Russia’s foreign-currency credit rating was cut to junk by Standard & Poor’s, putting it below investment grade for the first time in a decade.

S&P, which last downgraded Russia in April, cut the sovereign one step to BB+, according to a statement released on Monday. The grade, which is on par with Bulgaria and Indonesia, has a negative outlook. Russia’s local currency ratings were reduced to BBB-, the lowest investment grade.

The world’s biggest energy exporter is on the brink of a recession after oil prices fell to the lowest since 2009 and the U.S. and its allies imposed sanctions over President Vladimir Putin’s actions in Ukraine. The penalties have locked Russian corporate borrowers out of international debt markets and curbed investor appetite for the ruble, stocks and bonds.

“Russia’s monetary-policy flexibility has become more limited and its economic growth prospects have weakened,” S&P said in a statement. “We also see a heightened risk that external and fiscal buffers will deteriorate due to rising external pressures and increased government support to the economy.”

The ruble, the world’s second-worst performer last year after a 46 percent plunge against the dollar, plummeted after the S&P decision and was trading 7.5 percent weaker at 69.0615 versus the U.S. currency at 10:57 p.m. in Moscow.

A cut to below investment grade could force ratings-sensitive investors to sell their remaining debt holdings.

“We had thought that the cut to junk was largely priced in, but the ruble is under pressure now and most likely the weakness will continue in the morning, and there’s likely going to be selling in bonds.” Dmitry Polevoy, an economist at ING Groep in Moscow, said by e-mail.

A selloff in local-currency bonds, known as OFZs, will be limited because they’re still rated above investment grade, according to Polevoy.

The rating company’s move showed “excessive pessimism,” Russian Finance Minister Anton Siluanov said in a statement.

“There’s no reason to dramatize the situation,” Siluanov said. “The decision shouldn’t have a further serious impact on the capital market because market participants already priced in the risks of a downgrade to Russia’s credit rating.”

Policy makers are struggling to contain the country’s worst currency crisis since 1998. The central bank shifted to a free-floating exchange rate ahead of schedule in November and is overseeing a 1 trillion-ruble ($15 billion) bank recapitalization plan. On Dec. 16, the central bank took its biggest step to shore up the currency, raising its key interest rate to 17 percent from 10.5 percent in a surprise announcement just before 1 a.m. in Moscow that day.

“We believe that Russia’s financial system is weakening and therefore limiting the central bank of Russia’s ability to transmit monetary policy,” S&P said. “The central bank faces increasingly difficult monetary policy decisions while also trying to support sustainable GDP growth.”

While policy makers spent $88 billion in interventions last year to prop up the currency, President Vladimir Putin last month scolded the regulator for not reacting to the crisis more quickly. The central bank replaced its head of monetary policy in January, selecting Dmitry Tulin to take on Ksenia Yudaeva’s role in the biggest leadership change since Governor Elvira Nabiullina took charge in June 2013.

Fitch Ratings and Moody’s Investors Service both downgraded Russia to their lowest investment grades this month.

Investors often disregard ratings companies’ credit grade and outlook changes. France’s 10-year yield, which was 3.08 percent when S&P removed its top rating in January 2012, tumbled to a record-low 1.339 percent on Aug. 15 this year.

“The trend of deteriorating ratings is more important than the rating cut itself,” Aleksei Belkin, chief investment officer at Kapital Asset Management LLC in Moscow, said by e-mail. “The cut was rather widely expected and for all practical purposes was well telegraphed and discounted. I am afraid we will see more selling, not panic selling, but positions will be trimmed again.”

Cut ‘Unjustified’?

Russian officials have bristled at the prospects of rating cuts after S&P last month put the nation’s debt on review for a potential downgrade. A decrease would be “unjustified,” compounding the risks for the economy already brought by sanctions, Economy Minister Alexei Ulyukayev said this month. Putin’s economic aide Andrey Belousov said Jan. 15 that a possible downgrade was already priced in, setting the stage for the ruble’s appreciation.

Even so, the government has acknowledged that the country faces a period of adversity. Russia is in an “extremely difficult” economic situation and must prepare for a hard landing, with the looming challenges worse than the crisis in 2008-2009, First Deputy Prime Minister Igor Shuvalov said last week.

To temper the effects of the unfolding slump, Russia is preparing an anti-crisis program that’s estimated to cost 1.4 trillion rubles, according to Shuvalov.

S&P predicts Russia’s economy will expand about 0.5 percent a year in 2015-2018, slowing from the 2.4 percent pace of the previous four years. Gross domestic product may contract 4 percent to 5 percent this year if oil prices remain at $45 a barrel, according to the Economy Ministry.

“Although the cut was expected our main concern are Russia’s possible counter-measures,” Vladimir Miklashevsky, a strategist at Danske Bank A/S, said by e-mail. “Expectations of retaliation will depress all Russian assets this week.”

Russian credit downgraded to Junk status by S&P

Moderators: Alyrium Denryle, Edi, K. A. Pital

Russian credit downgraded to Junk status by S&P

http://www.bloomberg.com/news/2015-01-2 ... ecade.html

You will be assimilated...bunghole!

- K. A. Pital

- Glamorous Commie

- Posts: 20813

- Joined: 2003-02-26 11:39am

- Location: Elysium

Re: Russian credit downgraded to Junk status by S&P

Totally expected.

Lì ci sono chiese, macerie, moschee e questure, lì frontiere, prezzi inaccessibile e freddure

Lì paludi, minacce, cecchini coi fucili, documenti, file notturne e clandestini

Qui incontri, lotte, passi sincronizzati, colori, capannelli non autorizzati,

Uccelli migratori, reti, informazioni, piazze di Tutti i like pazze di passioni...

