Are you being serious?Surlethe wrote:Because information costs are so high?

Buffett, Ballmer predict bright economic future

Moderators: Alyrium Denryle, Edi, K. A. Pital

Re: Buffett, Ballmer predict bright economic future

Re: Buffett, Ballmer predict bright economic future

Looking at median wages is a terrible, terrible way to gauge aggregate demand. America has very serious problems concerning inequality, but when talking about recession economics you want to look at aggegate measures, and despite terrible income distribution, gross incomes have been going up over the past 15-20 years, due to large productivity gains (leading to large creation of wealth and GDP per capita increases).What's the US economy based upon? Well let's see, 70% or so is consumer spending. What enables consumer spending? Well, there's two things; wages and credit/borrowing. Inflation adjusted wages have been flat for at least a couple decades for all but the rich and show no signs of rising, plus the easy credit & borrowing binge which we've had for the past 15-20 years is now over. Where does the spending come from either now or in the future? Unless there is a substantial re-alignment of the US economy or consumer spending is restarted at 2005 levels, or a combination of the above, there is no recovery. Period. I do not see any signs, anywhere, of either of the above taking place.

This aggregate growth, although the median worker may not enjoy the long-term benefits, is enough to fuel recovery from a recession the size of 2010's.

Despite your claims of new, unconventional models needed to explain future events, there's really nothing about the current economic crisis that is new to macroeconomics. Granted, economists didn't predict the current crisis, because bubbles are nortoriously hard to diagnose and predict, but they are really easy to understand.

Re: Buffett, Ballmer predict bright economic future

Good luck. I've made a rather optimistic assumption in that post, if the debt unwind takes place over 5 years instead of 10 for example, that's over a trillion sucked out of the economy every year. Add in the multiplier effects from the lost spending and there is no way income growth, assuming there is any, is going to keep up with that level of demand destruction.TheKwas wrote:Looking at median wages is a terrible, terrible way to gauge aggregate demand. America has very serious problems concerning inequality, but when talking about recession economics you want to look at aggegate measures, and despite terrible income distribution, gross incomes have been going up over the past 15-20 years, due to large productivity gains (leading to large creation of wealth and GDP per capita increases).

This aggregate growth, although the median worker may not enjoy the long-term benefits, is enough to fuel recovery from a recession the size of 2010's.

The non-conventional models predicted the crisis in advance whereas ALL conventional models failed. Why should we continue to use broken models which do not have predictive abilities instead of carrying out further research using and based upon the models which work and do have predictive abilities? I reject conventional economics because it does not work, and because its assumptions are retarded. View the notes filed under Political Economy: Critiques on Prof. Steve Keen's lectures for a quick explanation of why this is.Despite your claims of new, unconventional models needed to explain future events, there's really nothing about the current economic crisis that is new to macroeconomics. Granted, economists didn't predict the current crisis, because bubbles are nortoriously hard to diagnose and predict, but they are really easy to understand.

This post is a 100% natural organic product.

The slight variations in spelling and grammar enhance its individual character and beauty and in no way are to be considered flaws or defects

I'm not sure why people choose 'To Love is to Bury' as their wedding song...It's about a murder-suicide

- Margo Timmins

When it becomes serious, you have to lie

- Jean-Claude Juncker

The slight variations in spelling and grammar enhance its individual character and beauty and in no way are to be considered flaws or defects

I'm not sure why people choose 'To Love is to Bury' as their wedding song...It's about a murder-suicide

- Margo Timmins

When it becomes serious, you have to lie

- Jean-Claude Juncker

Re: Buffett, Ballmer predict bright economic future

Interest rates are extremely low at the moment. Why would we have a debt crisis within the next 5 years? Are you predicting a huge increase in interest rates that the market doesn't currently see? I would recommend putting money on it.Good luck. I've made a rather optimistic assumption in that post, if the debt unwind takes place over 5 years instead of 10 for example, that's over a trillion sucked out of the economy every year. Add in the multiplier effects from the lost spending and there is no way income growth, assuming there is any, is going to keep up with that level of demand destruction.

