Surlethe wrote:How is a one-time dip of the stock market to underneath the Great Depression trend somehow indicative that it will stay that way, and that somehow the current crisis is "worse than the Great Depression"? It's bad enough to jump from Wall Street trends to overall economic performance, let alone comparing the Dow and the S&P or using a single dip underneath the GD trend as evidence that our economic situation is worse than it was in the 1930s. For all we know, this is a short-term market dip, caused by irrational panic that will blow over in a few months and the line will rise back up to the red or green.

Indeed, there are multiple substantial reasons to believe this is worse than the Great Depression of '29 according Krassimir Petrov and others like Soros.

The one major similarity that is exacerbated by modern credit driven debt is the real estate issue. Consider the inflated property figures from the past economic problems with those of today.

It is abundantly clear that we have far surpassed the bubble of '29 with our reckless inflating of the property bubble and misuse of discretionary spending and credit instruments. Case-Shiller has been showing some alarming trends in the last few years that will lead, inevitably, to a correction that will dwarf all previous occurrences combined. Further, this is a global property bubble (one of the major differences between '29 and today is that this is

not a primarily US based problem; one need only look at Europe, for instance, especially the Eastern bloc) while '29 was just the US' own endeavour.

Causing this bubble, as we all know, was the cheap credit that afforded those on otherwise meagre salaries to start mortgages that far exceeded the traditional earnings to value ratio used normally, in some cases, with people nearing 10:1 on the property they want.

This chart is outdated. The present credit percentage is 350%. A correction is needed in order to return values to what the fundamentals support, and this means the last three and more decades of credit expansion need to be brought in line. This, also, will be significantly more than that of '29.

I think we've already established that derivatives, although present in the '20s, are far more widely used today which has led to the problems in finding out who has bad debts on their books by virtue of the whole system being needlessly complex: the world's ultimate shell game. Currently, the global derivatives market is over one quadrillion dollars in the latest analyses of the problem. This is far and beyond the US' GDP and that of the world's, something that has only really taken off without any controls since the early nineties.

Other factors include the

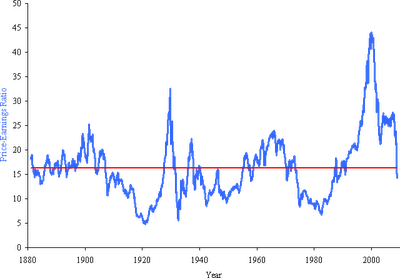

stock bubbles, like the property one; global money reserve increases; Bretton Woods II leading to a reserve currency with no basis within physical limits and emerging economies and populations for ever dwindling resources (Chindia, Brazil and Russia).

On top of that, the world has passed the peak of cheap oil globally and is in desperate need of further investment (on the order of $26 trillion or more) in order to maintain basic oil supply and a buffer for some economic growth. The IEA's WEO 2008 outlook casts serious doubt on the ability of non-OPEC nations to do anything about this, and OPEC has overinflated reserves of oil, with what additional capacity they can bring online being of a lower EROEI, high monetary and time input and offering lower output rates. This situation alone would cause severe economic problems even without the Credit Crunch, though it has been argued the financial problem now, despite eventually leading to a bust, was brought forward because of our energy problems manifesting since 2005.

The United States has also many other differences between now and '29. It is the largest debtor nation in history, with liabilities that can never be repaid. It has practically no manufacturing industry compared to the past, and imports a vast amount of materials and energy in exchange for a currency that has a questionable future at best. We also will see the first waves of "baby boomers" entering retirement in the next few years, paving the way for a larger, older non-workforce population being supported by a far smaller, younger workforce. The influx of immigrants from Mexico, which is also in the process of imploding given 40% of the government's revenue comes from PEMEX oil exports (with the added side-effect of the US losing 10% of its oil supply by 2012-13), will cause economic and social strains for the states bordering the nation. This while China and India relentlessly grow in order to standstill, a sort of economic red queen effect, thanks to the promises of a Western lifestyle and a population that even with lower birth rates, has grown too far already to not further strain the resource limits already been bumped against.

Keep in mind, in order for the economy to grow, cheap energy is mandatory. The idea that building nuclear or renewables will replace the loss of cheap oil is wishful thinking at best, dangerous at worst. With the economies still requiring the current system of energy to maintain any semblance of order, the ever dwindling availability of that energy will be required to also replace what infrastructure we have today, that is, every barrel of oil needs to be used twice: once to keep us with business as usual, and again to instigate the movement to a non-fossil fuel based future. With returns falling, and natural decline rates approaching 9% globally, and surpassing 30% in giant fields which produce the bulk of global oil output, it is doubtful current GDP can be maintained, much less grown to continue the Keynesian economic model we've been used to for so long. In an age of frozen credit lines, it is questionable the how future mega-projects for replacing ageing infrastructure etc. can be funded. The price of oil and other energy products, will indeed rise in the future, if only to fulfil the prophecy of energy price volatility as the higher prices further retard economic recovery (the law of receding horizons). The UK, especially, has problems due to the natural gas situation with more gas required to be pumped through the Interconnector from the continent and nations who have already clearly acknowledged that the UK is not a priority. A similar problem with Canada's natural gas supply can be seen thanks to the Athabasca project.

In summation, there are key differences and similarities between the present economic turmoil and that of the past. With much of what was done in the roaring '20s being taken to an unprecedented high and various natural and geo-political obstacles coming into being today that weren't around even a decade ago, it would be foolish to consider this past 18 months or so to be the sum total punishment for so many years of living beyond our means.