...La tranquillità è importante ma la libertà è tutto!

Lì paludi, minacce, cecchini coi fucili, documenti, file notturne e clandestini

Qui incontri, lotte, passi sincronizzati, colori, capannelli non autorizzati,

Uccelli migratori, reti, informazioni, piazze di Tutti i like pazze di passioni...

...La tranquillità è importante ma la libertà è tutto!

Assalti Frontali

-

Simon_Jester

- Emperor's Hand

- Posts: 30165

- Joined: 2009-05-23 07:29pm

Re: Russian credit downgraded to Junk status by S&P

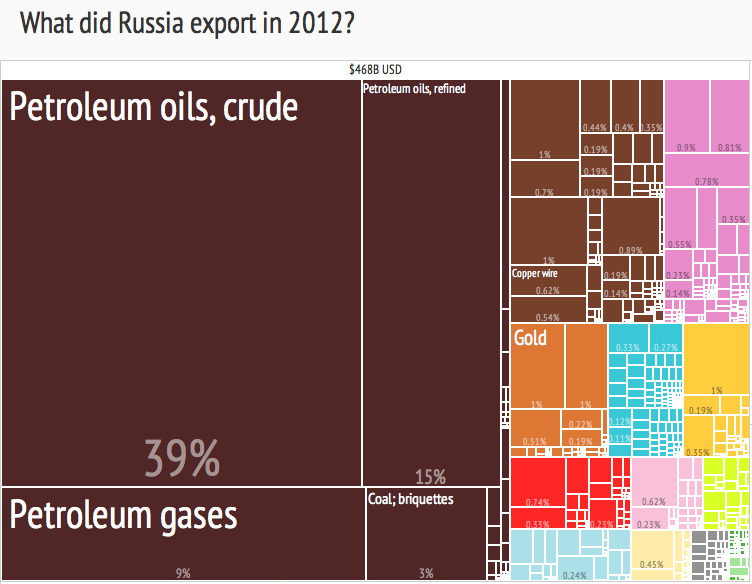

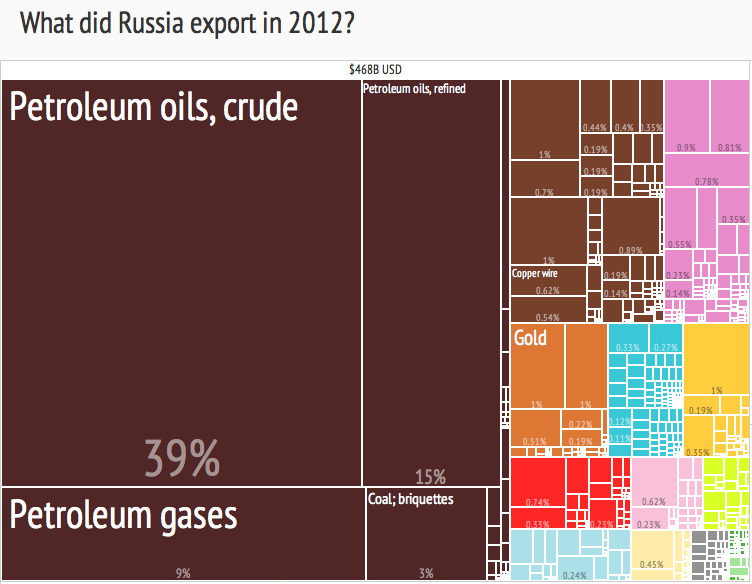

Uh, most of those boxes are not labeled at all, could you give us some idea of what the colors represent? Aside from, obviously, the big dark brown region on the left being various fossil fuels.

This space dedicated to Vasily Arkhipov

Re: Russian credit downgraded to Junk status by S&P

I think the take away point of the picture is that more than 50% of Russia's exports this past year were on Petroleum or it's products, and since crude oil price has crashed to below 50% of it's value then this obviously means that Russia is in fucking big trouble.Simon_Jester wrote:Uh, most of those boxes are not labeled at all, could you give us some idea of what the colors represent? Aside from, obviously, the big dark brown region on the left being various fossil fuels.

Η ζωή, η ζωή εδω τελειώνει!

"Science is one cold-hearted bitch with a 14" strap-on" - Masuka 'Dexter'

"Angela is not the woman you think she is Gabriel, she's done terrible things"

"So have I, and I'm going to do them all to you." - Sylar to Arthur 'Heroes'

Re: Russian credit downgraded to Junk status by S&P

Found the origin of that, for those who are curious.

http://atlas.cid.harvard.edu/explore/tr ... show/2012/

Low detail is nice for an "At a glance" image of economic diversity.

http://atlas.cid.harvard.edu/explore/tr ... show/2012/

Low detail is nice for an "At a glance" image of economic diversity.

- mr friendly guy

- The Doctor

- Posts: 11235

- Joined: 2004-12-12 10:55pm

- Location: In a 1960s police telephone box somewhere in Australia

Re: Russian credit downgraded to Junk status by S&P

Wouldn't we need to know how much of Russia's economy is exports for the full impact of the graph to make sense? If say exports are a small percentage of the economy compared to investment and consumption, then falling oil prices won't hit as hard. I suspect however its not the case, although some figures would be nice.

Never apologise for being a geek, because they won't apologise to you for being an arsehole. John Barrowman - 22 June 2014 Perth Supernova.

Countries I have been to - 14.

