I need raw data of 2008 Light Sweet Crude prices, help?

Moderator: Alyrium Denryle

-

Adrian Laguna

- Sith Marauder

- Posts: 4736

- Joined: 2005-05-18 01:31am

I need raw data of 2008 Light Sweet Crude prices, help?

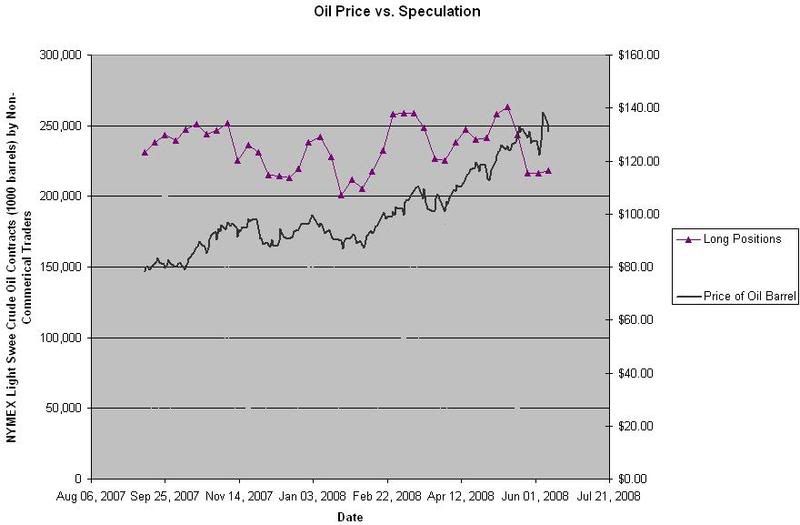

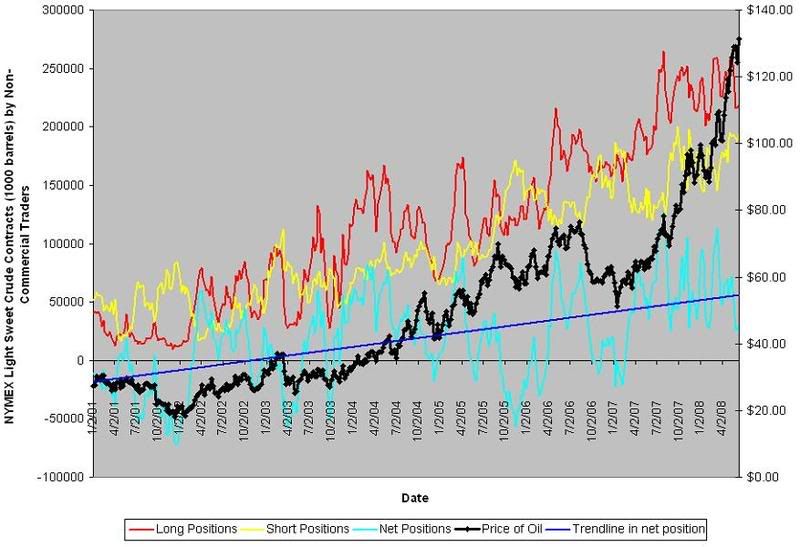

I intend to make a graph that shows the number of long sales and short sales by non-commercial buyers on Light Sweet Crude and how they compare to the current oil price (or, alternatively, the change in oil price). The idea being to have something that can visually and swiftly put paid to the idea that speculators are behind the rise in oil prices.

http://tonto.eia.doe.gov/dnav/pet/hist/rclc1d.htm

The DOE is your friend, daily data all the way back to 1983.

The DOE is your friend, daily data all the way back to 1983.

This post is a 100% natural organic product.

The slight variations in spelling and grammar enhance its individual character and beauty and in no way are to be considered flaws or defects

I'm not sure why people choose 'To Love is to Bury' as their wedding song...It's about a murder-suicide

- Margo Timmins

When it becomes serious, you have to lie

- Jean-Claude Juncker

The slight variations in spelling and grammar enhance its individual character and beauty and in no way are to be considered flaws or defects

I'm not sure why people choose 'To Love is to Bury' as their wedding song...It's about a murder-suicide

- Margo Timmins

When it becomes serious, you have to lie

- Jean-Claude Juncker

-

Adrian Laguna

- Sith Marauder

- Posts: 4736

- Joined: 2005-05-18 01:31am

-

Adrian Laguna

- Sith Marauder

- Posts: 4736

- Joined: 2005-05-18 01:31am

Re: I need raw data of 2008 Light Sweet Crude prices, help?

