LinkWhen a month ago the CEO of Wal Mart Americas told the world to "prepare for serious inflation", the Chairman laughed in his face, saying it was nothing a 15 minutes Treasury Call sell order can't fix (granted net of a few billions in commissions for JPM). 4 weeks later the Chairman is no longer laughing, having been forced to hike up his inflation expectations while trimming (not for the last time) his economic outlook. "U.S. consumers face "serious" inflation in the months ahead for clothing, food and other products, the head of Wal-Mart's U.S. operations warned Wednesday talking to USA Today. And if Wal-Mart which is at the very bottom of commoditized consumer retail, and at the very peak of avoiding reexporting of US inflation by way of China is concerned, it may be time to panic, or at least cancel those plane tickets to Zimbabwe, which is soon coming to us." In light of that perhaps today's words of caution from Wal Mart CEO Mike Duke will be taken a tad more seriously (yes, even with the $50 billion in "squatters rent" that the deadbeats spend on iPads instead of paying their mortgage: that money is rapidly ending). Warning is as follows: "Wal-Mart's core shoppers are running out of money much faster than a year ago due to rising gasoline prices, and the retail giant is worried. "We're seeing core consumers under a lot of pressure," Duke said at an event in New York. "There's no doubt that rising fuel prices are having an impact." Tell that to Printocchio please.

From Money:

Wal-Mart shoppers, many of whom live paycheck to paycheck, typically shop in bulk at the beginning of the month when their paychecks come in.Also remember that long-running joke from the NBER short bus that the recession ended in late 2009? Turns out they were just kidding, as well as blatantly lying.

Lately, they're "running out of money" at a faster clip, he said.

"Purchases are really dropping off by the end of the month even more than last year," Duke said. "This end-of-month [purchases] cycle is growing to be a concern.

Wal-Mart which averages 140 million shoppers weekly to its stores in the United States, is considered a barometer of the health of the consumer and the economy.Here's an idea: how about we let someone with actual business experience, who runs the one company employing more people than even the Federal Reserve, Mike Duke, control US monetary policy for a few months and see what happens? Surely it can't get worse than what that other insane sociopath is doing, as with each passing day we are now moving closer and closer to a hyperstaglfationary conclusion, and even the collective cheerleading crew of Cottonelle bearing monkeys, half of whom were reading "Monetary Policy for TV Reporters" (just two steps down below idiots), from yesterday's FOMC conference are finally starting to realize this.

To that end, Duke said he's not seeing signs of a recovery yet.

With food prices rising, Duke said Wal-Mart is charging customers more for some fresh groceries while reducing prices on other merchandise such as electronics.

Wal-Mart has struggled with seven straight quarters of sales declines in its stores.

Wal-Mart's Shoppers Running Out of Cash.

Moderators: Alyrium Denryle, Edi, K. A. Pital

- Big Orange

- Emperor's Hand

- Posts: 7108

- Joined: 2006-04-22 05:15pm

- Location: Britain

Wal-Mart's Shoppers Running Out of Cash.

Ah-ha, the ultimate price of costs sooooo low they're bankrupting the US consumer base by importing its cheap goods from Asia:

'Alright guard, begin the unnecessarily slow moving dipping mechanism...' - Dr. Evil

'Secondly, I don't see why "income inequality" is a bad thing. Poverty is not an injustice. There is no such thing as causes for poverty, only causes for wealth. Poverty is not a wrong, but taking money from those who have it to equalize incomes is basically theft, which is wrong.' - Typical Randroid

'I think it's gone a little bit wrong.' - The Doctor

'Secondly, I don't see why "income inequality" is a bad thing. Poverty is not an injustice. There is no such thing as causes for poverty, only causes for wealth. Poverty is not a wrong, but taking money from those who have it to equalize incomes is basically theft, which is wrong.' - Typical Randroid

'I think it's gone a little bit wrong.' - The Doctor

- SirNitram

- Rest in Peace, Black Mage

- Posts: 28367

- Joined: 2002-07-03 04:48pm

- Location: Somewhere between nowhere and everywhere

Re: Wal-Mart's Shoppers Running Out of Cash.

Hyperflation? Well, that ruins my opinions of the editorializer.

As for Wal-Mart, very definitely not surprised. When you participate and lobby for lower and lower wages, less and less health care, and more and more outsourced industry, local people have.. Less and less money!

As for Wal-Mart, very definitely not surprised. When you participate and lobby for lower and lower wages, less and less health care, and more and more outsourced industry, local people have.. Less and less money!

Manic Progressive: A liberal who violently swings from anger at politicos to despondency over them.

Out Of Context theatre: Ron Paul has repeatedly said he's not a racist. - Destructinator XIII on why Ron Paul isn't racist.

Shadowy Overlord - BMs/Black Mage Monkey - BOTM/Jetfire - Cybertron's Finest/General Miscreant/ASVS/Supermoderator Emeritus

Debator Classification: Trollhunter

Out Of Context theatre: Ron Paul has repeatedly said he's not a racist. - Destructinator XIII on why Ron Paul isn't racist.

Shadowy Overlord - BMs/Black Mage Monkey - BOTM/Jetfire - Cybertron's Finest/General Miscreant/ASVS/Supermoderator Emeritus

Debator Classification: Trollhunter

- fgalkin

- Carvin' Marvin

- Posts: 14557

- Joined: 2002-07-03 11:51pm

- Location: Land of the Mountain Fascists

- Contact:

Re: Wal-Mart's Shoppers Running Out of Cash.

