Allegedly, there were talks, talks which were officially denied. I'm told there's an article in the German press today with more details, apparently it's this one, a translation from a German speaking member would be appreciated.French and Germans explore idea of smaller euro zone

By Julien Toyer and Annika Breidthardt

BRUSSELS | Wed Nov 9, 2011 9:58pm GMT

(Reuters) - German and French officials have discussed plans for a radical overhaul of the European Union that would involve setting up a more integrated and potentially smaller euro zone, EU sources say.

"France and Germany have had intense consultations on this issue over the last months, at all levels," a senior EU official in Brussels told Reuters, speaking on condition of anonymity because of the sensitivity of the discussions.

"We need to move very cautiously, but the truth is that we need to establish exactly the list of those who don't want to be part of the club and those who simply cannot be part," the official said.

French President Nicolas Sarkozy gave some flavor of his thinking during an address to students in the eastern French city of Strasbourg on Tuesday, when he said a two-speed Europe -- the euro zone moving ahead more rapidly than all 27 countries in the EU -- was the only model for the future.

The discussions among senior policymakers in Paris, Berlin and Brussels raised the possibility of one or more countries leaving the euro zone while the remaining core pushes on toward deeper economic integration, including on tax and fiscal policy.

The change has been discussed on an "intellectual" level but had not moved to operational or technical discussions, the EU official said. A French finance ministry spokesman denied there was any project in the works to reduce the currency bloc's membership .

"There have been no conversations between French and German authorities at any level on decreasing the size of the euro zone," the spokesman said .

A radical overhaul of the European Union would be opposed by many members.

"This will unravel everything our forebears have painstakingly built up and repudiate all that they stood for in the past sixty years," one EU diplomat told Reuters."This will redraw the map geopolitically and give rise to new tensions. It could truly be the end of Europe as we know it."

In Berlin, European Commission President Jose Manuel Barroso warned about the economic costs of any splits in the euro zone. Germany's gross domestic product could contract and its economy would shed one million jobs, he said in a speech.

Barroso said any push toward deeper economic policy integration should not come at the price of creating new divisions among EU members.

"There cannot be peace and prosperity in the North or in the West of Europe, if there is no peace and prosperity in the South or in the East," he said.

To an extent the taboo on a country leaving the 17-member currency bloc was already broken at the G20 summit in Cannes last week, when German Chancellor Angela Merkel and Sarkozy both effectively said that Greece might have to drop out if the euro zone's long-term stability was to be maintained.

But the latest discussions among European officials point to a more fundamental re-evaluation of the 12-year-old currency project -- including which countries and what policies are needed to keep it strong and stable -- before Europe's debt crisis manages to break it apart.

In large part the aim is to reshape the currency bloc along the lines it was originally intended; strong, economically integrated countries sharing a currency, before nations such as Greece managed to get in.

"In doing this exercise, we will be very serious on the criteria that will be used as a benchmark to integrate and share our economic policies," the senior EU official said.

One senior German government official said it was a case of pruning the euro zone to make it stronger.

"You'll still call it the euro, but it will be fewer countries," he said, without identifying those that would have to drop out.

"We won't be able to speak with one voice and make the tough decisions in the euro zone as it is today. You can't have one country, one vote," he said, referring to rules that have made decision-making complex and slow, exacerbating the crisis.

Speaking in Berlin, Merkel reiterated a call for changes to be made to the EU treaty -- the laws which govern the European Union -- saying the situation was now so unpleasant that a rapid breakthrough was needed.

From Germany's point of view, altering the EU treaty would be an opportunity to reinforce euro zone integration and could potentially open a window to make the mooted changes to its make-up.

EU officials have told Reuters treaty change will be formally discussed at a summit in Brussels on December 9, with an 'intergovernmental conference', the process required to make alterations, potentially being convened in the new year, although multiple obstacles remain before such a step is taken.

ACCELERATION

While the two-speed Europe referred to by Sarkozy is already reality in many respects -- and a frustration for the likes of Poland, which hopes to join the euro zone -- the officials interviewed by Reuters spoke of a more formal process to create a two-tier structure and allow the smaller group to push on.