Remember it's not the debt burden that matters, it's the debt affordablity. Right now, taking on debt is extremely cheap.

After we're out of the rabbits hole in the next 5-10 years, the debt unwind can take place over as many years as wanted.

Any model that claims to be able to predict bubbles better than the market is either bollocks, or has an author who is is a very genourous person who declined to get rich off it.The non-conventional models predicted the crisis in advance whereas ALL conventional models failed. Why should we continue to use broken models which do not have predictive abilities instead of carrying out further research using and based upon the models which work and do have predictive abilities? I reject conventional economics because it does not work, and because its assumptions are retarded. View the notes filed under Political Economy: Critiques on Prof. Steve Keen's lectures for a quick explanation of why this is.

Furthermore, being able to predict a bubble, and knowing what to do after it are two very different things. You can watch a lecture about shadowbanking for hours without even hearing the word "aggregate". An economic discussion about getting out a recession, on the other hand, shouldn't last 40 seconds without the word.

There's been doomsayers seeing the appocalypse around every corner for as long as I can remember. Just because they happened to be right in 2007 doesn't mean I'll start taking every crazy idea they have seriously. Basic Keynesian economics remains valid and insightful, and invisiable bond vigilantes are still looking for invisiable bond increases.

Re: Buffett, Ballmer predict bright economic future

Sorry, MY DAD predicted the crash. Should we all listen to my dad on economic matters now? I can even invent some investment successes and personal skills to pad out his internet resume if you like.

It's pretty funny to get an Australian perspective, because teaching (if not thinking) highlighted the risks ages ago.

It's pretty funny to get an Australian perspective, because teaching (if not thinking) highlighted the risks ages ago.

Re: Buffett, Ballmer predict bright economic future

Why wouldn't we have a debt problem of some sort?TheKwas wrote:Interest rates are extremely low at the moment. Why would we have a debt crisis within the next 5 years? Are you predicting a huge increase in interest rates that the market doesn't currently see? I would recommend putting money on it.

So why isn't it happening? Why is debt deleveraging taking place throughout the private sector?Remember it's not the debt burden that matters, it's the debt affordablity. Right now, taking on debt is extremely cheap.

We have 11 models which worked.Any model that claims to be able to predict bubbles better than the market is either bollocks, or has an author who is is a very genourous person who declined to get rich off it.

Unfortunately. Political & business considerations & so forth.Furthermore, being able to predict a bubble, and knowing what to do after it are two very different things. You can watch a lecture about shadowbanking for hours without even hearing the word "aggregate". An economic discussion about getting out a recession, on the other hand, shouldn't last 40 seconds without the word.

We can take those models and test them using historical data to see how well they correlate with actual events. That's actually one of the projects I'm currently working on for my employers.There's been doomsayers seeing the appocalypse around every corner for as long as I can remember. Just because they happened to be right in 2007 doesn't mean I'll start taking every crazy idea they have seriously.

So Iceland, Greece, Spain, Portugal and Ireland do not exist in this world of yours? The yield on Greek 10 year bonds going from 5% to ~18% earlier this year was a collective delusion?Basic Keynesian economics remains valid and insightful, and invisiable bond vigilantes are still looking for invisiable bond increases.

This post is a 100% natural organic product.

The slight variations in spelling and grammar enhance its individual character and beauty and in no way are to be considered flaws or defects

I'm not sure why people choose 'To Love is to Bury' as their wedding song...It's about a murder-suicide

- Margo Timmins

When it becomes serious, you have to lie

- Jean-Claude Juncker

The slight variations in spelling and grammar enhance its individual character and beauty and in no way are to be considered flaws or defects

I'm not sure why people choose 'To Love is to Bury' as their wedding song...It's about a murder-suicide

- Margo Timmins

When it becomes serious, you have to lie

- Jean-Claude Juncker

- Broomstick

- Emperor's Hand

- Posts: 28846

- Joined: 2004-01-02 07:04pm

- Location: Industrial armpit of the US Midwest

Re: Buffett, Ballmer predict bright economic future

The fly in the ointment, there, is that people like me didn't decrease our consumer spending because we were saving money, we decreased it because we don't have any money period! Where does this "savings" come from if there are millions of people (about 40 million, last I heard) who have no income, or insufficient income for basic needs?Surlethe wrote:Why wouldn't the economy realign and begin to grow? When debt has fallen far enough, consumer spending will stabilize and begin to start rising again. In fact, if consumer spending falls as a proportion of GDP, economies will actually grow more quickly (on average) because the increased saving will be invested.