You're making an assumption in regard to what you believe about the number of transactions versus speculators affecting prices.Adrian Laguna wrote:I intend to make a graph that shows the number of long sales and short sales by non-commercial buyers on Light Sweet Crude and how they compare to the current oil price (or, alternatively, the change in oil price). The idea being to have something that can visually and swiftly put paid to the idea that speculators are behind the rise in oil prices.

The word assumption is very appropriate in this context.

Price can even go up by a number of percent in one day (and has done so on occasion in the recent past). That's not necessarily simply because the physical rate of production versus demand typically changes quite that fast. Perceived value can change on the day of a particular news announcement and create a market trend when investors react.

Speculators aren't the sole factor. Speculation and other manipulation is one of multiple factors, not the sole cause but not happening to be of zero effect either.speculators are behind the rise in oil prices.

Some people have gotten rich from treating investing in oil much like investing in a stock. Likewise, there's sometimes a very strong financial incentive for an entity like Iran to intentionally delay selling oil from some tankers when the result is a number of dollars per barrel greater sale price, which can contribute to reduction of near-term supply and increased prices as a side-effect.

There are multiple factors in the price rise of oil as discussed in another thread:

- Historical slow net increase in the total production of oil and oil-equivalents is less than the increase rate of desired demand, including rapidly growing economies such as China. Although alternative fuel and unconventional production is increasing, production is meanwhile declining from some segments of the conventional crude supply.

- The value of the dollar has greatly declined, contributing to further increasing the cost of oil measured in U.S. dollars; for example, in 2002, it took $0.94 to buy 1 euro of goods, but now it takes $1.55.

- The enormous financial incentive for speculation and for limiting the near-term supply of oil to make more profit selling it later at higher prices is another contribution.

-

Adrian Laguna

- Sith Marauder

- Posts: 4736

- Joined: 2005-05-18 01:31am

Once, when in a class years ago, we did an experiment where we treated an imaginary stock as paying out a certain small amount of dividends, but we could buy and sell the stock. Once the sale price of the stock started to greatly rise, it became logical to bid extremely high amounts on it, not particularly because of the limited value of the dividends but because one could see from the trend that it was logical to do so in order to turn around and later resell it for more.

The number of transactions we did per unit time was constant due to the way the experiment was set up (every minute or so we did another buy/sale round). Obviously, the number of traders was constant too. Meanwhile, prices were not constant, going up exponentially for a while.

For almost anything that one can invest within, if one thinks its price will go up by tens of percent in a short period of time, it is worthwhile to get it for later profit. The result can be present value determined in large part by perceived future value.

The number of transactions we did per unit time was constant due to the way the experiment was set up (every minute or so we did another buy/sale round). Obviously, the number of traders was constant too. Meanwhile, prices were not constant, going up exponentially for a while.

For almost anything that one can invest within, if one thinks its price will go up by tens of percent in a short period of time, it is worthwhile to get it for later profit. The result can be present value determined in large part by perceived future value.

-

Adrian Laguna

- Sith Marauder

- Posts: 4736

- Joined: 2005-05-18 01:31am

I'm not saying speculation is not a factor, or that you will not see correlation between people taking long positions and the price in oil rise. However, if speculation were a cause of the rise in oil prices I would be expecting a strong correlation between that and price, if it's not then I would expect a weak correlation. It would be really awesome if I remembered how to do statistical analysis. Even getting a good score (4) on your AP Exam doesn't save you from the ol' "use it or lose it", and since I haven't used it since then, I've lost it.