And you keep charging them more and more for food. Great, innit?

Have a very nice day.

-fgalkin

Have a very nice day.

-fgalkin

- Starglider

- Miles Dyson

- Posts: 8709

- Joined: 2007-04-05 09:44pm

- Location: Isle of Dogs

- Contact:

Re: Wal-Mart's Shoppers Running Out of Cash.

So, when the market for US Treasuries inevitably collapses, and both new borrowing and debt rollover costs go through the roof, which of these do you think will happen;SirNitram wrote:Hyperflation? Well, that ruins my opinions of the editorializer.

(a) Massive cuts to all government spending including entitlements.

(b) Massive tax rises.

(c) Much more extensive and blatant money printing, than the already significant amounts.

You seem to be under the delusion that anything other than (c) is politicially feasible. It's true that the transition from (brutally) high inflation to outright hyperinflation would require incomes to start climbing as well as prices, but that doesn't all have to be wages; US government transfer payments are at all-time highs and still trending upwards.

-

Simon_Jester

- Emperor's Hand

- Posts: 30165

- Joined: 2009-05-23 07:29pm

Re: Wal-Mart's Shoppers Running Out of Cash.

One big question is "how are we defining hyperinflation?"

"Normal" inflation in an economy is something like 3% a year, right? Maybe a bit higher. It's not too hard for investment and economic growth to stay ahead of a rate like that, so it's not too big a problem over the long run.

10% a year is high inflation, enough to create large incentives against saving money, and enough that nothing but the highest-risk financial gimmicks can let you gain nominal dollars faster than inflation eats the value of those dollars. However, while it's high, it won't destroy your life savings faster than you can adapt; if you had significant money saved before, after ten years of 10% annual inflation you will still have money, in meaningful quantities.

But there are cases that involve much, much higher rates than that: say, a decline in the value of money by a factor of two in a year. 100% annual inflation is a whole different level of problem than 10% annual inflation: keep that up for a decade and the value of money declines by a factor of 1000, in which case any savings anyone had before the burst of inflation will practically disappear by the end of it. No one, no matter how brilliant a speculator they are, can realistically hope to keep ahead of inflation at those rates.

And yet there are rates of inflation much higher than that, in certain extreme financial crises: during the worst days of the Weimar Republic, prices increased so much that the currency underwent 100% inflation every two days, translating to an annual rate of something like... [maths]... 8*(10^54) percent, though that rate was not sustained for a full year. This creates such a crisis that there is literally no option for the government other than to step in and redefine the currency along with other such draconian measures.

When we talk about "hyperinflation," we must be sure which of these we mean. It is very unlikely that the US government would engage in money printing fast enough to create something like the Weimar Republic's 1923 burst of hyperinflation, because the resulting chaos would destroy them politically even more surely than tax hikes or huge entitlement cuts. It is somewhat more credible that they would print money fast enough to bring about 100% annual inflation, and quite credible that they would do it fast enough to bring about 10% annual inflation.

And yet it's quite possible that when this Wal-Mart executive talks about 'hyperinflation," he is speaking colloquially of the idea of 10% or 20% inflation per year, which is relatively quite plausible in a time of economic depression and the other factors we now face.

"Normal" inflation in an economy is something like 3% a year, right? Maybe a bit higher. It's not too hard for investment and economic growth to stay ahead of a rate like that, so it's not too big a problem over the long run.

10% a year is high inflation, enough to create large incentives against saving money, and enough that nothing but the highest-risk financial gimmicks can let you gain nominal dollars faster than inflation eats the value of those dollars. However, while it's high, it won't destroy your life savings faster than you can adapt; if you had significant money saved before, after ten years of 10% annual inflation you will still have money, in meaningful quantities.

But there are cases that involve much, much higher rates than that: say, a decline in the value of money by a factor of two in a year. 100% annual inflation is a whole different level of problem than 10% annual inflation: keep that up for a decade and the value of money declines by a factor of 1000, in which case any savings anyone had before the burst of inflation will practically disappear by the end of it. No one, no matter how brilliant a speculator they are, can realistically hope to keep ahead of inflation at those rates.

And yet there are rates of inflation much higher than that, in certain extreme financial crises: during the worst days of the Weimar Republic, prices increased so much that the currency underwent 100% inflation every two days, translating to an annual rate of something like... [maths]... 8*(10^54) percent, though that rate was not sustained for a full year. This creates such a crisis that there is literally no option for the government other than to step in and redefine the currency along with other such draconian measures.

When we talk about "hyperinflation," we must be sure which of these we mean. It is very unlikely that the US government would engage in money printing fast enough to create something like the Weimar Republic's 1923 burst of hyperinflation, because the resulting chaos would destroy them politically even more surely than tax hikes or huge entitlement cuts. It is somewhat more credible that they would print money fast enough to bring about 100% annual inflation, and quite credible that they would do it fast enough to bring about 10% annual inflation.

And yet it's quite possible that when this Wal-Mart executive talks about 'hyperinflation," he is speaking colloquially of the idea of 10% or 20% inflation per year, which is relatively quite plausible in a time of economic depression and the other factors we now face.

This space dedicated to Vasily Arkhipov

- bobalot

- Jedi Council Member

- Posts: 1733

- Joined: 2008-05-21 06:42am

- Location: Sydney, Australia

- Contact:

Re: Wal-Mart's Shoppers Running Out of Cash.