"Good economic news?" Bullshit. Tell me when I start getting a slice of the pie again, THEN I'll call it good news!

(Yes, I"m in a pissy mood. It's because my business partner/employer broke his foot yesterday and we're BOTH out of work until he can get back in the game)

A life is like a garden. Perfect moments can be had, but not preserved, except in memory. Leonard Nimoy.

Now I did a job. I got nothing but trouble since I did it, not to mention more than a few unkind words as regard to my character so let me make this abundantly clear. I do the job. And then I get paid.- Malcolm Reynolds, Captain of Serenity, which sums up my feelings regarding the lawsuit discussed here.

If a free society cannot help the many who are poor, it cannot save the few who are rich. - John F. Kennedy

Sam Vimes Theory of Economic Injustice

Now I did a job. I got nothing but trouble since I did it, not to mention more than a few unkind words as regard to my character so let me make this abundantly clear. I do the job. And then I get paid.- Malcolm Reynolds, Captain of Serenity, which sums up my feelings regarding the lawsuit discussed here.

If a free society cannot help the many who are poor, it cannot save the few who are rich. - John F. Kennedy

Sam Vimes Theory of Economic Injustice

Re: Buffett, Ballmer predict bright economic future

J, and/or others, is there any chance you could run by me why the ongoing economic pain is so much more severe in the US than in Oz? Are we afloat purely because of primary resources exporting, or are our much-vaunted economic regulations assisting too? I ask because it doesn't 'feel' like we're in economic trouble down here - I understand that the current bet is on whether the RBA raises interest rates before or after Christmas - while from what you guys are saying it looks like the US is in serious strife.

Re: Buffett, Ballmer predict bright economic future

Regardless of what happens in AU, there's a propagation delay from events in the US. If the US dies in the ass we're fucked too.

Re: Buffett, Ballmer predict bright economic future

Because there's bigger issues on our plate: ie. the recession.Why wouldn't we have a debt problem of some sort?

Because that's actually normal for a recession. Paradox of thrift. Look at gross debt with government debt included.So why isn't it happening? Why is debt deleveraging taking place throughout the private sector?

Buh?Unfortunately. Political & business considerations & so forth.

And 101 doomsayers which didn't work out. I remain unimpressed.We have 11 models which worked.[

Exactly what models are these that are able to predict bubble bursts? I would enjoy make a good fortune the next time there's a big one.

Way to point out the fringes of the Eurozone?So Iceland, Greece, Spain, Portugal and Ireland do not exist in this world of yours? The yield on Greek 10 year bonds going from 5% to ~18% earlier this year was a collective delusion?

Krugman

Trying to compare America to the Euro-fringe is simply bad economics. America isn't tied into a currency that is ill-fitted for it's economic situation. Greece and Spain are.

Re: Buffett, Ballmer predict bright economic future

Alrighty, if you want to play that game, the recession is over according to the NBER, and has been over for more than a year. Why does debt deleveraging continue, and why isn't debt a problem?TheKwas wrote:Because there's bigger issues on our plate: ie. the recession.Why wouldn't we have a debt problem of some sort?

Because that's actually normal for a recession. Paradox of thrift. Look at gross debt with government debt included.So why isn't it happening? Why is debt deleveraging taking place throughout the private sector?

Ah yes, Krugman, the same retard who advocated a housing bubble back in 2002?Way to point out the fringes of the Eurozone?So Iceland, Greece, Spain, Portugal and Ireland do not exist in this world of yours? The yield on Greek 10 year bonds going from 5% to ~18% earlier this year was a collective delusion?