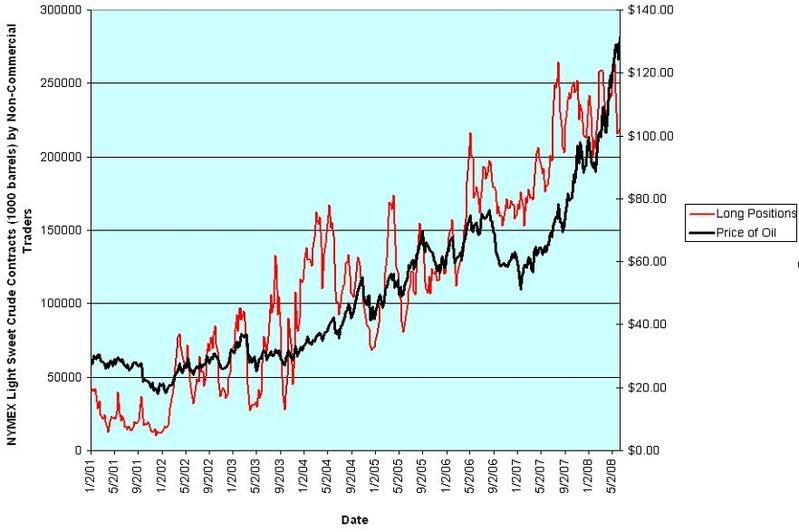

Anyway, here's the graph.

Anyway, here's the graph.

Comparing for trends in peaks and troughs is easier with a quick look at your graph with just two plots.

For speculation being only one factor, there is an interesting degree of partial correlation seeming to appear, not strong when so much else effects oil prices too but noticeable.

With that showing non-commercial traders, it would be interesting to see the results for commercial traders as well.

However, the main question here isn't determined by whether someone goes to the trouble of doing statistical analysis. It is rather the starting assumptions, as all the calculations in the world are only as good as the assumptions upon which they are based, like the saying in computer programming: GIGO (garbage in, garbage out).It would be really awesome if I remembered how to do statistical analysis.

Behind the graph, is your assumption that speculation can only have much effect if the number of contracts goes up in a manner nearly directly proportional to the price per barrel?

As a thought experiment, pretend the price of oil doubled while the number of barrels produced remained almost the same. Would you think speculation was not having much effect unless the number of contracts for 1000 barrels of oil each also nearly doubled, unless the number of barrels of oil being traded in such a manner also nearly doubled?

I doubt one can expect the number of contracts for X barrels to go up indefinitely if the production rate of oil is relatively constant in the relevant timeframe. Whatever the amount of speculation, I wouldn't expect more than some number of barrels to be traded at a time when oil production is a certain number of barrels.

In the example of the economic experiment in my last post with an imaginary stock bubble, the number of trades per unit time did not have to go up proportionally to the price rise, although the average dollar value per individual trade did go up.

-----------

From here.May 23rd, 2008

According to PetroLogics Ltd., a company that tracks oil-carrying vessels, Iran is now storing crude oil in 20 tankers in the Persian Gulf; this is up from an estimate of ten earlier this month.

According to Nightingale, the cost of leasing tankers tripled in the period between April 8 and May 2. Additionally, the number of available tankers fell from from 59 to 21 during the same period, according to the Turksih Daily News.

There has been speculation that this is an attempt by Iran to manipulate the global oil market

From here.A large number of tankers lie at anchor in the Persian Gulf, and elsewhere, all leased by Iran and Venezuela, and all therefore unavailable to carry oil for other prospective charter clients [...] thus driving up oil prices to stratospheric levels, and benefiting both countries financially.

Although I wouldn't use the exact terminology of the article since such is far from the only factor leading to the rise in oil prices, as previously discussed, it can be one significant factor.

- SirNitram

- Rest in Peace, Black Mage

- Posts: 28367

- Joined: 2002-07-03 04:48pm

- Location: Somewhere between nowhere and everywhere

Light sweet crude 'premium' leaps 4x since 2000.

I thought it'd be relevent to the discussion, as there's now basically a 5 buck surcharge on light sweet barrels. I'm unsure how this impacts the trends as a whole, and if it's factored into the soaring price we are told.

I thought it'd be relevent to the discussion, as there's now basically a 5 buck surcharge on light sweet barrels. I'm unsure how this impacts the trends as a whole, and if it's factored into the soaring price we are told.

Manic Progressive: A liberal who violently swings from anger at politicos to despondency over them.