Do you have any actual evidence that any of this will actually happen? Or is this going to be like your brainfart in the other thread where you mentioned hyperinflation?Starglider wrote:So, when the market for US Treasuries inevitably collapses, and both new borrowing and debt rollover costs go through the roof, which of these do you think will happen;SirNitram wrote:Hyperflation? Well, that ruins my opinions of the editorializer.

(a) Massive cuts to all government spending including entitlements.

(b) Massive tax rises.

(c) Much more extensive and blatant money printing, than the already significant amounts.

You seem to be under the delusion that anything other than (c) is politicially feasible. It's true that the transition from (brutally) high inflation to outright hyperinflation would require incomes to start climbing as well as prices, but that doesn't all have to be wages; US government transfer payments are at all-time highs and still trending upwards.

"This statement, in its utterly clueless hubristic stupidity, cannot be improved upon. I merely quote it in admiration of its perfection." - Garibaldi

"Problem is, while the Germans have had many mea culpas and quite painfully dealt with their history, the South is still hellbent on painting themselves as the real victims. It gives them a special place in the history of assholes" - Covenant

"Over three million died fighting for the emperor, but when the war was over he pretended it was not his responsibility. What kind of man does that?'' - Saburo Sakai

Join SDN on Discord

"Problem is, while the Germans have had many mea culpas and quite painfully dealt with their history, the South is still hellbent on painting themselves as the real victims. It gives them a special place in the history of assholes" - Covenant

"Over three million died fighting for the emperor, but when the war was over he pretended it was not his responsibility. What kind of man does that?'' - Saburo Sakai

Join SDN on Discord

- Starglider

- Miles Dyson

- Posts: 8709

- Joined: 2007-04-05 09:44pm

- Location: Isle of Dogs

- Contact:

Re: Wal-Mart's Shoppers Running Out of Cash.

Of course they can. You either buy the assets that are leading the price rises, e.g. commodities futures, or move your savings to other currencies (cash or bonds). Even something as simple as physical gold historically has done quite well at preserving savings. The problem of 'keeping up' is only impossibly hard if you are a traditional saver looking at bonds and CDs in your home currency only.Simon_Jester wrote:100% annual inflation is a whole different level of problem than 10% annual inflation: keep that up for a decade and the value of money declines by a factor of 1000, in which case any savings anyone had before the burst of inflation will practically disappear by the end of it. No one, no matter how brilliant a speculator they are, can realistically hope to keep ahead of inflation at those rates.

In those terminal stages of a hyperinflationary episode there is no chance of stabilising the original currency, and the real economy reverts to alternate currencies (foreign currencies, e.g. USD in Zimbabwe, and precious metals) and barter. However AFAIK this has never happened in an economy with pervasive electronic payments. It would be interesting (although tragic) to see it happen in a first world country.And yet there are rates of inflation much higher than that, in certain extreme financial crises: during the worst days of the Weimar Republic, prices increased so much that the currency underwent 100% inflation every two days,

Zimbabwe did it, despite being a relatively modern economy. The US isn't horribly dependant on a central state to the same degree, but commerce in the US is incredibly dependent on a few large banks, which also have massive political influence. So I wouldn't rule it out although I agree that it would probably fail cost/benefit analysis for the leaders at the time to let the situation run for that long. Better to move everyone onto a new centrally-controlled fiat standard early than risk people moving to forms of money not completely controlled by the Federal Reserve.When we talk about "hyperinflation," we must be sure which of these we mean. It is very unlikely that the US government would engage in money printing fast enough to create something like the Weimar Republic's 1923 burst of hyperinflation

[qupte] It is somewhat more credible that they would print money fast enough to bring about 100% annual inflation, and quite credible that they would do it fast enough to bring about 10% annual inflation.

[/quote]

In the early stages the leaders always believe that that they can keep it under control, say an unpleasant but manageable 20 - 40% per year. The chairman of the US Federal Reserve is on the record saying that he's confident that he can stop inflation dead any time he wants to. Several linked inertia and ratchet effects mean that once you start down that slope, it gets extremely difficult to turn away.

Hyperinflation is defined simply as 'out of control' inflation, in that normal monetary policy tools are not sufficient to arrest it. The actual price increase rate at which this occurs varies depending on which economist you ask, usually in the range 30% to 300% per year.And yet it's quite possible that when this Wal-Mart executive talks about 'hyperinflation," he is speaking colloquially of the idea of 10% or 20% inflation per year, which is relatively quite plausible in a time of economic depression and the other factors we now face.

- Starglider

- Miles Dyson

- Posts: 8709

- Joined: 2007-04-05 09:44pm

- Location: Isle of Dogs

- Contact:

Re: Wal-Mart's Shoppers Running Out of Cash.

Spot the reversal of the decade-long trend :bobalot wrote:Do you have any actual evidence that any of this will actually happen?

Note that the 'US Federal Reserve' holdings are all bought with printed money - also these are the sanitised official figures, estimates of the real situation are significantly less favorable. Or did you believe that foreign countries will continue to hand the US massive amounts of money indefinitely, despite its declining credit rating?

-

Simon_Jester

- Emperor's Hand

- Posts: 30165

- Joined: 2009-05-23 07:29pm

Re: Wal-Mart's Shoppers Running Out of Cash.