Australia, Canada, China, Colombia, Denmark, Ecuador, Finland, Germany, Malaysia, Netherlands, Norway, Singapore, Sweden, USA.

Always on the lookout for more nice places to visit.

Countries I have been to - 14.

Australia, Canada, China, Colombia, Denmark, Ecuador, Finland, Germany, Malaysia, Netherlands, Norway, Singapore, Sweden, USA.

Always on the lookout for more nice places to visit.

Re: Russian credit downgraded to Junk status by S&P

If I were China I would now buy up the bonds. A russian default is unlikely and this would give them even more influence.

Whoever says "education does not matter" can try ignorance

------------

A decision must be made in the life of every nation at the very moment when the grasp of the enemy is at its throat. Then, it seems that the only way to survive is to use the means of the enemy, to rest survival upon what is expedient, to look the other way. Well, the answer to that is 'survival as what'? A country isn't a rock. It's not an extension of one's self. It's what it stands for. It's what it stands for when standing for something is the most difficult! - Chief Judge Haywood

------------

My LPs

------------

A decision must be made in the life of every nation at the very moment when the grasp of the enemy is at its throat. Then, it seems that the only way to survive is to use the means of the enemy, to rest survival upon what is expedient, to look the other way. Well, the answer to that is 'survival as what'? A country isn't a rock. It's not an extension of one's self. It's what it stands for. It's what it stands for when standing for something is the most difficult! - Chief Judge Haywood

------------

My LPs

Re: Russian credit downgraded to Junk status by S&P

You're wrong. Look at the OP - as number of economists said already, both factors nullify themselves to large degree. Falling rouble means Russian exporters get roughly the same amount of roubles for oil despite falling prices. Russian budget transfers and worker wages are both in roubles so they didn't really noticed anything on that front yet, so far. Putin is safe as long as economy continues to grow, even slowly as noted in first post.Crown wrote:I think the take away point of the picture is that more than 50% of Russia's exports this past year were on Petroleum or it's products, and since crude oil price has crashed to below 50% of it's value then this obviously means that Russia is in fucking big trouble.

Now, where falling rouble matters is their currency reserves - but alas, due to sanctions they can't do much with them anyway. Fall also matters for importers - but here, Russia doesn't really trade with USA so that is not important. Russia does trade with EU so fall would make their trade deficit larger, perhaps even move EU to have positive trade balance with Russia - but oops, Russian counter-embargo forced importers to move onto cheaper countries where incidentally currencies didn't jumped as much. So while important, that factor is limited too, unless you're Russian oligarch buying new collection of 2015 gold plated Swiss watches.

You want to know who really is in big fucking trouble? Let's see:

I'd read the full article on Guardian - the maps and graphs have larger impact than just dry words. Badly thought out embargo hurting the very Ukraine it's supposed to "save" and Baltic EU countries (plus border countries like Finland, Poland, and Slovakia, where people didn't rely on remittances but entire eastern fringes of these lived off border trade with Russians and now are in recession). Who could have seen that coming? Oh, wait, everyone who actually seen the regionRussia’s rouble crisis poses threat to nine countries relying on remittances

Drop in rouble value not only decimating amount sent home by workers from Caucasus and central Asia, but could lead to political unrest

According to data projections based on World Bank figures, nine countries that rely heavily on roubles sent home from Russia could collectively lose more than $10bn in 2015.

Russia’s rouble crisis is posing a major threat to countries along its southern fringe, whose economies rely heavily on billions of dollars shipped home every year by their own citizens working within Russia.

The 50% drop in the rouble has not only decimated the value of remittances sent home by workers from the Caucasus and central Asia, but is discouraging migrants from staying in Russia to earn a salary for themselves and their families. According to data projections by the Guardian, based on World Bank figures, nine countries that rely heavily on cash sent home from Russia for their economic buoyancy could collectively lose more than $10bn (£6.6bn) in 2015 because of the weak Russian currency.

“I’ve sacrificed starting a family, I’ve sacrificed any kind of normal life to work here, and now I’m only able to send home a few hundred dollars a month,” said Aziz, who works at a car repair plant in northern Moscow. His regular job and some moonlighting as a cab driver has typically earned him around £600 per month to send home to his parents and sisters, who live in the Fergana valley in Uzbekistan. Now he is lucky to earn half that sum. “I’m starting to think there is not much point in staying. Life is miserable enough here anyway, the only reason to be here was for the money. I think it could be time to go home.”

Aziz is not the only person thinking about leaving. As the economic situation in Russia deteriorates, authorities have also introduced a new harsher system for obtaining work permits for migrant workers. Currently, there are millions of citizens of former Soviet countries working illegally in Russia.

“So far people are not leaving en masse, mainly because they are worried they won’t be able to come back,” says Gavkhar Dzhurayeva, who runs an organisation offering free legal support to migrant workers. “However, lots of people are talking about it, if things don’t improve.”

According to the World Bank, 21% of Armenia’s economy, 12% of Georgia’s, 31.5% of Kyrgyzstan’s, 25% of Moldova’s, 42% of Tajikistan’s, 5.5% of Ukraine’s, 4.5% of Lithuania’s, 2.5% of Azerbaijan’s and 12% of Uzbekistan’s, rely on remittances.

These are some of the highest rates in the world. Of the five countries globally whose GDP is most reliant on these payments, three are former Soviet republics. In most of these cases money from immigrants in Russia comprises a significant portion of these inflows. About 40% of remittances to Armenia, Georgia, Moldova and Ukraine are from Russia, rising to 79% for Kyrgyzstan.