Krugman

Trying to compare America to the Euro-fringe is simply bad economics. America isn't tied into a currency that is ill-fitted for it's economic situation. Greece and Spain are.

http://www.nytimes.com/2002/08/02/opini ... ble&st=cse

Excerpt:

He was completely wrong in that article by the way as historical events have proven.The basic point is that the recession of 2001 wasn't a typical postwar slump, brought on when an inflation-fighting Fed raises interest rates and easily ended by a snapback in housing and consumer spending when the Fed brings rates back down again. This was a prewar-style recession, a morning after brought on by irrational exuberance. To fight this recession the Fed needs more than a snapback; it needs soaring household spending to offset moribund business investment. And to do that, as Paul McCulley of Pimco put it, Alan Greenspan needs to create a housing bubble to replace the Nasdaq bubble.

This is also the moron who advocates destroying 1/10 of the physical currency each year to create negative real interest rates forcing people to spend.

This post is a 100% natural organic product.

The slight variations in spelling and grammar enhance its individual character and beauty and in no way are to be considered flaws or defects

I'm not sure why people choose 'To Love is to Bury' as their wedding song...It's about a murder-suicide

- Margo Timmins

When it becomes serious, you have to lie

- Jean-Claude Juncker

The slight variations in spelling and grammar enhance its individual character and beauty and in no way are to be considered flaws or defects

I'm not sure why people choose 'To Love is to Bury' as their wedding song...It's about a murder-suicide

- Margo Timmins

When it becomes serious, you have to lie

- Jean-Claude Juncker

Re: Buffett, Ballmer predict bright economic future

Oh, and one more thing.TheKwas wrote:Because there's bigger issues on our plate: ie. the recession.Why wouldn't we have a debt problem of some sort?

For sustainable growth that line needs to come back to the historical trend, otherwise the public debt eventually runs away and debt service costs will consume the entire government's revenue. The government can't tax as revenue what the people do not earn, continue the current trend long enough and the choice is either a government debt default or the Zimbabwe model.

This post is a 100% natural organic product.

The slight variations in spelling and grammar enhance its individual character and beauty and in no way are to be considered flaws or defects

I'm not sure why people choose 'To Love is to Bury' as their wedding song...It's about a murder-suicide

- Margo Timmins

When it becomes serious, you have to lie

- Jean-Claude Juncker

The slight variations in spelling and grammar enhance its individual character and beauty and in no way are to be considered flaws or defects

I'm not sure why people choose 'To Love is to Bury' as their wedding song...It's about a murder-suicide

- Margo Timmins

When it becomes serious, you have to lie

- Jean-Claude Juncker

Re: Buffett, Ballmer predict bright economic future

The reason it's not nearly as bad in Canada and Australia is that we started from a much better fundamental position. We had balanced budgets, a much lower government debt load, our banks & financials didn't get as stupid with their lending practices, and they didn't get as involved in the securitization and structured finance derivatives crap. Then you add in the resource exporting and high resource prices and it puts us in better shape. For now.xt828 wrote:J, and/or others, is there any chance you could run by me why the ongoing economic pain is so much more severe in the US than in Oz? Are we afloat purely because of primary resources exporting, or are our much-vaunted economic regulations assisting too? I ask because it doesn't 'feel' like we're in economic trouble down here - I understand that the current bet is on whether the RBA raises interest rates before or after Christmas - while from what you guys are saying it looks like the US is in serious strife.

But that doesn't make us immune, both countries and especially Australia are dependent on China staying strong and continuing to consume our resources and keeping the prices high. The problem there is that China currently depends heavily on exporting manufactured goods to OECD countries, most of which have shaky economies and some of which are at risk of going into a full-on depression. If that happens then China's economy gets hit hard since they're now stuck with a bunch of goods they can't sell, unless they can somehow ramp up their internal demand in time. If China gets hit, we get raped.

Lusankya: Deal!

Say, do you want it to be a threesome with your wife? Or a foursome with your wife and sister-in-law? I'm up for either.

Re: Buffett, Ballmer predict bright economic future

Yes, quite. It is very difficult to predict which areas of the economy are in a bubble and which are growing, and when the bubbles will burst.J wrote:Are you being serious?Surlethe wrote:Because information costs are so high?