"This is something that has been in the air for some time, at least in high-level talks," said one EU diplomat. "The difference now is that some countries are moving forward very quickly ... The risk of a split, of a two-speed Europe, has never been so real."

In Sarkozy's vision, the euro zone would rapidly deepen its integration, including in sensitive areas such as corporate and personal taxation, while the remainder of the EU would be left as a "confederation", possibly expanding from 27 to 35 in the coming decade, with enlargement to the Balkans and beyond.

Within the euro zone, the critical need would be for core countries to coordinate their economic policies quickly so that defenses could be erected against the sovereign debt crisis.

"Intellectually speaking, I can see it happening in two movements: some technical arrangements in the next weeks to strengthen the euro zone governance, and some more fundamental changes in the coming months," the senior EU official said.

But he cautioned: "Practically speaking, we all know that the crisis may deepen and that the picture can change radically from one day to another."

France and Germany see themselves as the backbone of the euro zone and frequently promote initiatives that other euro zone countries reject. The idea of a core, pared-down euro zone is likely to be strongly opposed by the Netherlands and possibly Austria, although both would be potential members.

"This sort of thinking is not the direction we want to go in. We want to keep the euro zone as it is," said a non Franco-German euro zone diplomat.

Britain, which is adamantly outside the euro zone, is also opposed to any moves that would create a two-speed Europe, or institutionalize a process even if it is already under way.

"We must move together. The greatest danger we face is division," Britain's deputy prime minister, Nick Clegg, said during a visit to Brussels on Wednesday.

(Additional reporting by Robin Emmott and Luke Baker in Brussels, writing by Luke Baker, editing by Angus MacSwan)

French and Germans explore idea of smaller euro zone

Moderators: Alyrium Denryle, Edi, K. A. Pital

French and Germans explore idea of smaller euro zone

Reuters link

This post is a 100% natural organic product.

The slight variations in spelling and grammar enhance its individual character and beauty and in no way are to be considered flaws or defects

I'm not sure why people choose 'To Love is to Bury' as their wedding song...It's about a murder-suicide

- Margo Timmins

When it becomes serious, you have to lie

- Jean-Claude Juncker

The slight variations in spelling and grammar enhance its individual character and beauty and in no way are to be considered flaws or defects

I'm not sure why people choose 'To Love is to Bury' as their wedding song...It's about a murder-suicide

- Margo Timmins

When it becomes serious, you have to lie

- Jean-Claude Juncker

Re: French and Germans explore idea of smaller euro zone

You might want to take a look at this two-page article from Spiegel. link.

Whoever says "education does not matter" can try ignorance

------------

A decision must be made in the life of every nation at the very moment when the grasp of the enemy is at its throat. Then, it seems that the only way to survive is to use the means of the enemy, to rest survival upon what is expedient, to look the other way. Well, the answer to that is 'survival as what'? A country isn't a rock. It's not an extension of one's self. It's what it stands for. It's what it stands for when standing for something is the most difficult! - Chief Judge Haywood

------------

My LPs

------------

A decision must be made in the life of every nation at the very moment when the grasp of the enemy is at its throat. Then, it seems that the only way to survive is to use the means of the enemy, to rest survival upon what is expedient, to look the other way. Well, the answer to that is 'survival as what'? A country isn't a rock. It's not an extension of one's self. It's what it stands for. It's what it stands for when standing for something is the most difficult! - Chief Judge Haywood

------------

My LPs

Re: French and Germans explore idea of smaller euro zone

A "Core" Eurozone? Doesn't that amount to Germany and France?

Re: French and Germans explore idea of smaller euro zone

Add BeNeLux and Austria to the mix, and once the situation is stabilized there, Italia and Spain - if I'm not mistaken, that'd roughly be the "core" of the Eurozone economy, Britain and Scandinavia excluded.