Excuse me.Starglider wrote:Of course they can. You either buy the assets that are leading the price rises, e.g. commodities futures, or move your savings to other currencies (cash or bonds). Even something as simple as physical gold historically has done quite well at preserving savings. The problem of 'keeping up' is only impossibly hard if you are a traditional saver looking at bonds and CDs in your home currency only.Simon_Jester wrote:100% annual inflation is a whole different level of problem than 10% annual inflation: keep that up for a decade and the value of money declines by a factor of 1000, in which case any savings anyone had before the burst of inflation will practically disappear by the end of it. No one, no matter how brilliant a speculator they are, can realistically hope to keep ahead of inflation at those rates.

You're right, I spoke based on a wrong impression. The problem, though, is that commodities futures and the like are a fairly limited sector of the economy, as is gold; not everyone can put their money into those things without causing the prices to bubble up even faster than inflation. So while yes, you're right and I'm wrong, you can save yourself from 100% annual inflation by buying gold and oil futures and the like, doing so on a large scale will only make the economic effects of very rapid inflation worse, by provoking additional price bubbles and inflation in the commodities that get the most speculation.

Precisely.In those terminal stages of a hyperinflationary episode there is no chance of stabilising the original currency, and the real economy reverts to alternate currencies (foreign currencies, e.g. USD in Zimbabwe, and precious metals) and barter. However AFAIK this has never happened in an economy with pervasive electronic payments. It would be interesting (although tragic) to see it happen in a first world country.And yet there are rates of inflation much higher than that, in certain extreme financial crises: during the worst days of the Weimar Republic, prices increased so much that the currency underwent 100% inflation every two days,

I just find it hard to believe that the US government could be talked into printing money fast enough to cause hyperinflation, even by bankers with tremendous political influence. They can get dubious policies enacted whose effects are subtle enough that the politicians can handwave and stonewall their way out of any awkward questions about "Wall Street versus Main Street" and the like. But there's a big gap between dubious policies and ones that totally, over a very short timescale, destroy the savings of the middle and lower-upper class.Zimbabwe did it, despite being a relatively modern economy. The US isn't horribly dependant on a central state to the same degree, but commerce in the US is incredibly dependent on a few large banks, which also have massive political influence. So I wouldn't rule it out although I agree that it would probably fail cost/benefit analysis for the leaders at the time to let the situation run for that long. Better to move everyone onto a new centrally-controlled fiat standard early than risk people moving to forms of money not completely controlled by the Federal Reserve.When we talk about "hyperinflation," we must be sure which of these we mean. It is very unlikely that the US government would engage in money printing fast enough to create something like the Weimar Republic's 1923 burst of hyperinflation

I mean sure, the bankers have power, but enough to make the government commit hara-kiri for the sake of the banks' fleeting advantage?

A fair point.In the early stages the leaders always believe that that they can keep it under control, say an unpleasant but manageable 20 - 40% per year. The chairman of the US Federal Reserve is on the record saying that he's confident that he can stop inflation dead any time he wants to. Several linked inertia and ratchet effects mean that once you start down that slope, it gets extremely difficult to turn away.It is somewhat more credible that they would print money fast enough to bring about 100% annual inflation, and quite credible that they would do it fast enough to bring about 10% annual inflation.

Yes.Hyperinflation is defined simply as 'out of control' inflation, in that normal monetary policy tools are not sufficient to arrest it. The actual price increase rate at which this occurs varies depending on which economist you ask, usually in the range 30% to 300% per year.And yet it's quite possible that when this Wal-Mart executive talks about 'hyperinflation," he is speaking colloquially of the idea of 10% or 20% inflation per year, which is relatively quite plausible in a time of economic depression and the other factors we now face.

My original point was that it's possible that what you call hyperinflation, what Nitram calls hyperinflation, and what the author of the original piece calls hyperinflation don't match up very well. Which is why Nitram scoffs when the author talks about hyperinflation, and why you in turn scoff at Nitram for scoffing.

If Nitram is thinking of "Weimar Germany" levels of hyperinflation, while you're thinking of 100% annual inflation and the original author was thinking of 30% annual inflation, it's easy to get a disconnect going as a result of that.

Thing is, Wal-Mart's business model is very strongly affected by even 'mild' hyperinflation, because they're paying salaries that will have to increase with inflation, or their many minimum-wage workers will be forced to quit because working at Wal-Mart no longer pays well enough to keep them alive. And because they're charging prices that will be strongly affected by inflation: consumer staples whose prices will go up in a hurry, and consumer luxuries that will simply not sell when inflation forces the average citizen to spend all their money on food.

This space dedicated to Vasily Arkhipov

- Starglider

- Miles Dyson

- Posts: 8709

- Joined: 2007-04-05 09:44pm

- Location: Isle of Dogs

- Contact:

Re: Wal-Mart's Shoppers Running Out of Cash.

It isn't a 'fleeting advantage', it's a very real and very large transfer of wealth. Those saved dollars are claim tickets on the assets and output of the economy as a whole, devaluing them transfers wealth to the people holding the claim tickets that are not devalued, e.g. banks and wealthy individuals holding whatever asset classes (shares, property, commodities futures, PMs) the money printing is driving higher. Most of the population have a mindset of 'wealth == bits of government-endorsed paper or electronic representations of same'. Banks and the upper class in general are not operating under this delusion.Simon_Jester wrote:But there's a big gap between dubious policies and ones that totally, over a very short timescale, destroy the savings of the middle and lower-upper class. I mean sure, the bankers have power, but enough to make the government commit hara-kiri for the sake of the banks' fleeting advantage?

