustained prices for oil in history, saying that it just isn't enough. Keep in mind that a lot of these projects are also hideously dirty, and many owned by Chinese interests who won't be selling to Joe Sixpack if push comes to shove.

Remember, the plateaux we're on now has existed for some years. Even with record prices, we have not surpassed the output of 2005 for crude, or 2007/8 for all liquids. Also keep in mind that, despite Mike's comments to the contrary, my biology background is highly relevant to this situation. You can't pass Bio 101 without knowing the intimate details of entropy and thermodynamics, and ecology is all about this. The simple physics works against us, with bio-fuels offering their best EROEI in the tropics. Any species that devotes an ever increasing amount of its energy to acquiring more energy will eventually hit a ratio of 1:1 (for illustration, oil production in the US circa 1930 was around 100:1, meaning 100 barrels of oil for each one used. A healthy bottom line), and when this happens, no matter what technology or social movement is around, the species will die off to appropriate levels. The UK, for instance, could not, contrary to what you may think, run its airlines off rapeseed. Thermal depolymerisation, Fischer-Tropsch etc. are all very energy intensive processes, and neither can be scaled up and be competitively priced. There is no magic bullet. I would highly recommend reading David MacKay's book on renewable energy, even if it is more UK specific, it has some highly relevant points here relating to the physics and ecology.

Biofuels and CTL or tar sands require more energy to produce, so while nominal volumes may rise dramatically (the ethanol boom of a couple years ago in the US is an example, mainly via government subsidies), total net energy will not be so dramatic. It is cheap, easy oil disappearing that is the point of contention. Your pointing to alternative, heavy, sour and in some cases, totally unlike oil at all, examples to fight off the decline is indicative of how dire the situation is. This is the precise reason why prices are rising so fast and causing the receding horizons problem to occur. If the cost to produce the oil is too high, then the economy stalls (as we can see the credit crisis produced, which energy inflation facilitated). If the prices are too low, then this potential untapped oil stays just that: untapped. You can't sell oil at a loss, and no company will try, which led to a dramatic drop in rig count as the credit crunch hit, to the point that in the US for instance, natural gas prices dropped through to historical lows and caused problems with supply as no one wants to risk their neck in investing in a loss (this same logic applies to refinery capacity: if you can tell me why Big Oil isn't investing in more refinery capacity when you seem so confident in there being a continuation of BAU, and don't use the peak oil argument, then I'll buy you a beer).

No, they won't.Crude did indeed already peak long ago in terms of the most conventional crude. In many ways, that's a good thing, though, as it has spurred the development of other methods of getting liquid fuel, which is going to help us greatly as the most conventional supplies in old oilfields continue their decline.

Again, wrong. This is most certainly NOT how the relevant agencies and commentators measure the health of global oil output. You have not addressed the fact that these new projects coming onstream are only keeping us on a plateaux. They have not, and will not, give us more production.

The global picture has been so much different meanwhile, though, because it is a superposition of many curves which are not all in sync, for different oil fields and for other sources. As a loose analogy, this is a bit like a mathematical situation, where you have a bunch of sine waves out of sync, and then you superimpose them to get a function which is relatively more flat than any single curve.

You think that speculation happens in a vacuum? Of course it was speculation! Please, read up on the marginal barrel and its relevance to this situation. Screaming "Speculators!" when prices rise is missing the point entirely.

This really comes down to disputes over the specific numbers. Again, though, when you make such short-term predictions, the passage of time rapidly renders my arguments here unneeded and superfluous. I think the relative decline of oil prices after a largely speculation-driven jump a couple years ago did far more to tone down some of the 2007-2008 predictions on the internet than any argument meanwhile would have done so.

And I have already shown you that the numbers are not disputed, not in the least. Appealing to the idea that the US military, for instance, is only thinking of a worst case scenario is laughable. Read the actual report and tell me that. This isn't Air Force 2025 fantasy masturbation, this is a 2010 assessment of America's energy security.

EDIT: Well fuck, I was editing the last post and it wouldn't save, so it resent another. Delete the one above, it's not corrected.