A Government founded upon justice, and recognizing the equal rights of all men; claiming higher authority for existence, or sanction for its laws, that nature, reason, and the regularly ascertained will of the people; steadily refusing to put its sword and purse in the service of any religious creed or family is a standing offense to most of the Governments of the world, and to some narrow and bigoted people among ourselves.

F. Douglass

Re: Buffett, Ballmer predict bright economic future

Perhaps it is for traditional economics, though I'd argue that reflects more on their broken models and theories.Surlethe wrote:Yes, quite. It is very difficult to predict which areas of the economy are in a bubble and which are growing, and when the bubbles will burst.

When you see charts like this which aren't backed up by revenues nor earnings, it's almost certainly a bubble.

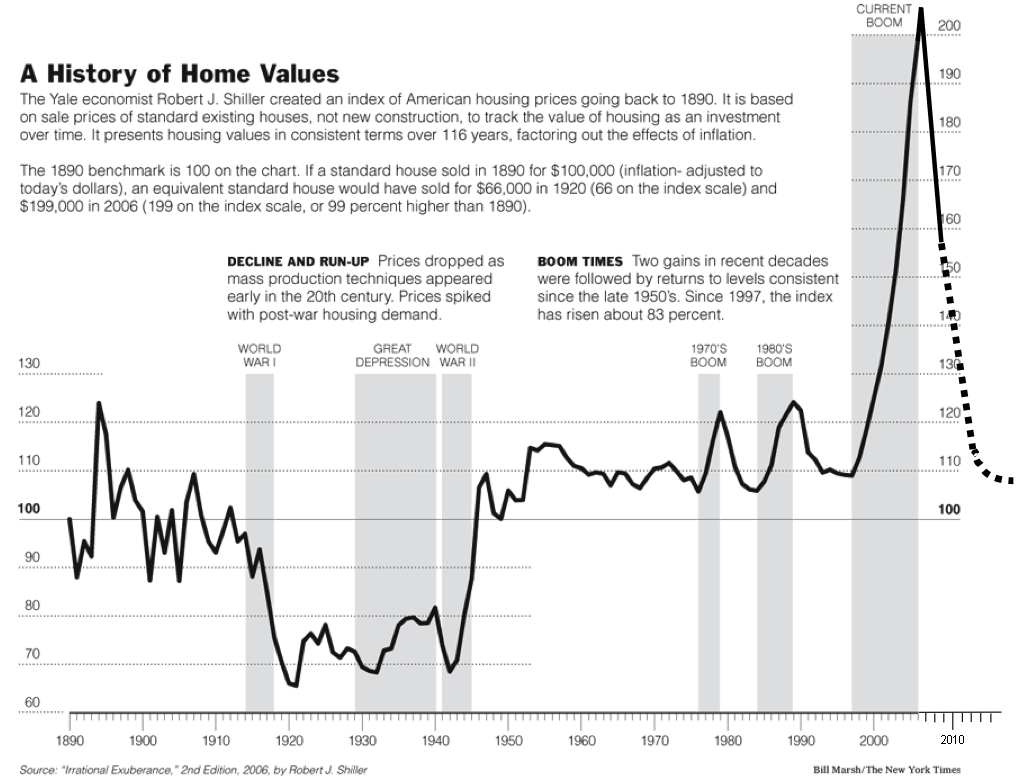

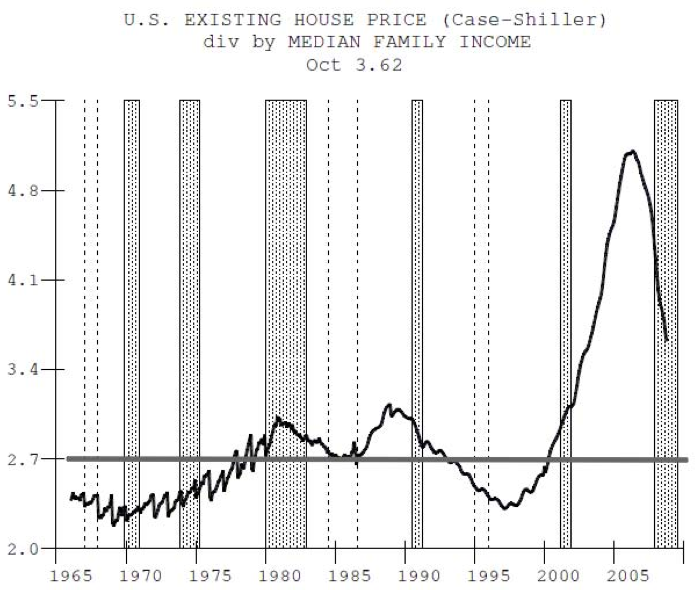

Next, I present housing prices as shown by the Case-Shiller Index and the housing price to income ratio.

Recall that mortgages have to be serviced from wage incomes, there is no future revenue to support mortgage payments if housing prices continue zooming upwards and the price:income ratio zips skyward along with it. Which means it's unsustainable and must correct at some point, and that by definition is a bubble. Warning bells should've been going off by 2003-2004, yet none of the conventional economists & models saw it nor picked it up until well after it had imploded. As a sidenote, Robert Shiller, he of the Case-Shiller Index, was one of the eleven who predicted the housing led economics implosion in advance.

I honestly don't believe finding and recognizing bubbles is as hard as it's claimed to be by conventional economists & theories. The only truly difficult part is predicting when the money to support the bubble runs out and results in its implosion. Which brings me to the final chart.

Note the pinkish line. The CBO projects $1 trillion+ debt increases every year for the 10 years or thereabouts, given that GDP is likely to be stagnant at best during this time, where does that put like the line and where have we seen this pattern before? Looks like the start of a sovereign debt bubble to me.

This post is a 100% natural organic product.

The slight variations in spelling and grammar enhance its individual character and beauty and in no way are to be considered flaws or defects

I'm not sure why people choose 'To Love is to Bury' as their wedding song...It's about a murder-suicide