Everyone moving their cash into gold would just push the value of gold to $50k/ounce and create an effective gold standard. Personally I don't think that's a bad outcome; it's not the best basis for a currency, but it's a hell of a lot better than constantly diluted fiat created by a private banking cartel. I'm pretty sure it won't happen though.

It's from a blog post on Zero Hedge. Speaking to their own readers, they take the progression from moderate to severe hyperinflation as a given. If it was aimed at general readership it would be more carefully worded.My original point was that it's possible that what you call hyperinflation, what Nitram calls hyperinflation, and what the author of the original piece calls hyperinflation don't match up very well.

Nitram scoffs at anyone who suggests that the government might not be able to give increasing amounts of free money to everyone forever. This is normalcy bias operating at a time when we are at a record, unprecedented deviation from the historical mean, especially in government debt interest rates. Widespread denial of the inevitable reversion to the mean (plus overshoot) is silly, but also completely in line with historical precedent.Which is why Nitram scoffs when the author talks about hyperinflation, and why you in turn scoff at Nitram for scoffing.

The only reason this hasn't already happened;Thing is, Wal-Mart's business model is very strongly affected by even 'mild' hyperinflation, because they're paying salaries that will have to increase with inflation, or their many minimum-wage workers will be forced to quit because working at Wal-Mart no longer pays well enough to keep them alive.

Instead of raising the minimum wage, government subsidies step in to maintain their buying power (plus of course a substantial cut for JP Morgan, the too-big-to-fail bank that administers the scheme). I'm not a Libertarian, but I have to laugh when the loony left still pretend that the US is a bastion of free-market capitalism.

Re: Wal-Mart's Shoppers Running Out of Cash.

I've never heard any Maoist-Third Worldists, neo-Stalinists, or Accelerationists describe the US as the bastion of free-market capitalism. Most of them tend to focus on things like imperialism or capitalism as a whole, regardless of whether it's purely free-market or not, being faulty and inhumane. Or were you simply pretending that all people describable as on the political left are mentally unstable?

In fact, the only people who really describe the US as the last home of the free market are the American neoliberal right, while the neoliberal center is content with simply describing it as free-market and capitalist.

In fact, the only people who really describe the US as the last home of the free market are the American neoliberal right, while the neoliberal center is content with simply describing it as free-market and capitalist.

Invited by the new age, the elegant Sailor Neptune!

I mean, how often am I to enter a game of riddles with the author, where they challenge me with some strange and confusing and distracting device, and I'm supposed to unravel it and go "I SEE WHAT YOU DID THERE" and take great personal satisfaction and pride in our mutual cleverness?

- The Handle, from the TVTropes Forums

- Starglider

- Miles Dyson

- Posts: 8709

- Joined: 2007-04-05 09:44pm

- Location: Isle of Dogs

- Contact:

Re: Wal-Mart's Shoppers Running Out of Cash.

Europe has plenty of socialists and communists whining endlessly about 'resisting the advance of savage Anglo-Saxon free-market capitalism', but this is off the point.Bakustra wrote:I've never heard any Maoist-Third Worldists, neo-Stalinists, or Accelerationists describe the US as the bastion of free-market capitalism.

I wouldn't need the prefix 'loony' if I was. In fact I would say the US has a noticably higher average quality of left-wing supporters than Europe, simply because in the US the lowest common denominator falls into the mindless fundamentalist conservative / fascist group, versus the same demographic in Europe tending towards the mindless socialist nanny-state supporter group. Again though, off the point.Or were you simply pretending that all people describable as on the political left are mentally unstable?

Re: Wal-Mart's Shoppers Running Out of Cash.

Inflation debates usually become a giant mess because everyone is talking about a different kind of inflation; there's monetary inflation and price inflation with a zillion ways to define either one of them.

The Walmart CEO speaks of price inflation as defined by the nominal prices of the goods and their affordability. The price of a given item is going up while customers' incomes are either not rising at the same rate, not moving at all or falling. The reason for this can be seen if you pull up a commodities price chart, every single commodity from wheat to oil to steel and everything else that's traded on the exchanges has gone up sharply in price over the past couple years or so, especially in the last 6-12 months. Those prices for food, energy, and raw materials take a little while to work through the supply chain; wheat doubling in price takes a few months to show up as a 20% increase in the price of bread & cereal.

The Walmart CEO speaks of price inflation as defined by the nominal prices of the goods and their affordability. The price of a given item is going up while customers' incomes are either not rising at the same rate, not moving at all or falling. The reason for this can be seen if you pull up a commodities price chart, every single commodity from wheat to oil to steel and everything else that's traded on the exchanges has gone up sharply in price over the past couple years or so, especially in the last 6-12 months. Those prices for food, energy, and raw materials take a little while to work through the supply chain; wheat doubling in price takes a few months to show up as a 20% increase in the price of bread & cereal.

This post is a 100% natural organic product.

The slight variations in spelling and grammar enhance its individual character and beauty and in no way are to be considered flaws or defects

I'm not sure why people choose 'To Love is to Bury' as their wedding song...It's about a murder-suicide

- Margo Timmins

When it becomes serious, you have to lie

- Jean-Claude Juncker

The slight variations in spelling and grammar enhance its individual character and beauty and in no way are to be considered flaws or defects

I'm not sure why people choose 'To Love is to Bury' as their wedding song...It's about a murder-suicide

- Margo Timmins

When it becomes serious, you have to lie

- Jean-Claude Juncker

- Broomstick

- Emperor's Hand

- Posts: 28846

- Joined: 2004-01-02 07:04pm

- Location: Industrial armpit of the US Midwest

Re: Wal-Mart's Shoppers Running Out of Cash.

