There's the "growth is all there is" meme about economic health, as one might expect, but I'm particularly curious about his assessment that Hoover's and Roosevelt's programs actually prolonged the Great Depression.President Bush argued that the passage of the Treasury rescue plan was necessary to prevent the U.S. from entering a severe downturn. Yesterday, the Federal Reserve announced it will begin buying commercial paper to, in the words of Fed Chairman Ben Bernanke, help "financial firms cope with reduced access to their usual sources of funding."

Both of these actions were designed to restore confidence in our financial markets. Unfortunately, they have created considerable fear about the underlying strength of the U.S. economy. This panic has roiled stock markets and led to comparisons between today's crisis and the Great Depression of the 1930s.

[Good Policies Can Save the Economy] Getty Images

The Treasury plan and the Fed's emergency measures are certainly useful. However, their main contribution is not preventing a Depression-like scenario from evolving out of the current financial crisis. The real economy is a great deal stronger than many believe.

Despite the September employment report, there are no signs that the economy is on the verge of a depression. Real GDP rose at an annual rate of 2.7% over the last five quarters, which is on trend, once a correction is made for the decline in the growth rate of the working-age population. Productivity growth remains rapid. Consumer installment borrowing, which represents most consumer nonmortgage borrowing, is up 5% year over year, and the interest rates on these loans are equal to, or below, the levels that prevailed over the last five years. Commercial and industrial loans are up 9% year over year. And to those with good credit histories, conforming mortgages are available at 30-year fixed rates of around 6%. That represents an inflation-adjusted mortgage rate that is low by historical standards. So the current financial crisis is not as deep or as broad as some have feared.

Moreover, financial panics and crises are not as depressing as many believe. Current discussions point to the banking crises of the Great Depression as the best evidence that the financial crisis would devastate the U.S. economy. This is based on the very common misperception that the banking crises of the 1930s helped turn a garden variety recession into the Great Depression.

Banking panics did not create the Great Depression, nor did the elimination of panics via the introduction of deposit insurance generate economic recovery. The first banking crisis of any national significance didn't occur until the fall of 1931. Before this, there were regional banking crises that had no measurable impact on capital markets, as the spreads between Treasurys and risky obligations changed very little. However, the Great Depression was already "great" at this point -- industrial production and employment had fallen by more than 35%. The genesis of the Great Depression was not a banking crisis.

Given my view that the crisis is not as deep as some have feared, and that the potential impact of the crisis would be smaller than what has been advertised, should we even have adopted the Treasury plan?

Absolutely. While the economy would avoid a serious downturn in the absence of the Treasury plan, recent financial market conditions left unchecked could lead to a moderate recession. And there is a real danger that even a moderate recession, along with the current perception of an economic crisis, would lead to calls from various quarters for bad economic policies -- policies that tend to either pander to special-interest groups, benefiting relatively few at the expense of many, or raising taxes, particularly on the nation's most productive citizens, many of whom create jobs through their own enterprises.

There are many historical precedents of bad policies following crises. The worst case was after the stock-market crash in October 1929, which produced a truly perfect storm of bad policies. Tax rates rose, tariffs rose (reflecting special interest groups attempting to insulate domestic producers from foreign competition), and both Presidents Herbert Hoover and Franklin Roosevelt strongly promoted industry-labor cartels that were designed to stifle domestic competition.

In the absence of these policies, the Great Depression would almost certainly have been like every other U.S. recession -- short-lived and relatively mild. Normal recovery didn't begin until the most onerous of these policies were reversed, a process that didn't begin until the end of the 1930s when antitrust activity was resumed, and during World War II when the National War Labor Board reduced union bargaining power by limiting negotiated wage increases to cost-of-living adjustments only.

Bad polices impact the two most important determinants of living standards: output per worker and the amount of time devoted to market work. We need look no further than Western Europe to see how bad policies have depressed a number of advanced market economies. Hours worked per adult in the average Western European country have declined nearly 30% since the 1960s, as tax rates on labor are up 15 to 20 percentage points.

Japan in the 1990s is an example of bad policies that depress productivity growth. Once Japan stopped subsidizing inefficient production and reformed its banking system, productivity growth resumed. Another example is Mexico. After a financial crisis in 1981, Mexico had a depression resulting from polices that depressed productivity by severely restricting competition in its banking sector and by allocating loans to preferred borrowers at artificially low rates. Chile also had a financial crisis in 1981, but in contrast to Mexico, introduced policies that fostered competition in its banking sector and streamlined bankruptcy process. These policies contributed to substantial productivity growth that has sustained Chile's growth "miracle" for the past 25 years.

