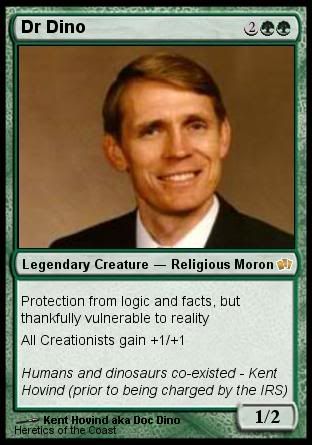

Anyone with half a brain shouldn't have to do more than look at this guy's criminal record. No matter what he says about dinosaurs, he's a crook.

Legal problems

Kent Hovind has been in trouble with law enforcement several times. These have included assault and battery, falsely declaring bankruptcy, failing to get necessary building permits, and various charges of tax evasion.

Assault and battery

In 2002, he was charged with one count of felony assault, one count of misdemeanor battery, and one count of burglary with assault/battery. In December 2002, the charges were dropped by the alleged victim, Hovind's secretary.

Property taxes and zoning ordinance

Hovind was charged on September 13, 2002, for failure to observe county zoning regulations with respect to Dinosaur Adventure Land. Despite arguments that the owners did not need a permit due to the nature of the building, the park has been found in violation of local regulations. On June 5th 2006, Hovind pled nolo contendere as charged to three counts: constructing a building without a permit, refusing to sign a citation (Case # 2001 MM 023489 A)and violating the county building code (case # 2002 MM 026670 A). Hovind was ordered to pay $225.00 per count. The plea brings to an end the 5-year criminal (misdemeanor) court battle over a $50.00 building permit. The 4-year civil court battle with the county remains open (Case # 2002 CA 000149). Hovind estimates he spent $40,000in legal expenses on this case. On June 19th, 2006, the delilquent 2003-2005 property taxes/penalties for Dinosaur Adventure Land were paid in an amount of $10,402.64.

Tax evasion

Hovind does not run his various educational and religious activities through a U.S. Internal Revenue Code Section 501(c)(3) organization. Instead, the organizational structure he uses apparently is "based on various questionable trust documents purchased from ... a known promoter of tax avoidance schemes." The U.S. Tax Court has concluded that Hovind used these trust documents as well as other fraudulent means to conceal the ownership and control of his activities and properties.

In 1996 Hovind unsuccessfully filed for bankruptcy to avoid paying federal income taxes. Hovind was found to have lied about his possessions and income. He claimed that as a minister of God everything he owns belonged to God and he is not subject to paying taxes to the United States on the money he received for doing God's work (citing US tax code §508(c)(1)(a)). The court ordered him to pay the money and upheld the IRS's determination that Hovind's claim "was filed in bad faith for the sole purpose of avoiding payment of federal income taxes." In the ruling, the judge called Hovind's arguments "patently absurd." The judge also noted that "the IRS has no record of the debtor ever having filed a federal income tax return," although this was not the court's reason for denying the bankruptcy claim.

On May 13, 1998, Hovind and his wife attempted to evade all responsibility for any previous promises, debts, or legal agreements made prior to April 15, 1998, by filing a document called "Power of Attorney and Revocation of Signature"with the Escambia County Clerk of Courts. The document reads, in part: "I/we do hereby revoke and make void... all signatures on any instruments...". The Hovinds claimed they had signed government documents "due to the use of various elements of fraud and misrepresentations, duress, coercion, under perjury, mistake, 'bankruptcy'."

In the document, the Hovinds argue that Social Security is essentially a "Ponzi scheme." The Hovinds referred to the United States Government as "the 'bankrupt' corporate government" and said they were renouncing their United States citizenship and social security numbers to become "a natural citizen of 'America' and a natural sojourner."). In 2002 Hovind was again delinquent in paying his taxes, and unsuccessfully sued the United States Internal Revenue Service for harassment. The Hovinds referred to their home state of Florida as "the State of Florida Body-Politic Corporation." Judges and the IRS did not appear to honor this as a legally relevant document in future decisions.

In 2004, IRS agents raided Hovind's home and business to confiscate financial records. IRS agent Scott Schneider said none of Hovind's businesses had a business license, nor tax-exempt status. The Associated Press quoted Schneider as saying "Since 1997, Hovind has engaged in financial transactions indicating sources of income and has made deposits to bank accounts well in excess of $1 million per year during some of these years, which would require the filing of federal income taxes." On June 3 2004, the IRS issued tax liens of $504,957.24 against Hovind and his son and their businesses. A separate lien was filed for each, due to previous legal maneuverings on the part of the elder Hovind to evade taxation by moving property between himself, his son, and other legal entities.

On July 7, 2006 the United States Tax Court (Docket number 011894-05L) found that Hovind was deficient in paying his federal income taxes in tax years 1995-97 in the amount of $504,957.24 . The Tax Court found that the IRS had a valid, perfected lien on Hovind's property in that amount. The IRS is currently levying against Hovind's property to satisfy his unpaid tax liabilities. In the Memorandum Opinion the judge noted that Hovind's "organizational structure . . . was based on various questionable trust documents purchased from Glen Stoll, a known promoter of tax avoidance schemes." Moreover, Hovind's defense was based on "bizarre arguments" and "some of which constitute tax protestor arguments involving excise taxes and the alleged '100% voluntary' nature of the income tax."

Threats, false complaints and criminal tax charges

Kent Hovind faces a 58-count federal indictment

On July 13, 2006, Kent Hovind was arrested and indicted in federal court on 58 charges. Of the charges filed, there is one count of corruptly endeavoring to obstruct and impede the due administration of the internal revenue laws, including falsifying bankruptcy documents, filing a false and frivolous lawsuit and complaints against the IRS, destroying records, and threatening to harm IRS investigators. 12 of the charges are for failing to pay employee-related taxes, totaling $473,818, and 45 charges of evading reporting requirements by making multiple cash withdrawals just under the $10,000 reporting requirement (smurfing). The withdrawals, totaling $430,500, were placed in 2001 and 2002.

Hovind has maintained his innocence. "I still don't understand what I'm being charged for and who is charging me," he said. Magistrate Miles Davis of the United States District Court for the Northern District of Florida asked Hovind if he wrote and spoke English, to which Hovind responded "To some degree". Davis replied that the government adequately explained the allegations and the defendant understands the charges "whether you want to admit it or not."[An October 17th trial date (originally September 5th) has been set for Kent Hovind and his co-defendant wife, Jo, who faces 44 charges.With his attorney, Public Defender Kafahni Nkrumah, Hovind stated that he did not recognize the government's right to try him on tax-fraud charges. At first he attempted to enter a plea of "subornation of false muster," but then entered a not guilty plea "under duress" when the judge offered to enter a plea for him.

A portion of Hovind's defense seems to be that although there are 30 people working for him, all of whom receive remuneration in cash, none of them are employees. According to Hovind, "Nobody's an employee, and they all know that when they come. They come, they work ... The laborer is worthy of his hire -- we try to take the purely scriptural approach. We do the best we can with helping people with their family needs. There are no employees here." Hovind has also claimed that he is not liable for taxes and his ministry does not have to "render unto Caesar" because it is not working for the government.