From Thanas' article :

[Britain treated like a second-class country, its influence on other EU countries reduced]

[David Cameron being told to shut his whore mouth when wanting to impose measures on Euro country while being at the head of a non-Euro country]

Ah, Schadenfreude... the sweetest form of entertainment...

Seriously, though... I hope this whole mess isn't going to explode in our face. It'd be pretty ugly for the EU and Airstrip One if the later were to quit the former...

From Thanas' article :

[Britain treated like a second-class country, its influence on other EU countries reduced]

[David Cameron being told to shut his whore mouth when wanting to impose measures on Euro country while being at the head of a non-Euro country]

Ah, Schadenfreude... the sweetest form of entertainment...

Seriously, though... I hope this whole mess isn't going to explode in our face. It'd be pretty ugly for the EU and Airstrip One if the later were to quit the former...

- The Duchess of Zeon

- Gözde

- Posts: 14566

- Joined: 2002-09-18 01:06am

- Location: Exiled in the Pale of Settlement.

Re: French and Germans explore idea of smaller euro zone

Germany, France, Austria, the Benelux, and probably actually Finland and Estonia rather than Italy and Spain, which have dangerously weak economies. The debt ratio of Estonia is quite good and the Scandinavian countries could be part of the eurozone if they wanted to, so Finland is obvious since it's already a member. And that would be the realistic current Eurozone if expansion hadn't gone on too quickly and irresponsibly.

The threshold for inclusion in Wikipedia is verifiability, not truth. -- Wikipedia's No Original Research policy page.

In 1966 the Soviets find something on the dark side of the Moon. In 2104 they come back. -- Red Banner / White Star, a nBSG continuation story. Updated to Chapter 4.0 -- 14 January 2013.

In 1966 the Soviets find something on the dark side of the Moon. In 2104 they come back. -- Red Banner / White Star, a nBSG continuation story. Updated to Chapter 4.0 -- 14 January 2013.

Re: French and Germans explore idea of smaller euro zone

The Italian economy isn't fundamentally unsound. It's generally solvent - it's just lacking in liquidity right now due to a massive panic reaction by investors.

Re: French and Germans explore idea of smaller euro zone

Don't make the error of underestimating the economy of Italy or Spain, or their importance for the Eurozone. Sure, they may be heavily indebted right now, or even structurally, but their industry (be it sit primary, secondary or tertiary) is still strong and diversified (Italy's at least), and their contribution to the rest of the European economy, by their exports & imports is really important.

An example : here in France, when you go any supermarket, roughly a third to a half of the fresh vegetables you can buy come from Spain.

An example : here in France, when you go any supermarket, roughly a third to a half of the fresh vegetables you can buy come from Spain.

- Starglider

- Miles Dyson

- Posts: 8709

- Joined: 2007-04-05 09:44pm

- Location: Isle of Dogs

- Contact:

Re: French and Germans explore idea of smaller euro zone

Fixed income trading was completely crazy yesterday due to the massive move in Italian bonds; the futures and other derivatives moved even more, six to nine standard deviations on heavy volume which just blew up a whole slew of pricing algos. Literally in many cases; spreadsheets crashing, pricers running out of memory, manic emergency server tuning etc. It was not quite so crazy today but now France is getting its first real taste of contagion.

It's solvent if you assume that the ECB is going to monetise another trillion or so of peripheral debt, and keep doing so every three to five years. That's what used to keep the PIIGS solvent, before they were forced to give up their central banks and shacked to the Euro. Personally I think the ECB will continue and in fact step up large scale monetisation, too many political careers on the line for those selfish spoilsport Germans to keep the free money spigots closed much longer.Zed wrote:It's generally solvent - it's just lacking in liquidity right now due to a massive panic reaction by investors.

Re: French and Germans explore idea of smaller euro zone

Italy runs a smaller budget deficit by percent of GDP than the United States. It also has lower external debt than the United States.