I am particularly concerned about bad policies because significantly higher taxes have been proposed by Barack Obama. His plan would raise the marginal tax rate on the most productive workers more than 10 percentage points -- an increase that would bring us near Western European levels. His plan would also raise capital income taxes, taxing capital gains and dividends at 20%, compared to a 15% rate under Sen. John McCain's plan. A five percentage-point difference might strike you as small, but it is not. I have calculated that a five percentage-point difference in overall capital income taxation over the long haul is equal to a difference in the nation's capital stock of about 18%. This means a 6% difference in GDP and a 6% difference in the average wage rate. This means that real GDP and the average wage would fall, gradually but persistently declining about 6% after 25 years. That's not quite a Great Depression, but a significant step towards one.

What should be done? We should encourage the immigration of prime-age individuals. Beginning in 2007, net immigration fell to half of its level over the previous five years. Increasing immigration would increase the demand for housing and raise home prices. And note that the benefit would be immediate. Home prices -- and the value of subprime obligations -- would rise in anticipation of a higher population base. The U.S. particularly needs highly skilled workers. These workers not only would purchase homes, but would generate higher living standards for all Americans.

Will we duck a depression? We will if the principles of economic growth -- increasing the incentives to work and save, promoting competition, and fostering economic openness -- are maintained. This is the most important lesson we learned, the hard way, from the 1930s.

[Op/Ed] Good policies would help economy avoid contraction

Moderators: Alyrium Denryle, Edi, K. A. Pital

[Op/Ed] Good policies would help economy avoid contraction

WSJ op/ed

A Government founded upon justice, and recognizing the equal rights of all men; claiming higher authority for existence, or sanction for its laws, that nature, reason, and the regularly ascertained will of the people; steadily refusing to put its sword and purse in the service of any religious creed or family is a standing offense to most of the Governments of the world, and to some narrow and bigoted people among ourselves.

F. Douglass

- The Spartan

- Sith Marauder

- Posts: 4406

- Joined: 2005-03-12 05:56pm

- Location: Houston

Re: [Op/Ed] Good policies would help economy avoid contraction

That would certainly go against what I learned in history class, which is that Hoover at best didn't help and at worst deepened the effects, while FDR's policies are what got us on the road to recovery.Surlethe wrote:There's the "growth is all there is" meme about economic health, as one might expect, but I'm particularly curious about his assessment that Hoover's and Roosevelt's programs actually prolonged the Great Depression.

The Gentleman from Texas abstains. Discourteously. PRFYNAFBTFC-Vice Admiral: MFS Masturbating Walrus :: Omine subtilite Odobenus rosmarus masturbari

PRFYNAFBTFC-Vice Admiral: MFS Masturbating Walrus :: Omine subtilite Odobenus rosmarus masturbari

Soy un perdedor.

"WHO POOPED IN A NORMAL ROOM?!"-Commander William T. Riker

Soy un perdedor.

"WHO POOPED IN A NORMAL ROOM?!"-Commander William T. Riker

- Admiral Valdemar

- Outside Context Problem

- Posts: 31572

- Joined: 2002-07-04 07:17pm

- Location: UK

Re: [Op/Ed] Good policies would help economy avoid contraction

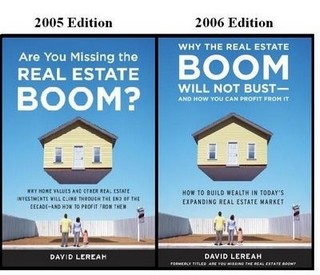

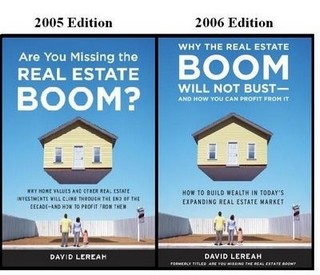

But the real estate boom was never meant to end! How can this be?

- Uraniun235

- Emperor's Hand

- Posts: 13772

- Joined: 2002-09-12 12:47am

- Location: OREGON

- Contact:

Re: [Op/Ed] Good policies would help economy avoid contraction

"There is no "taboo" on using nuclear weapons." -Julhelm What is Project Zohar?

What is Project Zohar?

"On a serious note (well not really) I did sometimes jump in and rate nBSG episodes a '5' before the episode even aired or I saw it." - RogueIce explaining that episode ratings on SDN tv show threads are bunk

"On a serious note (well not really) I did sometimes jump in and rate nBSG episodes a '5' before the episode even aired or I saw it." - RogueIce explaining that episode ratings on SDN tv show threads are bunk

-

Gerald Tarrant

- Jedi Knight

- Posts: 752

- Joined: 2006-10-06 01:21am

- Location: socks with sandals

Re: [Op/Ed] Good policies would help economy avoid contraction

Smoot-Hawley for one gets a large amount of attention as one of the causes of the Great Depression. Many of President Roosevelt's proposals were designed to keep prices at a pre-depression level, that often caused demand to decline, and hurt both consumers and producers, where is wage/price arbitrage would probably have let employment and purchasing numbers go up.Surlethe wrote: There's the "growth is all there is" meme about economic health, as one might expect, but I'm particularly curious about his assessment that Hoover's and Roosevelt's programs actually prolonged the Great Depression.