Already, the sharp decline in the rouble has forced currency devaluations in Turkmenistan this month, and speculation that Kazakhstan’s tenge may need a further devaluation against the dollar after a 19% move last February.

The economies of the region are strongly tied together, with Belarus sending more than half of its exports to Russia, and the nascent Eurasian Economic Union supposedly tying together Russia, Belarus and Kazakhstan as a single bloc. Armenia and Kyrgyzstan have also joined. In addition to the plummeting rouble, these countries will also have to deal with a potentially huge shortfall in remittances, which cannot but have an effect on GDP.

In October 2014 the World Bank estimated that remittances for the year to the nine countries mentioned earlier would have totalled $33.3bn by the end of 2014. Of this figure, about $19bn would have been outflows from Russia.

At the time of the World Bank estimate, one US dollar exchanged for 40 roubles. By the end of the year, the currency had lost about 50% of its value. If that new rate held steady throughout this year – and remittances were otherwise unchanged – their value would drop precipitously in 2015, to just $7.6bn.

It is also worth noting that the figures given are the official numbers, sent via bank transfers. The real amounts, which include wads of dollars brought home in person by migrants or given to friends to carry, are likely to be much higher.

A weak rouble over a sustained period of time would have a minimal impact in the Baltics, but in several other countries the effects could be felt far more. In those countries where GDP relies so heavily on migrants sending money back home, a prolonged currency crisis throughout 2015 would, all other factors remaining the same, potentially even lead to double-digit economic contraction.

Most vulnerable are the central Asian countries of Kyrgyzstan, Tajikistan and Uzbekistan, where the ailing economies and dictatorial political systems are in large part propped up by the money from its nationals working in Russia.

In Uzbekistan, ageing dictator Islam Karimov said in 2013 that migrant workers who went to Russia were “lazy” and should find a job at home, but in reality, there is little work in Uzbekistan, where £100 per month is considered a good salary and many towns simply have no opportunity for work at all. Regional experts say that if the money flow from migrant labourers dries up, rulers like Karimov would be in serious trouble.

“If oil continues falling and the rouble continues falling, then migrants will begin to return home,” says Daniil Kislov, who runs fergana.ru, a central Asia news portal. “There are 2.4 million Uzbek migrants in Russia, and those are just the official figures. These people and their families are all surviving because of money made in Russia. Essentially Russia has saved Uzbekistan and Tajikistan from revolution, and if all these people return it will cause a social explosion. Not today, but maybe in a year, or two, or five.”

And one more thing. The other group mentioned in the article - Kyrgyzstan, Tajikistan and Uzbekistan. These are Muslim countries with radical Muslim movements spreading there from Afghanistan. Guess where people there turn if these countries fall into deep economic crisis? Why yes, to well funded extremists. I wonder what embargo planners will say if their brainchild ends up creating another ISIS? "Oops"? Or maybe "just as planned"?

Re: Russian credit downgraded to Junk status by S&P

Oh, and something else that caught my eye but since I verified it the edit window closed:

Let's take a look at 9 countries that have highest AAA status in all rating agencies (link).

Nr 1, Australia: http://atlas.cid.harvard.edu/explore/tr ... show/2012/

Nr 6, Norway: http://atlas.cid.harvard.edu/explore/tr ... show/2012/

Oh, somehow that looks suspiciously similar to your Russia picture. And they are not the only ones - if you look at Iceland, Canada, Holland, Scotland and several other first world countries the energy exports in some form, direct or indirect, also take just as big slice of export pie as in Russia. If you add agricultural products as simple resource export, the number grows even bigger. Are these basket cases too?

I saw that picture of Russian export on various blogs (mostly right wing ones) lots of times but virtually no one ever bothered to explain in his own words why it's unusual and/or bad, just simple "lol Russia sells oil and nothing more". All while ignoring that compared to above countries, Russia also has internal market about as big as all of above combined. So, that picture is even less useful for saying anything about production.

Yes, I guess it would be nice if export structure looked like in Switzerland or Germany, but saying that needs to be the case is like the economy "experts" proposing to solve unemployment by making everyone start their own company and become CEO. That is, not very practical, unless you find 1-2 billion extra consumers somewhere willing to absorb industrial production glut it would cause.

May I ask how it follows, exactly?Stas Bush wrote:Totally expected.

Let's take a look at 9 countries that have highest AAA status in all rating agencies (link).

Nr 1, Australia: http://atlas.cid.harvard.edu/explore/tr ... show/2012/

Nr 6, Norway: http://atlas.cid.harvard.edu/explore/tr ... show/2012/

Oh, somehow that looks suspiciously similar to your Russia picture. And they are not the only ones - if you look at Iceland, Canada, Holland, Scotland and several other first world countries the energy exports in some form, direct or indirect, also take just as big slice of export pie as in Russia. If you add agricultural products as simple resource export, the number grows even bigger. Are these basket cases too?

I saw that picture of Russian export on various blogs (mostly right wing ones) lots of times but virtually no one ever bothered to explain in his own words why it's unusual and/or bad, just simple "lol Russia sells oil and nothing more". All while ignoring that compared to above countries, Russia also has internal market about as big as all of above combined. So, that picture is even less useful for saying anything about production.

Yes, I guess it would be nice if export structure looked like in Switzerland or Germany, but saying that needs to be the case is like the economy "experts" proposing to solve unemployment by making everyone start their own company and become CEO. That is, not very practical, unless you find 1-2 billion extra consumers somewhere willing to absorb industrial production glut it would cause.

- Soontir C'boath

- SG-14: Fuck the Medic!