Out Of Context theatre: Ron Paul has repeatedly said he's not a racist. - Destructinator XIII on why Ron Paul isn't racist.

Shadowy Overlord - BMs/Black Mage Monkey - BOTM/Jetfire - Cybertron's Finest/General Miscreant/ASVS/Supermoderator Emeritus

Debator Classification: Trollhunter

Out Of Context theatre: Ron Paul has repeatedly said he's not a racist. - Destructinator XIII on why Ron Paul isn't racist.

Shadowy Overlord - BMs/Black Mage Monkey - BOTM/Jetfire - Cybertron's Finest/General Miscreant/ASVS/Supermoderator Emeritus

Debator Classification: Trollhunter

You're looking at the long positions only, which isn't correct. Draw the graph for short positions since the end of February and it also shows a mild correlation to the rise in oil prices, but that would be rather absurd if you think about it.Sikon wrote:Comparing for trends in peaks and troughs is easier with a quick look at your graph with just two plots.

For speculation being only one factor, there is an interesting degree of partial correlation seeming to appear, not strong when so much else effects oil prices too but noticeable.

There should be and generally is a correlation between the net number or percentage of long contract positions and the price of the item in the contract. There are short term exceptions but they get ironed out on options expiration day unless the regulators are deliberately enabling fraud.Behind the graph, is your assumption that speculation can only have much effect if the number of contracts goes up in a manner nearly directly proportional to the price per barrel?

As a thought experiment, pretend the price of oil doubled while the number of barrels produced remained almost the same. Would you think speculation was not having much effect unless the number of contracts for 1000 barrels of oil each also nearly doubled, unless the number of barrels of oil being traded in such a manner also nearly doubled?

With regards to the thought experiment, no the total number of contracts does not matter at all, it could be 10 or 10 million, no difference at all. What counts is how many of them are long & short, to create such a spike a large percentage of net longs are required, for instance, 99% of all traders went long on oil after it was revealed that GWB was going to nuke the Middle East. The total volume could be exactly the same, 10 contracts, 1000 contracts, whatever, the difference is everyone is now long.

Actually, it can. Even back in 2006, the number of crude futures contracts traded on NYMEX reached over 600,000. Given that each contract is 1000 barrels, this would mean over 600 million barrels traded that day, that number has since doubled. Keep in mind that daily oil production was and still is around 85 million barrel a day. I'll have to find the reference somewhere, but it's said that around 200 million barrels are traded on the floor at NYMEX every single day, though it's actually the same 4-5 million barrels going round & round & round again.I doubt one can expect the number of contracts for X barrels to go up indefinitely if the production rate of oil is relatively constant in the relevant timeframe. Whatever the amount of speculation, I wouldn't expect more than some number of barrels to be traded at a time when oil production is a certain number of barrels.

This post is a 100% natural organic product.

The slight variations in spelling and grammar enhance its individual character and beauty and in no way are to be considered flaws or defects

I'm not sure why people choose 'To Love is to Bury' as their wedding song...It's about a murder-suicide

- Margo Timmins

When it becomes serious, you have to lie

- Jean-Claude Juncker

The slight variations in spelling and grammar enhance its individual character and beauty and in no way are to be considered flaws or defects

I'm not sure why people choose 'To Love is to Bury' as their wedding song...It's about a murder-suicide