- Starglider

- Miles Dyson

- Posts: 8709

- Joined: 2007-04-05 09:44pm

- Location: Isle of Dogs

- Contact:

Re: French and Germans explore idea of smaller euro zone

I find it pretty funny that you're trying to use the US as a desirable standard of solvency. The US is only 'solvent' because it has its own central bank ready and willing to print as much money as it it takes to keep rolling over government debt. In fact the only reason we aren't already on QE 13 instead of debating QE 3 is that the US has the world's reserve currency, and to engage in most global trade you must buy dollars at some point. If the Federal Reserve's ability to invent money out of thin air was removed the US would experience runaway treasury yields, government debt and insolvency in fairly short order.Zed wrote:Italy runs a smaller budget deficit by percent of GDP than the United States. It also has lower external debt than the United States.

Italy has no ability to print money and is wholly reliant on Germany's willingness to tolerate ECB monetisation.

-

Pelranius

- Sith Marauder

- Posts: 3539

- Joined: 2006-10-24 11:35am

- Location: Around and about the Beltway

Re: French and Germans explore idea of smaller euro zone

What about the Czechs? They seem to have been in relatively good financial health (though I'm certainly no expert).

Turns out that a five way cross over between It's Always Sunny in Philadelphia, the Ali G Show, Fargo, Idiocracy and Veep is a lot less funny when you're actually living in it.

Re: French and Germans explore idea of smaller euro zone

As far as wikipedia can be trusted, the Czech Republic isn't part of the Eurozone.

Re: French and Germans explore idea of smaller euro zone

Yup, that would be Slovakia, who is the only Central-European Eurozone member. But it's economy is rather healthy, compared to the PIGS.

- Starglider

- Miles Dyson

- Posts: 8709

- Joined: 2007-04-05 09:44pm

- Location: Isle of Dogs

- Contact:

Re: French and Germans explore idea of smaller euro zone

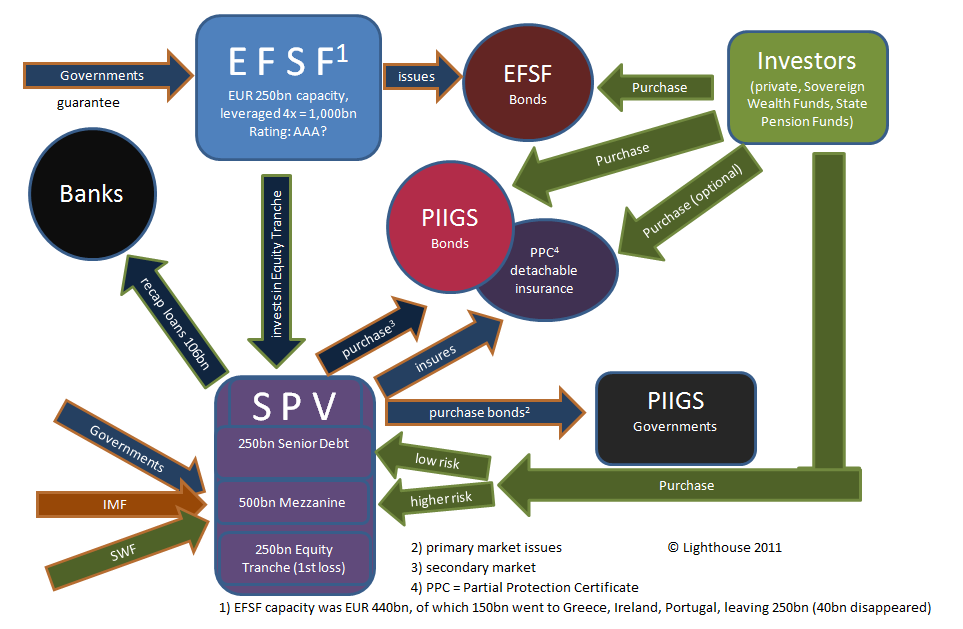

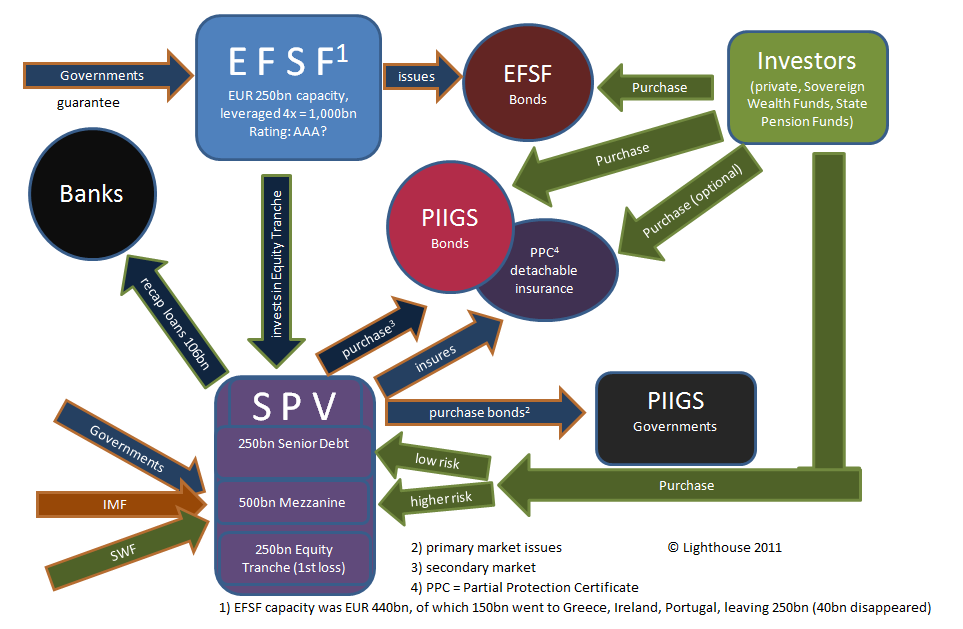

Good diagram of the proposed EFSF structure;

This is exactly the kind of obfuscated financially engineered inherently unstable bullshit that caused the 2007 subprime crisis (CDO squared etc). It blows my mind that europhiles are lauding the EFSF and the ECB as wise prudent saviors who will fix everything, while simultaneously decrying too-big-to-fail private banks and investment bankers. This is scaling new hights of cognitive dissonance, because both the strategies and the type of people involved are effectively identical. Fortunately fixed income investors are at last starting to show a once-bitten twice-shy attitude and it looks like the EFSF will really struggle to implement this plan. Cue the backup plan, which is of course for the ECB to man up, discard the pretense of being unable to monetise and start printing in earnest.

This is exactly the kind of obfuscated financially engineered inherently unstable bullshit that caused the 2007 subprime crisis (CDO squared etc). It blows my mind that europhiles are lauding the EFSF and the ECB as wise prudent saviors who will fix everything, while simultaneously decrying too-big-to-fail private banks and investment bankers. This is scaling new hights of cognitive dissonance, because both the strategies and the type of people involved are effectively identical. Fortunately fixed income investors are at last starting to show a once-bitten twice-shy attitude and it looks like the EFSF will really struggle to implement this plan. Cue the backup plan, which is of course for the ECB to man up, discard the pretense of being unable to monetise and start printing in earnest.

Re: French and Germans explore idea of smaller euro zone

Hmmm...that looks like a sound plan, what could possibly go wrong?Starglider wrote:Good diagram of the proposed EFSF structure;

Who am I kidding, they already an EFSF bond auction failure. A mere 3 billion Euro auction and it failed.

Clearly, this plan will solve all our problems. Clearly.

This post is a 100% natural organic product.

The slight variations in spelling and grammar enhance its individual character and beauty and in no way are to be considered flaws or defects

I'm not sure why people choose 'To Love is to Bury' as their wedding song...It's about a murder-suicide

- Margo Timmins

When it becomes serious, you have to lie

- Jean-Claude Juncker

The slight variations in spelling and grammar enhance its individual character and beauty and in no way are to be considered flaws or defects

I'm not sure why people choose 'To Love is to Bury' as their wedding song...It's about a murder-suicide