- Posts: 6866

- Joined: 2002-07-06 12:15am

- Location: Queens, NYC I DON'T FUCKING CARE IF MANHATTEN IS CONSIDERED NYC!! I'M IN IT ASSHOLE!!!

- Contact:

Re: Russian credit downgraded to Junk status by S&P

So is there a Russian eBay that ships cheap items to America?

I have almost reached the regrettable conclusion that the Negro's great stumbling block in his stride toward freedom is not the White Citizen's Counciler or the Ku Klux Klanner, but the white moderate, who is more devoted to "order" than to justice; who constantly says: "I agree with you in the goal you seek, but I cannot agree with your methods of direct action"; who paternalistically believes he can set the timetable for another man's freedom; who lives by a mythical concept of time and who constantly advises the Negro to wait for a "more convenient season."

Re: Russian credit downgraded to Junk status by S&P

Irbis wrote:You're wrong. Look at the OP - as number of economists said already, both factors nullify themselves to large degree.Crown wrote:I think the take away point of the picture is that more than 50% of Russia's exports this past year were on Petroleum or it's products, and since crude oil price has crashed to below 50% of it's value then this obviously means that Russia is in fucking big trouble.

Huh? Where does it say any of that in the OP?

More than willing to concede this.Irbis wrote:Falling rouble means Russian exporters get roughly the same amount of roubles for oil despite falling prices. Russian budget transfers and worker wages are both in roubles so they didn't really noticed anything on that front yet, so far. Putin is safe as long as economy continues to grow, even slowly as noted in first post.

Η ζωή, η ζωή εδω τελειώνει!

"Science is one cold-hearted bitch with a 14" strap-on" - Masuka 'Dexter'

"Angela is not the woman you think she is Gabriel, she's done terrible things"

"So have I, and I'm going to do them all to you." - Sylar to Arthur 'Heroes'

- K. A. Pital

- Glamorous Commie

- Posts: 20813

- Joined: 2003-02-26 11:39am

- Location: Elysium

Re: Russian credit downgraded to Junk status by S&P

They already are.Thanas wrote:If I were China I would now buy up the bonds. A russian default is unlikely and this would give them even more influence.

Lì ci sono chiese, macerie, moschee e questure, lì frontiere, prezzi inaccessibile e freddure

Lì paludi, minacce, cecchini coi fucili, documenti, file notturne e clandestini

Qui incontri, lotte, passi sincronizzati, colori, capannelli non autorizzati,

Uccelli migratori, reti, informazioni, piazze di Tutti i like pazze di passioni...

...La tranquillità è importante ma la libertà è tutto!

Lì paludi, minacce, cecchini coi fucili, documenti, file notturne e clandestini

Qui incontri, lotte, passi sincronizzati, colori, capannelli non autorizzati,

Uccelli migratori, reti, informazioni, piazze di Tutti i like pazze di passioni...

...La tranquillità è importante ma la libertà è tutto!

Assalti Frontali

Re: Russian credit downgraded to Junk status by S&P

Great find, Stas! It really shows how Russia has failed to diversify its economy and with the prices crashing and with the sanctions, it's understandable how Russia has found itself in this situation.Stas Bush wrote:Totally expected.

- K. A. Pital

- Glamorous Commie

- Posts: 20813

- Joined: 2003-02-26 11:39am

- Location: Elysium

Re: Russian credit downgraded to Junk status by S&P

What is even more interesting is that if you take the data back to 1995, you will see how oil was a much smaller share back then; Russia's exports really primitivized over the last decade, steadily becoming more and more oil-gas and generally raw resource-dependent.Mange wrote:Great find, Stas! It really shows how Russia has failed to diversify its economy and with the prices crashing and with the sanctions, it's understandable how Russia has found itself in this situation.

What Irbis doesn't understand is that unlike the other oil producers who are not sanctioned simultaneously with the falling price, Russia cannot take new credits at a low rate in the West any more, as it's been cut off from the credit supply, but it still has to pay its obligations in hard currency - a similar thing happened with Iran's currency. They had to pay back in dollars and their local currency crashed massively when hit by sanctions.

Admittedly, the sanctions against Iran were much stronger (including a SWIFT cut-off), but the oil prices were much, much higher too - at 100+ dollars.

Lì ci sono chiese, macerie, moschee e questure, lì frontiere, prezzi inaccessibile e freddure

Lì paludi, minacce, cecchini coi fucili, documenti, file notturne e clandestini

Qui incontri, lotte, passi sincronizzati, colori, capannelli non autorizzati,

Uccelli migratori, reti, informazioni, piazze di Tutti i like pazze di passioni...

...La tranquillità è importante ma la libertà è tutto!

Lì paludi, minacce, cecchini coi fucili, documenti, file notturne e clandestini

Qui incontri, lotte, passi sincronizzati, colori, capannelli non autorizzati,

Uccelli migratori, reti, informazioni, piazze di Tutti i like pazze di passioni...

...La tranquillità è importante ma la libertà è tutto!

Assalti Frontali

Re: Russian credit downgraded to Junk status by S&P

Sorry, by that I meant prices of currency and oil mentioned there. In the immediate term, it doesn't matter if you get 100$ per barrel with 40 roubles per dollar or 50$ per barrel with 80 roubles per dollar, local money you get stays the same. Well, it sucks when you need to import but so far Russia had big trade surplus there, Putin won't be in big trouble until government will be in red with rouble transfers.Crown wrote:Irbis wrote:Look at the OP - as number of economists said already, both factors nullify themselves to large degree.

