slow handclap for the Tories, please.Stephen Boyle, head of group economics at the Royal Bank of Scotland, said the last time the economy was so bad was immediately after World War One and World War Two, when GDP fell in double digits.

"Those aside, 2008-12 fall was bigger than any since before Victoria ascended the throne," he said.

"It's the worst economic performance since at least 1830, outside of post-war demobilisations," he told The Daily Telegraph. "It's worse than the 1920s, it's worse than the Great Depression."

So, how's austerity doing for the UK?

Moderators: Alyrium Denryle, Edi, K. A. Pital

So, how's austerity doing for the UK?

http://www.telegraph.co.uk/news/9826857 ... ssion.html

"Aid, trade, green technology and peace." - Hans Rosling.

"Welcome to SDN, where we can't see the forest because walking into trees repeatedly feels good, bro." - Mr Coffee

"Welcome to SDN, where we can't see the forest because walking into trees repeatedly feels good, bro." - Mr Coffee

- UnderAGreySky

- Jedi Knight

- Posts: 641

- Joined: 2010-01-07 06:39pm

- Location: the land of tea and crumpets

Re: So, how's austerity doing for the UK?

And Osborne doesn't even admit there is a problem. At least in public.

What's worse has been the Torygraph's opinion section. i've always found it to be horrendous but today was a new depth. Jeremy Warner has an absolutely ridiculous piece titled Does anyone believe the GDP figures any more?:

He does raise an interesting point:

but Warner ends is article going back to stupid:

What's worse has been the Torygraph's opinion section. i've always found it to be horrendous but today was a new depth. Jeremy Warner has an absolutely ridiculous piece titled Does anyone believe the GDP figures any more?:

Summary: "Take out the stuff that I don't like and it's all fine! Furthermore, if you discount the chicken and bacon a chicken, bacon and mayo sandwich is a vegetarian dish!".Does anyone really believe the GDP figures any more? OK, so I'll rephrase that. Those that want to use the latest dollop of bad news for political purposes plainly do. On cue, Ed Balls, the shadow Chancellor, will shortly be saying that if only the Government had followed his advice and gone easy on deficit reduction, then the situation would be much better. By the time you read this, he will perhaps already have said it.

I don't deny that the situation is grim, and there's no quarrelling with the renewed fall in manufacturing output. What would you expect with recession in Europe? But the official figures are increasingly difficult to square with a robust private sector jobs market, and you don't get much sense, even outside the London bubble, that things are really as bad as the numbers suggest.

Strip out disruptions to north sea oil production, and the fall in GDP wasn't as calamitous as it first appears – 0.1pc as against the headline number of 0.3pc. Don't get me wrong. We are only just beginning to come to terms with the harm that Britain's unrestrained credit boom did to the economy. The ongoing process of deleveraging – banking and household – is a fierce contraint on return to acceptable levels of economic growth. It's going to take time.

He does raise an interesting point:

At least one person thinks this is because of lower productivity.Even so, how do you reconcile this flatlining economy with the private sector jobs market, which is growing at its fastest yearly rate in twenty years? There are only two explanations. Either the GDP numbers are quite significantly wrong, or labour productivity has gone into precipitous decline, with growing numbers of people prepared to accept poorly paid, "grunt" jobs.

My own view is that it is a combination of the two. The situation is probably not as bad as the headline number suggests, but by the same token, these are by and large not great jobs that are being created – scraping by on part time work and self employment. A whole new army of white van man is being created. Some work is better than no work, but this is not a healthy development.

but Warner ends is article going back to stupid:

Yes, the chief economist at the IMF... what would he know about the UK's economy?Olivier Blanchard, chief economist at the IMF has this week urged George Osborne to ease back on deficit reduction, but has he taken a look at just how dire the UK's public finances really are? This would be very dangerous. None the less, there is a growing case for immediate tax cuts and increased infrastructure spending, funded by greater cuts in government spending further down the line.

Can't keep my eyes from the circling skies,

Tongue-tied and twisted, just an earth-bound misfit, I

Tongue-tied and twisted, just an earth-bound misfit, I

-

Dr. Trainwreck

- Jedi Knight

- Posts: 834

- Joined: 2012-06-07 04:24pm

Re: So, how's austerity doing for the UK?

So austerity is a piece of shit no matter what, eh? Who woulda guessed. Because I remember some people (not necessarily on this board) saying that when Greece had a 26% unemployment rate, it was their fault for not executing the plan properly and because the Greek state is disorganised. And here it is, happening in a country with pretty good institutions, and people will again bitch and moan that the plan is good but the execution is flunked.

Well, England. The No True Scotsman returns to the Isle.

Well, England. The No True Scotsman returns to the Isle.

If we take the IMF's performance in Greece as a basis, jack and shit. But Blanchard, right now, is just a broken clock.Yes, the chief economist at the IMF... what would he know about the UK's economy?

Ποταμοῖσι τοῖσιν αὐτοῖσιν ἐμϐαίνουσιν, ἕτερα καὶ ἕτερα ὕδατα ἐπιρρεῖ. Δὶς ἐς τὸν αὐτὸν ποταμὸν οὐκ ἂν ἐμβαίης.

