Demos articleRobert Frank wrote:I’ve written before about the myth of sudden inequality. While income inequality has increased dramatically over the past 30 years, it’s declined since 2007 and wealth inequality is actually lower than it was in 1995 – raising questions about the link between inequality and the current unemployment rate.

A new report puts an even finer point on changes in inequality.

“Basically,” the report finds “income inequality hasn’t changed in 25 years.”

The study, by Ronald M. Schmidt, of the William E. Simon Graduate School of Business Administration University of Rochester, challenges the recent CBO report that found that income inequality expanded dramatically between 1979 and 2007. That report said the incomes of the top 1% grew by 275% over the period, while incomes for most Americans grew by 40% or less.

Schmidt’s study said that most of the CBO’s cited growth in inequality happened between 1979 and 1986. “Most of the increase from 1979 and 2009 had occurred by 1986,” he writes.

Any increases in inequality during the 2000s was “wiped out” by the current recession, which saw incomes at the top fall more than the rest as of 2009. “In fact,” he writes, “there was a marked decline in income inequality over the entire decade” of the 2000s.

I should note that the post-2009 data may tell a different story. Inequality may well have dipped temporarily in 2009 but rebounded with stock markets in 2010 and 2011. Inequality may actually be higher today than it was in 2007. And even if it’s not, inequality in America is still high compared to other developed countries.

But as Schmidt points out, the most current data shows that the difference in average after-tax incomes between those making more than $500,000 and those making less than $500,000 was $1.5 million in 2000. That distance shrunk by $450,000 by 2009.

“A careful analysis reveals no significant deterioration in economic inequality that could serve as a pretext for raising taxes,” Schmidt argues.

Do you think “rising” inequality is a good reason to raise taxes on the rich?

Jack Temple wrote:If you take away nothing else from President Obama's address yesterday, make sure you hold on to this point: What today's record-high levels of economic inequality prove, once and for all, is that trickle-down economics is a fantasy that has not delivered on its promise to provide shared prosperity.

Of course, I didn't expect the Right to sit still in the face of this criticism, but their response is puzzling: rather than defending the fairness of the free market, they have decided to deny that record-high levels of inequality even exist in the first place.

In his column yesterday in the Wall Street Journal, Robert Frank cited a report by Prof. Ronald M. Schmidt of the University of Rochester, who claims to have successfully invalidated the evidence of increasing economic inequality published in a recent and widely-cited CBO report. The report revealed that average real after-tax household income for the top 1 percent of households grew at a rate of 275 percent from 1979-2007, while income for the bottom 20 percent increased by only 18 percent in the same period.

Prof. Schmidt says this is nonsense:

In fact, there has been a marked decline in income inequality over the last decade. From 2000 to 2009, average [Adjusted Gross Income] declined by 15.0 percent and average after-tax income declined by 11.0 percent for returns with AGI of at least $500,000. (Filers with an AGI of at least $500,000 represent 0.5 percent of all returns in both years, so this comparison is similar in spirit to the CBO report, which looks at the top 1 percent of households.) For all other returns, there were increases of 14.6 percent for average AGI and 17.3 percent for average after-tax income.

There seems to be some fuzzy math going on here. First, he shifts the time frame to 2000-2009, which is significant given the steep economic decline that occurred in the beginning of that decade before incomes started rising again. The CBO report explains it clearly:

After falling sharply in 2001 because of the recession and stock market drop, average real after-tax income for the top 1 percent of the population rose by more than 85 percent between 2002 and 2007.

In other words, sure, if you select a time frame that folds in a period of steep income decline with a period of steep income increases, then the overall average is going to appear less dramatic -- but it would also obscure the point that incomes for the wealthiest 1 percent can bounce back vigorously even after a serious recession. The same cannot be said for middle class incomes.

Second, he divides all income earners into two categories: those making at least $500,000 per year, and those making less than $500,000. This doesn't exactly sound like an accurate split between the "haves" and the "have-nots" -- yes, granted, it does (roughly) separate the richest 1 percent from the remaining 99 percent, but the claim by OWS. about the declining welfare of "the 99 percent" is really meant to be taken as more of a rhetorical gesture.

While the richest 1 percent have enjoyed run-away levels of income growth, it's important to note that the rest of the top quintile has still enjoyed favorable growth rates relative to the bottom 80 percent. Household incomes for the 81st-99th percentile have grown at a rate of 65 percent from 1979-2007: while this is, admittedly, more than 4 times slower than the rate of growth enjoyed by the top 1 percent, it is also almost 4 times faster than the rate of income growth experience by the lowest quintile (which, as I mentioned above, was a measly 18 percent). Bottom line: if you treat everyone from the 99th percentile on down as one group, you'll obscure the inequality that exists within this grouping, making their collective economic welfare seem better than it is.

Manipulating the numbers won't erase what Americans now overwhelmingly know to be true: While the incomes of the richest 1 percent may be volatile, they abolustely do not trickle down.

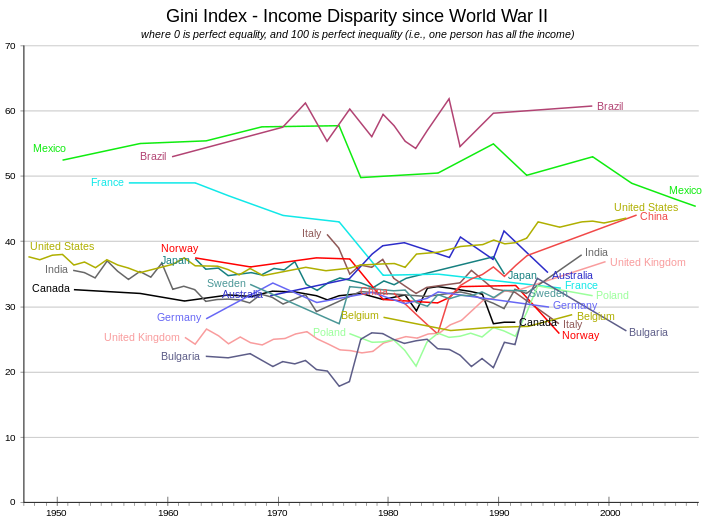

I'd be interested in going back further in time to the 20th century and prior to see how income inequality progressed.