Huh? Where does it say any of that in the OP?

It also shows your utter lack of reading comprehension of following posts which given how short this thread is required real effort.Mange wrote:Great find, Stas! It really shows how Russia has failed to diversify its economy and with the prices crashing and with the sanctions, it's understandable how Russia has found itself in this situation.

I am sure that border customs barrier that separated Russia with 12 of their closest economically aligned countries that were their biggest market and new round of Balkan wars that demolished their closest ally left in that part of world had nothing to do with it and if only they weren't so stupid they could well unprimitivize, eh?Stas Bush wrote:What is even more interesting is that if you take the data back to 1995, you will see how oil was a much smaller share back then; Russia's exports really primitivized over the last decade, steadily becoming more and more oil-gas and generally raw resource-dependent.

Maybe take a look at Warsaw Pact countries and point to us one that didn't primitivize, foreign owned factories of half finished goods excluded. In fact, if you look at GNP per capita of various Eastern European countries in say 1985 and 2015 you will see they somehow outperformed quite a lot of these that started at higher level. You cannot build high tech industry without building solid foundations first.

Oh, and for a finisher - yes, Russia had much smaller share of oil production in 1995. Except, it's because 1995 happens to be year of historical lowest oil export and what happened wasn't export slice of other goods growing smaller, it was oil slice growing larger. See this chart, congratulations, all you managed to prove is that Russia didn't manage to increase other exports 2.5x times like they did with oil.

And here you are wrong again. NATO is, sadly, not the whole West. Had this thread wanted to show some real problems Russians might have, one would just need to point to Switzerland, big financial centre that didn't join embargo. Recent decision of Swiss national bank to stop defending franc caused its huge jump to all currencies and made that option less attractive for Russia (and, oh, only caused big problems to about 2 million people with mortgage in Central Europe alone). Still, that's one financial market, not all, and that connection didn't made tabloid headlines so you don't hear about it.What Irbis doesn't understand is that unlike the other oil producers who are not sanctioned simultaneously with the falling price, Russia cannot take new credits at a low rate in the West any more, as it's been cut off from the credit supply, but it still has to pay its obligations in hard currency - a similar thing happened with Iran's currency. They had to pay back in dollars and their local currency crashed massively when hit by sanctions.

As for Iran, can you please compare levels of debt of both countries before you start making such comparisons? Frankly, Norway would be much more relevant example in similarities to Russia and no one is going to claim they are anywhere near Norwegian economy.

Really, there are things you might point at and say 'Russia is fucked' but I am afraid showing that requires a bit more effort than pasting flashy pictures. In fact, I freely admit there is something potentially even bigger than Swiss crisis looming over them, but pointing it out requires more research than looking for a single badly performing indicator so I won't be holding my breath waiting to read about it any time soon

- K. A. Pital

- Glamorous Commie

- Posts: 20813

- Joined: 2003-02-26 11:39am

- Location: Elysium

Re: Russian credit downgraded to Junk status by S&P

You do understand how stupid Russian apologism sounds when you try it on a Russian, don't you?

Exactly the problem: a country which doesn't produce anything competitive and sells raw resources only is pretty much a house of cards - and unless other powerful countries want the house of cards to stay, its stability is questionable.Irbis wrote:See this chart, congratulations, all you managed to prove is that Russia didn't manage to increase other exports 2.5x times like they did with oil.

You are wrong: Switzerland has joined the sanctions, although it was not a EU nation. The rouble collapsed last autumn, way before the SNB decision to remove the CHF peg. Do not even try this history revisionism with me.Irbis wrote:And here you are wrong again. NATO is, sadly, not the whole West. Had this thread wanted to show some real problems Russians might have, one would just need to point to Switzerland, big financial centre that didn't join embargo.

No, Norway is not a relevant example as it's a high-income country with full access to lowest possible rate credit in the West.Irbis wrote:Frankly, Norway would be much more relevant example in similarities to Russia and no one is going to claim they are anywhere near Norwegian economy.

Lì ci sono chiese, macerie, moschee e questure, lì frontiere, prezzi inaccessibile e freddure

Lì paludi, minacce, cecchini coi fucili, documenti, file notturne e clandestini

Qui incontri, lotte, passi sincronizzati, colori, capannelli non autorizzati,

Uccelli migratori, reti, informazioni, piazze di Tutti i like pazze di passioni...

...La tranquillità è importante ma la libertà è tutto!

Lì paludi, minacce, cecchini coi fucili, documenti, file notturne e clandestini

Qui incontri, lotte, passi sincronizzati, colori, capannelli non autorizzati,

Uccelli migratori, reti, informazioni, piazze di Tutti i like pazze di passioni...

...La tranquillità è importante ma la libertà è tutto!

Assalti Frontali

Re: Russian credit downgraded to Junk status by S&P

The difference between Canada and Russia is that Canada has a massive friendly trade partner right next door and good relations with China. Even with falling oil prices we still have lumber, copper, and diamonds (among other things) to export and with access to cheap loans we can use our lower dollar value in times of economic hardship to allow the economy to self correct. Russia doesn't have access to any of these things right now and is thus is a far worse position and one they should have seen coming given that they don't have a great power ally to back them up when times get rough.Irbis wrote:Oh, somehow that looks suspiciously similar to your Russia picture. And they are not the only ones - if you look at Iceland, Canada, Holland, Scotland and several other first world countries the energy exports in some form, direct or indirect, also take just as big slice of export pie as in Russia. If you add agricultural products as simple resource export, the number grows even bigger. Are these basket cases too?