There's a substantial minority of economists who share this guy's view.

Here's a slightly more wonkish quote about the effects

From the Same Guy"President Roosevelt believed that excessive competition was responsible for the Depression by reducing prices and wages, and by extension reducing employment and demand for goods and services," said Cole, also a UCLA professor of economics. "So he came up with a recovery package that would be unimaginable today, allowing businesses in every industry to collude without the threat of antitrust prosecution and workers to demand salaries about 25 percent above where they ought to have been, given market forces. The economy was poised for a beautiful recovery, but that recovery was stalled by these misguided policies."

Using data collected in 1929 by the Conference Board and the Bureau of Labor Statistics, Cole and Ohanian were able to establish average wages and prices across a range of industries just prior to the Depression. By adjusting for annual increases in productivity, they were able to use the 1929 benchmark to figure out what prices and wages would have been during every year of the Depression had Roosevelt's policies not gone into effect. They then compared those figures with actual prices and wages as reflected in the Conference Board data.

In the three years following the implementation of Roosevelt's policies, wages in 11 key industries averaged 25 percent higher than they otherwise would have done, the economists calculate. But unemployment was also 25 percent higher than it should have been, given gains in productivity.

Meanwhile, prices across 19 industries averaged 23 percent above where they should have been, given the state of the economy. With goods and services that much harder for consumers to afford, demand stalled and the gross national product floundered at 27 percent below where it otherwise might have been.

"High wages and high prices in an economic slump run contrary to everything we know about market forces in economic downturns," Ohanian said. "As we've seen in the past several years, salaries and prices fall when unemployment is high. By artificially inflating both, the New Deal policies short-circuited the market's self-correcting forces."

I also found the academic paper where he makes most of these assertions. It's a PDF PDF LINK

The rain it falls on all alike

Upon the just and unjust fella'

But more upon the just one for

The Unjust hath the Just's Umbrella

Upon the just and unjust fella'

But more upon the just one for

The Unjust hath the Just's Umbrella

Re: [Op/Ed] Good policies would help economy avoid contraction

Ah, the mythical market's self-correcting forces."High wages and high prices in an economic slump run contrary to everything we know about market forces in economic downturns," Ohanian said. "As we've seen in the past several years, salaries and prices fall when unemployment is high. By artificially inflating both, the New Deal policies short-circuited the market's self-correcting forces."

"Okay, I'll have the truth with a side order of clarity." ~ Dr. Daniel Jackson.

"Reality has a well-known liberal bias." ~ Stephen Colbert

"One Drive, One Partition, the One True Path" ~ ars technica forums - warrens - on hhd partitioning schemes.

"Reality has a well-known liberal bias." ~ Stephen Colbert

"One Drive, One Partition, the One True Path" ~ ars technica forums - warrens - on hhd partitioning schemes.

Re: [Op/Ed] Good policies would help economy avoid contraction

Self-correcting market forces are quite real. However, HDS put it best when he described the "invisible hand" as a powerfist from Warhammer 40k rather than a velvet glove. I don't understand why so many conservatives have mythicized what they believe to be the "free market" into some benevolent watchman there to ensure the manifest destiny of god and country. First off, what they believe in is economic anarchy. Second, even if a free market were to exist, it would be amorally and brutally efficient. When the stock markets crashed in 1929, that was the market self-correcting. Similarly, the S&L crises of the 1980's and 1990's were instances of the market self-correcting. The subprime morgage fiasco that precipitated our current-day situation is another example of the market correcting itself.

The problem isn't that we artificially prevented the market from self-correcting. The problem is that we made extremely bad calls, and now the effects of market corrective forces are kicking in. Unless measures are taken to solve the problems before market forces do, they will smash through the economy like Katrina through the Lower Ninth Ward or a tsunami through Southeast Asia.

The problem isn't that we artificially prevented the market from self-correcting. The problem is that we made extremely bad calls, and now the effects of market corrective forces are kicking in. Unless measures are taken to solve the problems before market forces do, they will smash through the economy like Katrina through the Lower Ninth Ward or a tsunami through Southeast Asia.

Re: [Op/Ed] Good policies would help economy avoid contraction

The basic problem is "self-correcting forces" are little more than crash and burn when people catchup that they are literially valuing things more than they are physically worth. Normally seen when people are using more than they are producing, this is painfully obvious in the real estate market since there is a fixed amount of land (and in good locations & quaility) and only so much capcity to develop it. In a system with vasts amounts of excess capacity, you can hide huge inefficiencies with resource allocation(corruption, etc) and resource over-valuation.