- Margo Timmins

When it becomes serious, you have to lie

- Jean-Claude Juncker

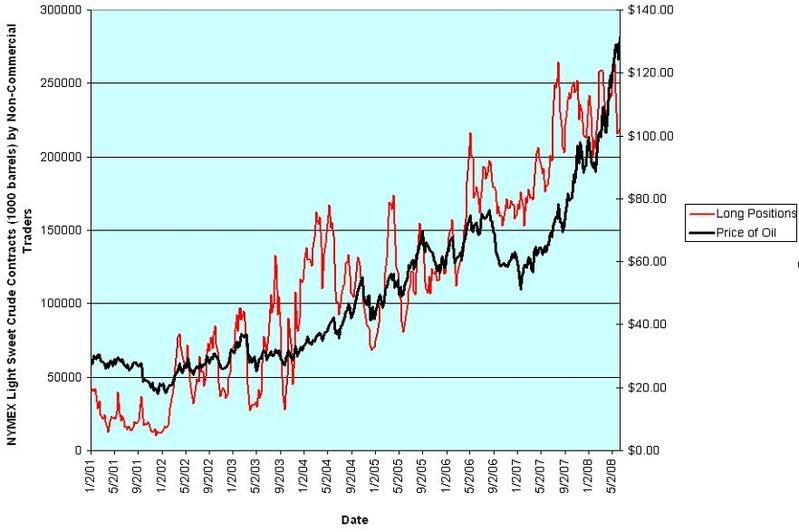

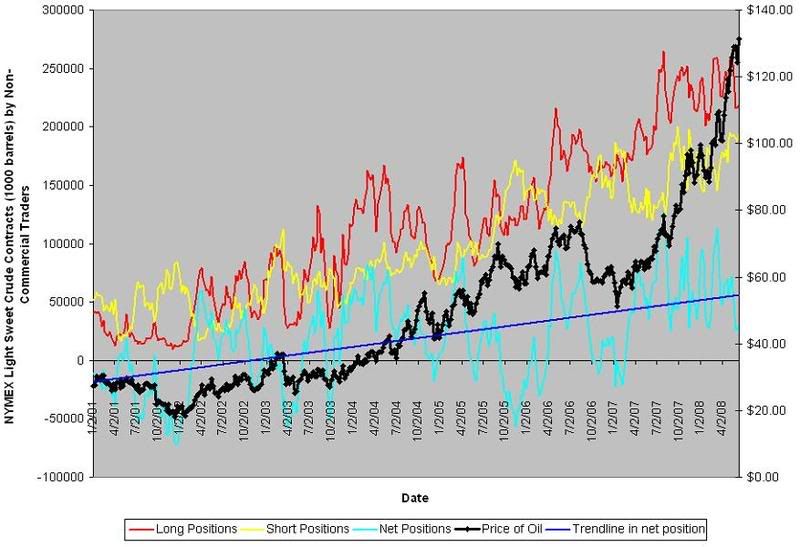

To make trends more clear, let's look at a longer timeframe than the small number of months graphed in Adrian Laguna's post.

Long positions are when a investment is made with an expectation that the asset will rise in value, trying to make a profit off its rise, whether one is talking about stocks, any commodity, or, in this case, oil.

Using data from here and here:

Among other things which can be observed in the second graph above, the trendline in net positions does illustrate a large increase in the net number of long positions.

However, whatever the dollar amount of money being made from speculation, that doesn't have to go up forever. One doesn't have to trade the same barrel of oil 100 times or 1000 times over for such. For example, ten times as many barrels of oil in contract trading as production in a day may be more than enough even with speculation comprising a non-trivial percentage of oil price.

--------

Speculation is only one factor, but there are a number of factors affecting oil prices, even beyond physical supply vs. desired demand directly.

--------

Such significant change in just three minutes is a good illustration of how the oil market is in some ways a little like the stock market. (It's not like physical production worldwide changed that much during those 3 minutes).

Oil price certainly is influenced most fundamentally by physical supply versus desired demand, but it also is partially influenced by a mixture of other factors. Perceptions of the future influence oil price now.

--------

Some have gotten rich by treating oil like an investment, as illustrated by index speculators having gone from investing $13+ billion in 2003 to $260+ billion in commodities at the end of March of this year. For activities not causing growth, a common economic saying is TANSTAAFL: "There ain't no such thing as a free lunch."

If many billions of dollars are being made from investment in oil, that money has to come from somewhere. It translates into an effect on the price of oil as the money comes from the pockets of consumers in the end. Such having no significant effect on oil prices wouldn't make much sense.

That's not entirely a bad thing in all regards, since extra rise in the price of oil does help encourage taking action to reduce dependence on conventional crude and promote alternatives. But it is of note.

Long positions are when a investment is made with an expectation that the asset will rise in value, trying to make a profit off its rise, whether one is talking about stocks, any commodity, or, in this case, oil.