- Fingolfin_Noldor

- Emperor's Hand

- Posts: 11834

- Joined: 2006-05-15 10:36am

- Location: At the Helm of the HAB Star Dreadnaught Star Fist

Re: Russian credit downgraded to Junk status by S&P

Russia has very good relations with China now.Jub wrote:The difference between Canada and Russia is that Canada has a massive friendly trade partner right next door and good relations with China. Even with falling oil prices we still have lumber, copper, and diamonds (among other things) to export and with access to cheap loans we can use our lower dollar value in times of economic hardship to allow the economy to self correct. Russia doesn't have access to any of these things right now and is thus is a far worse position and one they should have seen coming given that they don't have a great power ally to back them up when times get rough.

Your spirit, diseased as it is, refuses to allow you to give up, no matter what threats you face... and whatever wreckage you leave behind you.

Kreia

- Nova Andromeda

- Jedi Master

- Posts: 1404

- Joined: 2002-07-03 03:38am

- Location: Boston, Ma., U.S.A.

Re: Russian credit downgraded to Junk status by S&P

It was my strong impression that China takes a very very dim view of Russia invading Ukraine as they oppose that sort of thing and don't want the precedent set. That said China is certainly very happy to do business with Russian and/or take advantage of their conflict with the 'west'. The more they can play Russian off against the 'west' while remaining at peace and improving their economy the faster they catch up / pass everyone else ... or so it seems to me.Fingolfin_Noldor wrote:Russia has very good relations with China now.Jub wrote:The difference between Canada and Russia is that Canada has a massive friendly trade partner right next door and good relations with China. Even with falling oil prices we still have lumber, copper, and diamonds (among other things) to export and with access to cheap loans we can use our lower dollar value in times of economic hardship to allow the economy to self correct. Russia doesn't have access to any of these things right now and is thus is a far worse position and one they should have seen coming given that they don't have a great power ally to back them up when times get rough.

Nova Andromeda

Re: Russian credit downgraded to Junk status by S&P

I'm not seeing China making any moves to secure Russia's finances at this early stage and frankly what does Russia sell that the Chinese would want to buy? According to this site China only accounts for 8.1% of Russia's export market, a significant chunk, but not really enough to call them partners in the way Canada and the US are. The US accounts for a massive 62% of Canada's exports according to that same site and China makes up just shy of 7% of our exports, which in percentage terms is pretty damned close to what Russia trades with a nation they supposedly have very good relations with. So unless China wants to start going out of their way to eat up Russian imports I really don't see them as a way for Russia to dig themselves out of this self inflicted hole they've dug.Fingolfin_Noldor wrote:Russia has very good relations with China now.Jub wrote:The difference between Canada and Russia is that Canada has a massive friendly trade partner right next door and good relations with China. Even with falling oil prices we still have lumber, copper, and diamonds (among other things) to export and with access to cheap loans we can use our lower dollar value in times of economic hardship to allow the economy to self correct. Russia doesn't have access to any of these things right now and is thus is a far worse position and one they should have seen coming given that they don't have a great power ally to back them up when times get rough.

-----

Side note:

Irbis is also even more full of shit than I thought, looking at the link for Canada above Canada exports more finished goods and chemicals than it does anything energy related. Followed by exporting metals, then energy, with agriculture, precious metals/gems, and lumber also being significant export products. You can look at the charts and see that Canada has a properly diversified economy and thus can stabilize rapidly once our dollar reaches a low enough point next to the US to encourage Americans to import more from us and cross the boarder to buy Canadian goods.

- mr friendly guy

- The Doctor

- Posts: 11235

- Joined: 2004-12-12 10:55pm

- Location: In a 1960s police telephone box somewhere in Australia

Re: Russian credit downgraded to Junk status by S&P

That's my impression as well. Its frankly not in China's interest to step in the middle of a spat between Russia and the US/EU/allied countries. Better to stay out of it and continue to trade with both.Nova Andromeda wrote: It was my strong impression that China takes a very very dim view of Russia invading Ukraine as they oppose that sort of thing and don't want the precedent set. That said China is certainly very happy to do business with Russian and/or take advantage of their conflict with the 'west'. The more they can play Russian off against the 'west' while remaining at peace and improving their economy the faster they catch up / pass everyone else ... or so it seems to me.

Mainly oil and gas, maybe some weapons depending on who you read. Both sides want to diversify who they trade in. Russia so in the case of a spat with the West they have another big customer, China because Russian oil and gas is right next door (energy security), and they could get it cheaper because of the problems Russia is having (albeit not that much cheaper from reports).Jub wrote: I'm not seeing China making any moves to secure Russia's finances at this early stage and frankly what does Russia sell that the Chinese would want to buy?

Never apologise for being a geek, because they won't apologise to you for being an arsehole. John Barrowman - 22 June 2014 Perth Supernova.

Countries I have been to - 14.

Australia, Canada, China, Colombia, Denmark, Ecuador, Finland, Germany, Malaysia, Netherlands, Norway, Singapore, Sweden, USA.

Always on the lookout for more nice places to visit.

Countries I have been to - 14.

Australia, Canada, China, Colombia, Denmark, Ecuador, Finland, Germany, Malaysia, Netherlands, Norway, Singapore, Sweden, USA.

Always on the lookout for more nice places to visit.

