Sikon wrote:Broomstick wrote:Sikon wrote:It is noteworthy but rather questionable how popular raising the retirement age is as an alternative to partially privatizing the system. For example, if it was raised to a higher figure like age 70 instead of 65-67 for normal retirement age, that becomes significantly closer to a person merely dying soon after starting to get benefits, when the average life expectancy is 78 years.

Oh, I don't think it would be popular...just necessary.

For all your concern about some foolish or unlucky individuals hypothetically having less income in retirement under a partially privatized program, I am concerned more with a very realistic, worse scenario already frequently happening, which is someone

dying before being able to retire, or dying so soon after retirement for it barely to count as benefit.

Why, exactly, is this an issue?

As MoO says - you do not have a

right to retire. Society back in the 1930's decided that people who lived to a certain, arbitrary age could retire and collect, for lack of a better word, a sort of pension or annuity from the government. This is after paying into the system during their working lives (certain groups actually do NOT get SS

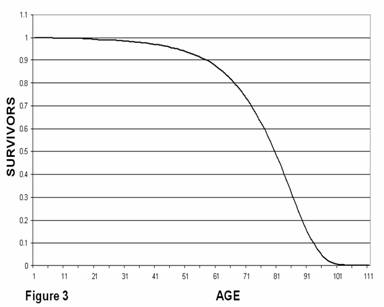

ever - railroad workers have a separate retirement system, and the Amish are exempt from both paying into the system and from collecting from it). That age was set high enough that

many people died prior to it, and few lived much beyond it. What has changed is life expectancy - more people live longer, and that's part of why the system is strained. If we raised the age to 70 or 75 then the result would be more like the system was

originally.

Anyone wanting to retire before that age is free to do so - but can't collect SS until that designated age. So, under either system a person can retire at 50, but they are on their own until SS age. It's just that in a revised system they'll be on their own a greater length of time. They will have to plan accordingly.

Anyone

disabled prior to retirement age

should be covered by the appropriate part of SS, which kicks in regardless of age.

You worry about some percentage of people losing the money they had in private savings accounts. Even in that imaginary scenario, they would still get some money from welfare and food stamps if so poor as to qualify, while Medicare covers the elderly in general, plus their income from any non-privatized base portion of social security. (For example, food stamps provide ~ $100 / month for food, sufficient for inexpensive bulk food purchases from supermarkets

Holy hell! $100 a month? $25 a week?

Have you tried to eat on that little?

I'd say not, if you think that is somehow adequate.

Oh, yes - a diet of potatoes, beans and white rice. There will be few fresh fruits or vegetables. You won't be able to afford much in the way of condiments either so it will be boring as fuck.

It will make NO allowances for medically needed special diets.

The reality is that most people on food stamps ALSO have to make use of food pantries and soup kitchens.

This is, of course, assuming the elderly person in question can physically manage "bulk purchases". I can lift a 25 or 50 pound sack of potatoes, my 76 year old mother

can't.

The only people who think $25/week would result in an adequate diet are those who have never tried to live on it.

More importantly, that hypothetical scenario wouldn't happen almost ever anyway under an appropriately designed partially privatized program as subsequently described.

"almost ever" is not never, and under the privatized program those who fall in the "worst scenario" crack - and it WILL happen to some percentage of people - will have only 4/5's as much to live on as they would under the present system. In other words, those who are the worst off, the ones who need the most protection, would be

even worse off than under the present system.

The main exception consists of those with little work history who wouldn't get much money back from current social security either.

You mean like stay-at-home housewives with no work history outside the home? If the main breadwinner dies they get survivor's benefits until they remarry or die. They aren't left in the cold.

It is a rather high expectation for the whole population to accept a higher retirement age for the sake of making better off a few who would hypothetically mismanage or lose money under a partially privatized program.

No, it makes sense to raise the retirement age to provide adequate funding for the program to continue

for everyone. Or a higher retirement age, but larger benefits

for everyone.

After all, you, me, and about everybody else reading this isn't willing to literally save a life for a fraction as much money and time equivalent, with a few thousand dollars capable of preventing some people from really starving to death in some parts of the third world.

Let's be honest here - I will save a member of my family before I save my life. I will save my neighbor before I worry about someone on the other side of the country. I will save my fellow countryman before I worry about someone on the other side of the planet. That doesn't mean I won't give to charities helping other folks, just that my priorities have a certain hierarchy.

If given an opportunity to do something foolish and risky with retirement savings like put all of it into the stock of a single company, ordinarily a significant portion of the population would do it. But the TSP rather gives them a choice of five diversified funds ranging from government securities to various stock indexes.

Uh-huh. Tell me, how are those "stock indexes" doing right now? If someone invested in them are they in a good position to retire or in a "sucks to be you" place?

Although the highest average annual return funds sometimes lose as much as 20% in a single poor year

And if that's the year you were planning to retire, just sucks to be you, right? Should have been born earlier or later.

At some point you no longer have time for "long term", you only have short term left.

Illuminatus Primus wrote:It means you would've spent around half your life not contributing.

Years more leisure and retirement time are such a huge gain that the economy would have to really crash and burn before it wasn't worthwhile to many people.

Sure, lounging around would be worth it to most people but you aren't

entitled to it. IF you want to retire early then YOU must fund it. Society only funds retirement past a certain age, and then only minimally. If you want more than the minimum YOU have to earn it, either while young or while working during "retirement".

SS is a floor you can't fall below That's why it's actually called social security

insurance - it's insuring you aren't completely destitute in retirement.

Besides, the preceding benefit for the rate of savings and investment is rather significant for the economy. Some investment and some R&D occurs with or without a portion of social security money going into private savings accounts. But a portion of the 13% withholdings getting saved and invested is a huge amount when the average American only voluntarily saves 1% to 2% of their income.

Well, sure, that sounds good... until you have a month like the last one. If you invest money you also risk losing it.

Actually, for example, Obama's

website gives a good illustration. There's a $500 universal mortgage credit for homeowners, and "Barack Obama will eliminate all income taxation of seniors making less than $50,000 per year." The latter would mean an unprecedented huge shifting of the tax burden for millions of the public, and a younger individual making $19000 a year would literally pay more income taxes than the zero paid by a senior making $49000 a year.

On the other hand, a geezer on SS probably has more fixed expenses than that 19 year old, who is presumably healthy and doesn't, for example, need to purchase multiple prescription drugs on his own; and the 19 year old can probably shovel the snow on his own walk whereas an 80 year old woman risks death by heart attack if she does so and thus must pay someone to clear her walk for her. Even with insurance coverage, my mother's medications cost $800 a month, that's $9,600 a year the 19 year old probably doesn't have to pay out of pocket. Yeah, that will take a bite out of your income. My mother requires a gluten-free diet - that also is more expensive than a minimum cost diet. She is prone to gout as well, which further adds to her dietary restrictions. No insurance covers the cost of food, even when a special diet is medically necessary, and again it's an additional cost to being old.

Not that I think that is an ideal position to take, or that 50k should be the cut off, but it can be expensive to be old.

The retirees in a partially privatized social security program would be subsisting off a society running on the nuclear power plants their past investment dollars helped build, the factories, etc.

Or maybe just funding the multi-million salaries and golden parachutes of financial "experts" who run formerly stable and respected businesses into the ground then walk away and ask the taxpayers for more money.