Threads like these always make me want to stock up on canned goods and expand my garden. Is that crazy or not?

A life is like a garden. Perfect moments can be had, but not preserved, except in memory. Leonard Nimoy.

Now I did a job. I got nothing but trouble since I did it, not to mention more than a few unkind words as regard to my character so let me make this abundantly clear. I do the job. And then I get paid.- Malcolm Reynolds, Captain of Serenity, which sums up my feelings regarding the lawsuit discussed here.

If a free society cannot help the many who are poor, it cannot save the few who are rich. - John F. Kennedy

Sam Vimes Theory of Economic Injustice

Now I did a job. I got nothing but trouble since I did it, not to mention more than a few unkind words as regard to my character so let me make this abundantly clear. I do the job. And then I get paid.- Malcolm Reynolds, Captain of Serenity, which sums up my feelings regarding the lawsuit discussed here.

If a free society cannot help the many who are poor, it cannot save the few who are rich. - John F. Kennedy

Sam Vimes Theory of Economic Injustice

-

Simon_Jester

- Emperor's Hand

- Posts: 30165

- Joined: 2009-05-23 07:29pm

Re: Wal-Mart's Shoppers Running Out of Cash.

Given what's happening in the US, I can't blame them.Starglider wrote:Europe has plenty of socialists and communists whining endlessly about 'resisting the advance of savage Anglo-Saxon free-market capitalism', but this is off the point.Bakustra wrote:I've never heard any Maoist-Third Worldists, neo-Stalinists, or Accelerationists describe the US as the bastion of free-market capitalism.

Definitely not.Broomstick wrote:Threads like these always make me want to stock up on canned goods and expand my garden. Is that crazy or not?

This space dedicated to Vasily Arkhipov

- Sea Skimmer

- Yankee Capitalist Air Pirate

- Posts: 37390

- Joined: 2002-07-03 11:49pm

- Location: Passchendaele City, HAB

Re: Wal-Mart's Shoppers Running Out of Cash.

If everyone in the US with land or a sunny balcony maintained a garden we could probably tangibly reduce oil consumption by reducing demand for fresh produce and all the refrigerated transportation that requires. It also means you know exactly what chemicals are being used and the stuff is as fresh as possible… not many reasons not to grow your own food at home. It certainly made a big difference in World War 2.Broomstick wrote:Threads like these always make me want to stock up on canned goods and expand my garden. Is that crazy or not?

"This cult of special forces is as sensible as to form a Royal Corps of Tree Climbers and say that no soldier who does not wear its green hat with a bunch of oak leaves stuck in it should be expected to climb a tree"

— Field Marshal William Slim 1956

— Field Marshal William Slim 1956

- SirNitram

- Rest in Peace, Black Mage

- Posts: 28367

- Joined: 2002-07-03 04:48pm

- Location: Somewhere between nowhere and everywhere

Re: Wal-Mart's Shoppers Running Out of Cash.

Wow, way to totally fail to make your case, and throw in some lies to view me as a liberal loony. But hey, I expect this from you.Starglider wrote:Nitram scoffs at anyone who suggests that the government might not be able to give increasing amounts of free money to everyone forever. This is normalcy bias operating at a time when we are at a record, unprecedented deviation from the historical mean, especially in government debt interest rates. Widespread denial of the inevitable reversion to the mean (plus overshoot) is silly, but also completely in line with historical precedent.Which is why Nitram scoffs when the author talks about hyperinflation, and why you in turn scoff at Nitram for scoffing.

I mean, it's not like we can pull up a graph that shows up personal consumption expenditures, like, oh, so

Let's cover more years,to discuss inflation..

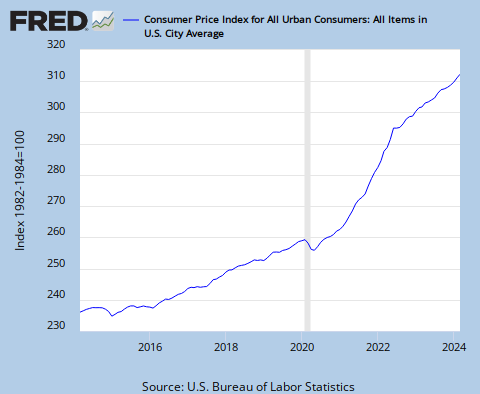

CPI instead? Don't mind if I do.

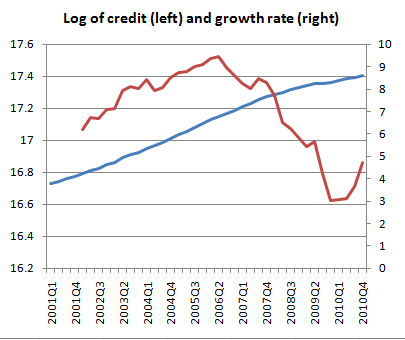

Perhaps, as you flail around, you expect credit to explode into an orgy of inflation. Let's check nonfinancial debt and growth..

Credit to the Economic Noble Laurete Krugman for those graphs.