- Fingolfin_Noldor

- Emperor's Hand

- Posts: 11834

- Joined: 2006-05-15 10:36am

- Location: At the Helm of the HAB Star Dreadnaught Star Fist

Re: Russian credit downgraded to Junk status by S&P

I dunno. The Chinese press was full of praise for Putin's standing up to the West, so take it what you will.Nova Andromeda wrote:It was my strong impression that China takes a very very dim view of Russia invading Ukraine as they oppose that sort of thing and don't want the precedent set. That said China is certainly very happy to do business with Russian and/or take advantage of their conflict with the 'west'. The more they can play Russian off against the 'west' while remaining at peace and improving their economy the faster they catch up / pass everyone else ... or so it seems to me.

Also, China is very aggressive in the South China Sea and has a dim view of US encroachment of its space. There are parallels here between US "encirclement" of Russia and China.

I think China at this point wants to be discreet about its backing of Russia at this point.mr friendly guy wrote:That's my impression as well. Its frankly not in China's interest to step in the middle of a spat between Russia and the US/EU/allied countries. Better to stay out of it and continue to trade with both.

Last edited by SCRawl on 2015-01-30 12:10pm, edited 3 times in total.

Reason: Deleted duplicate post - SCRawl

Reason: Deleted duplicate post - SCRawl

Your spirit, diseased as it is, refuses to allow you to give up, no matter what threats you face... and whatever wreckage you leave behind you.

Kreia

- K. A. Pital

- Glamorous Commie

- Posts: 20813

- Joined: 2003-02-26 11:39am

- Location: Elysium

Re: Russian credit downgraded to Junk status by S&P

Russia does have good relations with China, but they have yet to transform into a steady stream of currency. Last I heard, Chinese state-owned banks - pretty much the only type of bank that exists in China - are not very eager to issue loans to Russian organizations, fearing their unreliability (and rightly so). China also agreed to a currency swap deal, but it is not enough to keep the currency from collapsing as the demands issued to Russian agents aren't in CNY, they are in USD and EUR. Now, when China starts paying for gas from the Siberian pipelines and when Russia closes its obligations towards Western agents (old credits), the currency and the economy will probably stabilize. That's a few years away.

Lì ci sono chiese, macerie, moschee e questure, lì frontiere, prezzi inaccessibile e freddure

Lì paludi, minacce, cecchini coi fucili, documenti, file notturne e clandestini

Qui incontri, lotte, passi sincronizzati, colori, capannelli non autorizzati,

Uccelli migratori, reti, informazioni, piazze di Tutti i like pazze di passioni...

...La tranquillità è importante ma la libertà è tutto!

Lì paludi, minacce, cecchini coi fucili, documenti, file notturne e clandestini

Qui incontri, lotte, passi sincronizzati, colori, capannelli non autorizzati,

Uccelli migratori, reti, informazioni, piazze di Tutti i like pazze di passioni...

...La tranquillità è importante ma la libertà è tutto!

Assalti Frontali

- Sidewinder

- Sith Acolyte

- Posts: 5466

- Joined: 2005-05-18 10:23pm

- Location: Feasting on those who fell in battle

- Contact:

Re: Russian credit downgraded to Junk status by S&P

Why is this? Due to fear the ruble will devalue to the point the Chinese banks will only get a fraction of what they loaned? (I'm reminded of what Germany did to its own currency, to pay off reparations from World War I.) Due to concerns regarding the yuan, e.g., its value will increase to the point the Chinese banks will only get a fraction of what they loaned?Stas Bush wrote:China also agreed to a currency swap deal, but it is not enough to keep the currency from collapsing as the demands issued to Russian agents aren't in CNY, they are in USD and EUR.

Please do not make Americans fight giant monsters.

Those gun nuts do not understand the meaning of "overkill," and will simply use weapon after weapon of mass destruction (WMD) until the monster is dead, or until they run out of weapons.

They have more WMD than there are monsters for us to fight. (More insanity here.)

Those gun nuts do not understand the meaning of "overkill," and will simply use weapon after weapon of mass destruction (WMD) until the monster is dead, or until they run out of weapons.

They have more WMD than there are monsters for us to fight. (More insanity here.)

- K. A. Pital

- Glamorous Commie

- Posts: 20813

- Joined: 2003-02-26 11:39am

- Location: Elysium

Re: Russian credit downgraded to Junk status by S&P

What I meant is that Russia has to pay to Western creditors in USD and EUR, and it still owes them more than China can feasibly provide (besides, China is keen on providing Chinese yuan and not the common reserve currencies).Sidewinder wrote:Why is this? Due to fear the ruble will devalue to the point the Chinese banks will only get a fraction of what they loaned? (I'm reminded of what Germany did to its own currency, to pay off reparations from World War I.) Due to concerns regarding the yuan, e.g., its value will increase to the point the Chinese banks will only get a fraction of what they loaned?Stas Bush wrote:China also agreed to a currency swap deal, but it is not enough to keep the currency from collapsing as the demands issued to Russian agents aren't in CNY, they are in USD and EUR.

Lì ci sono chiese, macerie, moschee e questure, lì frontiere, prezzi inaccessibile e freddure

Lì paludi, minacce, cecchini coi fucili, documenti, file notturne e clandestini

Qui incontri, lotte, passi sincronizzati, colori, capannelli non autorizzati,

Uccelli migratori, reti, informazioni, piazze di Tutti i like pazze di passioni...

...La tranquillità è importante ma la libertà è tutto!

Lì paludi, minacce, cecchini coi fucili, documenti, file notturne e clandestini

Qui incontri, lotte, passi sincronizzati, colori, capannelli non autorizzati,

Uccelli migratori, reti, informazioni, piazze di Tutti i like pazze di passioni...

...La tranquillità è importante ma la libertà è tutto!

Assalti Frontali