- Margo Timmins

When it becomes serious, you have to lie

- Jean-Claude Juncker

- K. A. Pital

- Glamorous Commie

- Posts: 20813

- Joined: 2003-02-26 11:39am

- Location: Elysium

Re: French and Germans explore idea of smaller euro zone

Oh... now I understand why some crazy commenters said the ECB should monetize immediately. They weren't really that crazy - the other plan with EFSF bonds is even more insane.Starglider wrote:Good diagram of the proposed EFSF structure;

Lì ci sono chiese, macerie, moschee e questure, lì frontiere, prezzi inaccessibile e freddure

Lì paludi, minacce, cecchini coi fucili, documenti, file notturne e clandestini

Qui incontri, lotte, passi sincronizzati, colori, capannelli non autorizzati,

Uccelli migratori, reti, informazioni, piazze di Tutti i like pazze di passioni...

...La tranquillità è importante ma la libertà è tutto!

Lì paludi, minacce, cecchini coi fucili, documenti, file notturne e clandestini

Qui incontri, lotte, passi sincronizzati, colori, capannelli non autorizzati,

Uccelli migratori, reti, informazioni, piazze di Tutti i like pazze di passioni...

...La tranquillità è importante ma la libertà è tutto!

Assalti Frontali

Re: French and Germans explore idea of smaller euro zone

So, they are trying to stop all further negative development by slowing everyone involved down with inpenetrable PowerPoint? That might actually buy us some time, tbh.Starglider wrote:Good diagram of the proposed EFSF structure;

I beg your pardon?folti78 wrote:Yup, that would be Slovakia, who is the only Central-European Eurozone member.

http://www.politicalcompass.org/test

Economic Left/Right: -7.12

Social Libertarian/Authoritarian: -7.74

This is pre-WWII. You can sort of tell from the sketch style, from thee way it refers to Japan (Japan in the 1950s was still rebuilding from WWII), the spelling of Tokyo, lots of details. Nothing obvious... except that the upper right hand corner of the page reads "November 1931." --- Simon_Jester

Economic Left/Right: -7.12

Social Libertarian/Authoritarian: -7.74

This is pre-WWII. You can sort of tell from the sketch style, from thee way it refers to Japan (Japan in the 1950s was still rebuilding from WWII), the spelling of Tokyo, lots of details. Nothing obvious... except that the upper right hand corner of the page reads "November 1931." --- Simon_Jester

Re: French and Germans explore idea of smaller euro zone

Sorry, brain fart, anything west of the former WARPAC countries (DDR included) considered Western-europe here ...Skgoa wrote:I beg your pardon?folti78 wrote:Yup, that would be Slovakia, who is the only Central-European Eurozone member.

Re: French and Germans explore idea of smaller euro zone

Slovenia and Estonia?folti78 wrote:Yup, that would be Slovakia, who is the only Central-European Eurozone member. But it's economy is rather healthy, compared to the PIGS.

Re: French and Germans explore idea of smaller euro zone

The game is afoot?

WSJ link

WSJ link

Euro Loses Ground

By STEPHEN L. BERNARD

NEW YORK—The euro dipped below $1.36 as investors are once again worried about the region's debt crisis.

The latest leg down for the euro came as German Chancellor Angela Merkel's CDU party voted to allow countries to voluntarily exit from the euro zone. The shifting political environment heightens the risk of a disorderly move in European debt markets, said Aroop Chatterjee, chief foreign exchange quantitative strategist at Barclays Capital in New York.

That risk is now being further priced into the common currency, he said.

The euro fell to a session low of $1.3596 from $1.3755 late Friday. The common currency recently traded at $1.3621.

Meanwhile, the dollar traded at ¥77.05 compared with ¥77.15, while the U.K. pound bought $1.5898 from $1.6070. The dollar changed hands at 0.9076 Swiss franc from 0.8996 franc.

The dollar index, which tracks the U.S. unit against a basket of six major currencies, rose to 77.52 from 76.947.

The dollar gained in early trade, with the euro coming under more pressure after a sale of five-year Italian government bonds came at the highest cost for the government since 1997. Also, traders were worried that a new technocratic government in Rome still faces daunting challenges in insulating the euro zone's third-largest economy from the region's debt crisis.