The mythical market's self-correcting forces require businesses and consumers who are rational actors who make globally optimum choices. That is mythical and does not exist

The mythical market's self-correcting forces require businesses and consumers who are rational actors who make globally optimum choices. That is mythical and does not exist

"Okay, I'll have the truth with a side order of clarity." ~ Dr. Daniel Jackson.

"Reality has a well-known liberal bias." ~ Stephen Colbert

"One Drive, One Partition, the One True Path" ~ ars technica forums - warrens - on hhd partitioning schemes.

"Reality has a well-known liberal bias." ~ Stephen Colbert

"One Drive, One Partition, the One True Path" ~ ars technica forums - warrens - on hhd partitioning schemes.

Re: [Op/Ed] Good policies would help economy avoid contraction

I don't think that he's referring to the free market, per se; as I understand the economist is asserting that the high wages and prices were an unstable equilibrium held in place by government policy. If the policy had been removed, the Depression (so the argument goes) would have been over more quickly.Xon wrote:Ah, the mythical market's self-correcting forces.

By the way, the free market can solve anything. For example, the free market can solve overpopulation and hunger. It does this by giving cakes to- I mean, starving poor people. The problem is that the free market does not always provide ethically satisfactory answers.

A Government founded upon justice, and recognizing the equal rights of all men; claiming higher authority for existence, or sanction for its laws, that nature, reason, and the regularly ascertained will of the people; steadily refusing to put its sword and purse in the service of any religious creed or family is a standing offense to most of the Governments of the world, and to some narrow and bigoted people among ourselves.

F. Douglass

Re: [Op/Ed] Good policies would help economy avoid contraction

Roughly paraphrased, the job of a central banker is to take the punchbowl & booze away just as the party's getting fun. I can't remember who said that, but IIRC it was one of the former Fed officials.

Unfortunately we don't do that, we just give more free booze to the drunken frat boys until they wreck the whole house, puke their guts out everywhere, and get carted away to the hospital. Then we patch up the house and let them do it all over again.

Good economic policies would help avoid contraction, because they'd never let the economy get into a bubble and blow up in the first place. You end up with slow sustainable growth with minor downturns every now and then instead of a wild rollercoaster ride.

Unfortunately we don't do that, we just give more free booze to the drunken frat boys until they wreck the whole house, puke their guts out everywhere, and get carted away to the hospital. Then we patch up the house and let them do it all over again.

Good economic policies would help avoid contraction, because they'd never let the economy get into a bubble and blow up in the first place. You end up with slow sustainable growth with minor downturns every now and then instead of a wild rollercoaster ride.

Lusankya: Deal!

Say, do you want it to be a threesome with your wife? Or a foursome with your wife and sister-in-law? I'm up for either.

- Darth Wong

- Sith Lord

- Posts: 70028

- Joined: 2002-07-03 12:25am

- Location: Toronto, Canada

- Contact:

Re: [Op/Ed] Good policies would help economy avoid contraction

Unfortunately, the people are too stupid for that. They will vote for whoever gives them the most short-term money, damn the long-term consequences. That's why Shrubby got elected to a second term: people were convinced that everything was going well, because it appeared to be. As long as he could keep that illusion going long enough to get re-elected, he didn't really care about anything else.

In a way, the wildly undamped boom-bust cycle is a direct result of populist politics. If this were a car, George W. Bush would have removed the shock absorbers and congratulated himself on saving money.

In a way, the wildly undamped boom-bust cycle is a direct result of populist politics. If this were a car, George W. Bush would have removed the shock absorbers and congratulated himself on saving money.

"you guys are fascinated with the use of those "rules of logic" to the extent that you don't really want to discussus anything."- GC

"I do not believe Russian Roulette is a stupid act" - Embracer of Darkness

"Viagra commercials appear to save lives" - tharkûn on US health care.

http://www.stardestroyer.net/Mike/RantMode/Blurbs.html

Re: [Op/Ed] Good policies would help economy avoid contraction

No kidding. If a politician promises a tax break the people will vote him in unless he's done something monumentally stupid.Darth Wong wrote:Unfortunately, the people are too stupid for that. They will vote for whoever gives them the most short-term money, damn the long-term consequences.

I remember when Harper was putting out his propaganda on how a 1% GST cut would save all of us thousands of dollars, my co-workers were all cheering for it and going "fuck yeah!" They never figured out that they'd have to spend $100k to "save" just $1000, let alone several thousand. $100k is more than their entire gross yearly income, in some cases, it's twice their annual earnings. The only people who'd save thousands are the millionaires who have truckloads of disposable income.

Lusankya: Deal!

Say, do you want it to be a threesome with your wife? Or a foursome with your wife and sister-in-law? I'm up for either.