Now, let's move next to your fearmongering about S&P's downgrading. Why, you might ask, am I discounting S&P, whose credit ratings are so often seen as reliable. Oh, right. Could it be they were part of the whole faulty-loan orgy, and busted their credibility? Plus, it's not like US credit hasn't been downgraded before. 95-96 had more than one group looking into downgrade, yet we were not swallowed by hyperinflation.

Next, the bond market. I don't see bond vigilantes, demanding their money back. I don't even see lack of demand. This is because bonds are absurdly safe: As long as there's a USA, the bonds get repaid.

One last word: If this hyperinflation is imminent, shouldn't core inflation not be at the 50 year low of 0.9%?

Where do people get this stuff...

Manic Progressive: A liberal who violently swings from anger at politicos to despondency over them.

Out Of Context theatre: Ron Paul has repeatedly said he's not a racist. - Destructinator XIII on why Ron Paul isn't racist.

Shadowy Overlord - BMs/Black Mage Monkey - BOTM/Jetfire - Cybertron's Finest/General Miscreant/ASVS/Supermoderator Emeritus

Debator Classification: Trollhunter

Out Of Context theatre: Ron Paul has repeatedly said he's not a racist. - Destructinator XIII on why Ron Paul isn't racist.

Shadowy Overlord - BMs/Black Mage Monkey - BOTM/Jetfire - Cybertron's Finest/General Miscreant/ASVS/Supermoderator Emeritus

Debator Classification: Trollhunter

- K. A. Pital

- Glamorous Commie

- Posts: 20813

- Joined: 2003-02-26 11:39am

- Location: Elysium

Re: Wal-Mart's Shoppers Running Out of Cash.

For Europe, where social democracy was traditionally strong, the US version of capitalism is obviously more "free", i.e. more unregulated.Starglider wrote:Europe has plenty of socialists and communists whining endlessly about 'resisting the advance of savage Anglo-Saxon free-market capitalism', but this is off the point.

Lì ci sono chiese, macerie, moschee e questure, lì frontiere, prezzi inaccessibile e freddure

Lì paludi, minacce, cecchini coi fucili, documenti, file notturne e clandestini

Qui incontri, lotte, passi sincronizzati, colori, capannelli non autorizzati,

Uccelli migratori, reti, informazioni, piazze di Tutti i like pazze di passioni...

...La tranquillità è importante ma la libertà è tutto!

Lì paludi, minacce, cecchini coi fucili, documenti, file notturne e clandestini

Qui incontri, lotte, passi sincronizzati, colori, capannelli non autorizzati,

Uccelli migratori, reti, informazioni, piazze di Tutti i like pazze di passioni...

...La tranquillità è importante ma la libertà è tutto!

Assalti Frontali

- Ariphaos

- Jedi Council Member

- Posts: 1739

- Joined: 2005-10-21 02:48am

- Location: Twin Cities, MN, USA

- Contact:

Re: Wal-Mart's Shoppers Running Out of Cash.

You don't even need to play 1996. S&P has downgraded Japan, just look at the collapsing Japanese bond market...SirNitram wrote: Now, let's move next to your fearmongering about S&P's downgrading. Why, you might ask, am I discounting S&P, whose credit ratings are so often seen as reliable. Oh, right. Could it be they were part of the whole faulty-loan orgy, and busted their credibility? Plus, it's not like US credit hasn't been downgraded before. 95-96 had more than one group looking into downgrade, yet we were not swallowed by hyperinflation.

It's even worse in the case of the US, where S&P's move is transparently political.

Give fire to a man, and he will be warm for a day.

Set him on fire, and he will be warm for life.

Set him on fire, and he will be warm for life.

- SirNitram

- Rest in Peace, Black Mage

- Posts: 28367

- Joined: 2002-07-03 04:48pm

- Location: Somewhere between nowhere and everywhere

Re: Wal-Mart's Shoppers Running Out of Cash.

One last thing to add, since I remembered the whinge about 'free money to everyone'. How about less free money to the oil companies, whose profits are breaking records each year? Or corporations? Or investors? Or the highest tax bracket?

Manic Progressive: A liberal who violently swings from anger at politicos to despondency over them.

Out Of Context theatre: Ron Paul has repeatedly said he's not a racist. - Destructinator XIII on why Ron Paul isn't racist.

Shadowy Overlord - BMs/Black Mage Monkey - BOTM/Jetfire - Cybertron's Finest/General Miscreant/ASVS/Supermoderator Emeritus

Debator Classification: Trollhunter

Out Of Context theatre: Ron Paul has repeatedly said he's not a racist. - Destructinator XIII on why Ron Paul isn't racist.

Shadowy Overlord - BMs/Black Mage Monkey - BOTM/Jetfire - Cybertron's Finest/General Miscreant/ASVS/Supermoderator Emeritus

Debator Classification: Trollhunter

- cosmicalstorm

- Jedi Council Member

- Posts: 1642

- Joined: 2008-02-14 09:35am

Re: Wal-Mart's Shoppers Running Out of Cash.

If things go down the shitter the way Starglider is implying it will, what would the general effects be for the rest of the world, and more specifically, for the Europe region?

Maybe I fail to understand the point you are trying to make, but is there seriously anyone on this board who disagrees with those points?SirNitram wrote:One last thing to add, since I remembered the whinge about 'free money to everyone'. How about less free money to the oil companies, whose profits are breaking records each year? Or corporations? Or investors? Or the highest tax bracket?

- SirNitram

- Rest in Peace, Black Mage

- Posts: 28367

- Joined: 2002-07-03 04:48pm

- Location: Somewhere between nowhere and everywhere

Re: Wal-Mart's Shoppers Running Out of Cash.