The euro bounced back from a midweek rout last week on hopes that a government led by economist and former European Commissioner Mario Monti would be able to implement austerity measures and economic reforms. The changes were demanded by Italy's European partners and designed to reassure investors that the country can rein in its debt load.

The Hungarian forint hit a new all-time low against the euro Monday, as investors' fears about the euro-zone debt crisis heightened and they fled Hungary's beleaguered currency.

The euro spiked to HUF317.66 against the forint from HUF310.93 late Friday. That marks a new all-time low for the forint against the single currency. However, traders say market volume has been thin and this can exaggerate moves.

The forint has underperformed in recent months, weakening more than 17% against the euro since August. Investors are on watch for a sovereign ratings downgrade to junk status for Hungary, while concerns about the country's high level of foreign currency debt and its proximity to the euro zone remains.

—Deborah Levine, William L. Watts and Erin McCarthy contributed to this article.

This post is a 100% natural organic product.

The slight variations in spelling and grammar enhance its individual character and beauty and in no way are to be considered flaws or defects

I'm not sure why people choose 'To Love is to Bury' as their wedding song...It's about a murder-suicide

- Margo Timmins

When it becomes serious, you have to lie

- Jean-Claude Juncker

The slight variations in spelling and grammar enhance its individual character and beauty and in no way are to be considered flaws or defects

I'm not sure why people choose 'To Love is to Bury' as their wedding song...It's about a murder-suicide

- Margo Timmins

When it becomes serious, you have to lie

- Jean-Claude Juncker

- Starglider

- Miles Dyson

- Posts: 8709

- Joined: 2007-04-05 09:44pm

- Location: Isle of Dogs

- Contact:

Re: French and Germans explore idea of smaller euro zone

Buying time is bad. National debts are steadily racheting up, as are bank loses and unfunded liabilities. The economy is getting worse and there are no credible solutions other than massive monetisation (using the world 'solution' loosely). More time does not fix anything, it just makes everything worse. Greece should have defaulted and/or been kicked out last year, but no, the europhiles were (and many still are) in utter total denial of any serious problem. The eurozone is buying worse-than-useless time at extrodinary cost. Of course the politicians don't see it that way, they see it as extending their careers and funelling a bit more money back to private benefactors at no cost to themselves.Skgoa wrote:So, they are trying to stop all further negative development by slowing everyone involved down with inpenetrable PowerPoint?

Re: French and Germans explore idea of smaller euro zone

Not all economies are, which probably is why the need to do something fast is not considered that urgent.Starglider wrote:The economy is getting worse and there are no credible solutions other than massive monetisation (using the world 'solution' loosely).

And I agree with that as well, seeing as how the last time we stumbled into things it pretty much screwed us long term. Far better to let the nations sort it out and then do something.

Whoever says "education does not matter" can try ignorance

------------

A decision must be made in the life of every nation at the very moment when the grasp of the enemy is at its throat. Then, it seems that the only way to survive is to use the means of the enemy, to rest survival upon what is expedient, to look the other way. Well, the answer to that is 'survival as what'? A country isn't a rock. It's not an extension of one's self. It's what it stands for. It's what it stands for when standing for something is the most difficult! - Chief Judge Haywood

------------

My LPs

------------

A decision must be made in the life of every nation at the very moment when the grasp of the enemy is at its throat. Then, it seems that the only way to survive is to use the means of the enemy, to rest survival upon what is expedient, to look the other way. Well, the answer to that is 'survival as what'? A country isn't a rock. It's not an extension of one's self. It's what it stands for. It's what it stands for when standing for something is the most difficult! - Chief Judge Haywood

------------

My LPs

Re: French and Germans explore idea of smaller euro zone

Yeah but Germany and France would have most, if not all, the influence in decision making.Rabid wrote:Add BeNeLux and Austria to the mix, and once the situation is stabilized there, Italia and Spain - if I'm not mistaken, that'd roughly be the "core" of the Eurozone economy, Britain and Scandinavia excluded.