Using data from here and here:

continuationJ wrote: If speculators are responsible for a large rise in oil prices, we'd expect to see a large increase in the net number of "long" positions in the contracts held by traders. In other words, lots more people bidding up the price of oil than shorting it down.

Among other things which can be observed in the second graph above, the trendline in net positions does illustrate a large increase in the net number of long positions.

It reached 1.092 million 1000-barrel contracts or 1.09 billion barrels in a recent daily volume record occuring on June 6th of this year.J wrote:Actually, it can. Even back in 2006, the number of crude futures contracts traded on NYMEX reached over 600,000. Given that each contract is 1000 barrels, this would mean over 600 million barrels traded that day, that number has since doubled. Keep in mind that daily oil production was and still is around 85 million barrel a day.Sikon wrote:I doubt one can expect the number of contracts for X barrels to go up indefinitely if the production rate of oil is relatively constant in the relevant timeframe. Whatever the amount of speculation, I wouldn't expect more than some number of barrels to be traded at a time when oil production is a certain number of barrels.

However, whatever the dollar amount of money being made from speculation, that doesn't have to go up forever. One doesn't have to trade the same barrel of oil 100 times or 1000 times over for such. For example, ten times as many barrels of oil in contract trading as production in a day may be more than enough even with speculation comprising a non-trivial percentage of oil price.

As illustrated in graphs above, there's no time when the long to short ratio was such. For example, even for non-commercial traders, in data covering 2001 through early June 2008, the long-short ratio has never been more than 4.3 for any week, never like 100:1.J wrote:99% of all traders went long on oil after it was revealed that GWB was going to nuke the Middle East.

--------

From hereSpeculators are largely responsible for driving crude prices to their peaks in recent weeks and the record oil price now looks like a bubble, George Soros has warned.

The billionaire investor's comments came only days after the oil price soared to a record high of $135 a barrel amid speculation that crude could soon be catapulted towards the $200 mark.

In an interview with The Daily Telegraph, Mr Soros said that although the weak dollar, ebbing Middle Eastern supply and record Chinese demand could explain some of the increase in energy prices, the crude oil market had been significantly affected by speculation.

From hereThe growth of funds designed to mimic the price of crude oil and other energy futures is reminiscent of a similar craze that precipitated the stock market crash of 1987, billionaire financier George Soros told lawmakers Tuesday.

The surge in popularity of commodity index funds is "intellectually unsound ... and distinctly harmful in its economic consequences," Soros told a Senate hearing. When speculators enter a market mostly on one side — in this case, betting on rising oil futures — it "distorts the otherwise prevailing balance between supply and demand." [...]

The U.S. Commodity Futures Trading Commission last week said it was six months into a probe of U.S. oil markets focused on possible price manipulation.

Speculation is only one factor, but there are a number of factors affecting oil prices, even beyond physical supply vs. desired demand directly.

--------

From hereReuters (Monday, June 16th) wrote:London Brent crude was up $3.05 at $138.16.

Prices leapt as the dollar fell after publication of data from the New York Federal Reserve that showed manufacturing in the state of New York contracted in June for the fourth time in five months. [...]

"Prices rose sharply in three minutes. U.S. manufacturing data was weak, so it is pressuring the dollar down," said Mike Wittner, energy analyst at Societe General.

Such significant change in just three minutes is a good illustration of how the oil market is in some ways a little like the stock market. (It's not like physical production worldwide changed that much during those 3 minutes).

Oil price certainly is influenced most fundamentally by physical supply versus desired demand, but it also is partially influenced by a mixture of other factors. Perceptions of the future influence oil price now.

--------

Some have gotten rich by treating oil like an investment, as illustrated by index speculators having gone from investing $13+ billion in 2003 to $260+ billion in commodities at the end of March of this year. For activities not causing growth, a common economic saying is TANSTAAFL: "There ain't no such thing as a free lunch."

If many billions of dollars are being made from investment in oil, that money has to come from somewhere. It translates into an effect on the price of oil as the money comes from the pockets of consumers in the end. Such having no significant effect on oil prices wouldn't make much sense.

That's not entirely a bad thing in all regards, since extra rise in the price of oil does help encourage taking action to reduce dependence on conventional crude and promote alternatives. But it is of note.