It was mostly a rhetorical barb against Starglider for his attempt to discredit me.cosmicalstorm wrote:If things go down the shitter the way Starglider is implying it will, what would the general effects be for the rest of the world, and more specifically, for the Europe region?

Maybe I fail to understand the point you are trying to make, but is there seriously anyone on this board who disagrees with those points?SirNitram wrote:One last thing to add, since I remembered the whinge about 'free money to everyone'. How about less free money to the oil companies, whose profits are breaking records each year? Or corporations? Or investors? Or the highest tax bracket?

Manic Progressive: A liberal who violently swings from anger at politicos to despondency over them.

Out Of Context theatre: Ron Paul has repeatedly said he's not a racist. - Destructinator XIII on why Ron Paul isn't racist.

Shadowy Overlord - BMs/Black Mage Monkey - BOTM/Jetfire - Cybertron's Finest/General Miscreant/ASVS/Supermoderator Emeritus

Debator Classification: Trollhunter

Out Of Context theatre: Ron Paul has repeatedly said he's not a racist. - Destructinator XIII on why Ron Paul isn't racist.

Shadowy Overlord - BMs/Black Mage Monkey - BOTM/Jetfire - Cybertron's Finest/General Miscreant/ASVS/Supermoderator Emeritus

Debator Classification: Trollhunter

- bobalot

- Jedi Council Member

- Posts: 1733

- Joined: 2008-05-21 06:42am

- Location: Sydney, Australia

- Contact:

Re: Wal-Mart's Shoppers Running Out of Cash.

Starglider has yet to provide any proof for any of his claims in this thread or the previous thread he started wailing about his hyper-inflation doomerism. He is just a typical Gold Standard loon who have been predicting hyperinflation for the last century. You would think their repeated failures would cause them to revise their predictions.cosmicalstorm wrote:If things go down the shitter the way Starglider is implying it will, what would the general effects be for the rest of the world, and more specifically, for the Europe region?

"This statement, in its utterly clueless hubristic stupidity, cannot be improved upon. I merely quote it in admiration of its perfection." - Garibaldi

"Problem is, while the Germans have had many mea culpas and quite painfully dealt with their history, the South is still hellbent on painting themselves as the real victims. It gives them a special place in the history of assholes" - Covenant

"Over three million died fighting for the emperor, but when the war was over he pretended it was not his responsibility. What kind of man does that?'' - Saburo Sakai

Join SDN on Discord

"Problem is, while the Germans have had many mea culpas and quite painfully dealt with their history, the South is still hellbent on painting themselves as the real victims. It gives them a special place in the history of assholes" - Covenant

"Over three million died fighting for the emperor, but when the war was over he pretended it was not his responsibility. What kind of man does that?'' - Saburo Sakai

Join SDN on Discord

- Ariphaos

- Jedi Council Member

- Posts: 1739

- Joined: 2005-10-21 02:48am

- Location: Twin Cities, MN, USA

- Contact:

Re: Wal-Mart's Shoppers Running Out of Cash.

You're saying 'if' like the situation Starglider describes is plausible. Keep in mind, the United States has been in worse positions before.cosmicalstorm wrote:If things go down the shitter the way Starglider is implying it will, what would the general effects be for the rest of the world, and more specifically, for the Europe region?

The essential conundrum is this

1) People can invest in United States debt, which means that the debt is funded

2) People can invest elsewhere, which means that employment is increased, which helps the economy at its root

3) People can remove their money from circulation, which means that printing money only maintains the amount actually circulated, thus not leading to hyperinflation.

You're essentially asking if you'll wake up someday and pi suddenly equals four. Starglider's scenario essentially requires that people keep their money in circulation, not invest in government debt, -and- the US Government starts printing like crazy, without raising taxes. It simply doesn't work that way - if people are all investing directly into the economy like that, the economy is then very, very healthy.

Give fire to a man, and he will be warm for a day.

Set him on fire, and he will be warm for life.

Set him on fire, and he will be warm for life.

Re: Wal-Mart's Shoppers Running Out of Cash.

Stas Bush wrote:For Europe, where social democracy was traditionally strong, the US version of capitalism is obviously more "free", i.e. more unregulated.Starglider wrote:Europe has plenty of socialists and communists whining endlessly about 'resisting the advance of savage Anglo-Saxon free-market capitalism', but this is off the point.

And, considering how those "socialist and commies" have weathered the storm much better than the UK did, I'd say they are about right too. How many in the UK are wishing they would have the German economy again?

Whoever says "education does not matter" can try ignorance

------------

A decision must be made in the life of every nation at the very moment when the grasp of the enemy is at its throat. Then, it seems that the only way to survive is to use the means of the enemy, to rest survival upon what is expedient, to look the other way. Well, the answer to that is 'survival as what'? A country isn't a rock. It's not an extension of one's self. It's what it stands for. It's what it stands for when standing for something is the most difficult! - Chief Judge Haywood

------------

My LPs

------------

A decision must be made in the life of every nation at the very moment when the grasp of the enemy is at its throat. Then, it seems that the only way to survive is to use the means of the enemy, to rest survival upon what is expedient, to look the other way. Well, the answer to that is 'survival as what'? A country isn't a rock. It's not an extension of one's self. It's what it stands for. It's what it stands for when standing for something is the most difficult! - Chief Judge Haywood

------------

My LPs