- Margo Timmins

When it becomes serious, you have to lie

- Jean-Claude Juncker

The slight variations in spelling and grammar enhance its individual character and beauty and in no way are to be considered flaws or defects

I'm not sure why people choose 'To Love is to Bury' as their wedding song...It's about a murder-suicide

- Margo Timmins

When it becomes serious, you have to lie

- Jean-Claude Juncker

Re: Buffett, Ballmer predict bright economic future

I'm not sure where you're getting that conventional models don't predict bubbles will burst and correct. The difficulty, as you say, is figuring out when, which is what I said.

A Government founded upon justice, and recognizing the equal rights of all men; claiming higher authority for existence, or sanction for its laws, that nature, reason, and the regularly ascertained will of the people; steadily refusing to put its sword and purse in the service of any religious creed or family is a standing offense to most of the Governments of the world, and to some narrow and bigoted people among ourselves.

F. Douglass

Re: Buffett, Ballmer predict bright economic future

Didn't you just say that conventional economics can't predict/identify which sectors are in a bubble in the first place?

This post is a 100% natural organic product.

The slight variations in spelling and grammar enhance its individual character and beauty and in no way are to be considered flaws or defects

I'm not sure why people choose 'To Love is to Bury' as their wedding song...It's about a murder-suicide

- Margo Timmins

When it becomes serious, you have to lie

- Jean-Claude Juncker

The slight variations in spelling and grammar enhance its individual character and beauty and in no way are to be considered flaws or defects

I'm not sure why people choose 'To Love is to Bury' as their wedding song...It's about a murder-suicide

- Margo Timmins

When it becomes serious, you have to lie

- Jean-Claude Juncker

Re: Buffett, Ballmer predict bright economic future

I guess. (Shame on me --- I haven't been rereading my own posts.)

A Government founded upon justice, and recognizing the equal rights of all men; claiming higher authority for existence, or sanction for its laws, that nature, reason, and the regularly ascertained will of the people; steadily refusing to put its sword and purse in the service of any religious creed or family is a standing offense to most of the Governments of the world, and to some narrow and bigoted people among ourselves.

F. Douglass