The seller was a Filipino called Dr. Wilson Lim, a self-declared friend of the M.I.L.F. -Grumman

The seller was a Filipino called Dr. Wilson Lim, a self-declared friend of the M.I.L.F. -Grumman

- UnderAGreySky

- Jedi Knight

- Posts: 641

- Joined: 2010-01-07 06:39pm

- Location: the land of tea and crumpets

Re: So, how's austerity doing for the UK?

I wouldn't go that far. But in this kind of a recession, it HAS been proven to be, well, shit.Dr. Trainwreck wrote:So austerity is a piece of shit no matter what, eh? Who woulda guessed.

I have respect for the man - and the organisation - because they evaluated their advice from the start of the recession, found that they were wrong and changed their advice accordingly. That's more than most.Dr. Trainwreck wrote:If we take the IMF's performance in Greece as a basis, jack and shit. But Blanchard, right now, is just a broken clock.

Can't keep my eyes from the circling skies,

Tongue-tied and twisted, just an earth-bound misfit, I

Tongue-tied and twisted, just an earth-bound misfit, I

-

Dr. Trainwreck

- Jedi Knight

- Posts: 834

- Joined: 2012-06-07 04:24pm

Re: So, how's austerity doing for the UK?

I don't really know about the man, but... you know, I was wrong. Just because he works in the IMF that doesn't mean he's a dunce. But I hold no respect for the organisation. So, they've found themselves to be wrong; colossally so. Greece followed their plan and is in the worst shape it has been since the civil war. But for some reason they remain trustworthy and dependable while the Greek government is not. How come nobody views them as the massive fuckups they demonstrably are?UnderAGreySky wrote:I have respect for the man - and the organisation - because they evaluated their advice from the start of the recession, found that they were wrong and changed their advice accordingly. That's more than most.

And besides, saying that the IMF gives advice is perhaps the most genteel euphemism in the history of bowdlerization.

Edit: fixed link.

Ποταμοῖσι τοῖσιν αὐτοῖσιν ἐμϐαίνουσιν, ἕτερα καὶ ἕτερα ὕδατα ἐπιρρεῖ. Δὶς ἐς τὸν αὐτὸν ποταμὸν οὐκ ἂν ἐμβαίης.

The seller was a Filipino called Dr. Wilson Lim, a self-declared friend of the M.I.L.F. -Grumman

The seller was a Filipino called Dr. Wilson Lim, a self-declared friend of the M.I.L.F. -Grumman

Re: So, how's austerity doing for the UK?

Of course it doesn't work. Not when a country is drowning in debt and past the point of no return. It's like telling an alcoholic to stop drinking after he's suffered terminal liver failure, he may live a little longer but in the end he'll still die a premature death. This is the common thread in all countries where austerity has been prescribed in the current depression, all of them were already at the point where they were doomed no matter which option was taken.

This post is a 100% natural organic product.

The slight variations in spelling and grammar enhance its individual character and beauty and in no way are to be considered flaws or defects

I'm not sure why people choose 'To Love is to Bury' as their wedding song...It's about a murder-suicide

- Margo Timmins

When it becomes serious, you have to lie

- Jean-Claude Juncker

The slight variations in spelling and grammar enhance its individual character and beauty and in no way are to be considered flaws or defects

I'm not sure why people choose 'To Love is to Bury' as their wedding song...It's about a murder-suicide

- Margo Timmins

When it becomes serious, you have to lie

- Jean-Claude Juncker

- UnderAGreySky

- Jedi Knight

- Posts: 641

- Joined: 2010-01-07 06:39pm

- Location: the land of tea and crumpets

Re: So, how's austerity doing for the UK?

Define "drowning in debt" and "past the point of no return".J wrote:Of course it doesn't work. Not when a country is drowning in debt and past the point of no return. It's like telling an alcoholic to stop drinking after he's suffered terminal liver failure, he may live a little longer but in the end he'll still die a premature death. This is the common thread in all countries where austerity has been prescribed in the current depression, all of them were already at the point where they were doomed no matter which option was taken.

Secondly, why add private debt to public debt to make a point? Aren't they two separate issues?

Can't keep my eyes from the circling skies,

Tongue-tied and twisted, just an earth-bound misfit, I

Tongue-tied and twisted, just an earth-bound misfit, I

Re: So, how's austerity doing for the UK?

If we look at historical precedent, a depression or debt default is almost guaranteed once the total debt to GDP ratio reaches 300% or thereabouts, or the government debt reaches 100$ of GDP. This was shown in many examples going back hundreds of years in This Time is Different: Eight Centuries of Financial Folly by Reinhart and Rogoff.

With regards to private & public debt, while they're not equal, both have a similar effect on the economy as a whole in that excessive amounts of either will constrain spending by imposing large interest payments. In both cases, it means money which would be spent on capital investments to create wealth and improve the economy is instead sucked into the black hole of debt service. Interest payments are a net drain on the economy and once enough money is being siphoned off to service debts the economy no longer has the surplus to invest, innovate, and grow, and as debt service costs rise further the economy is forced to cannibalize itself or default.

The time for austerity is early, as was done by Canada in the early 90s. For the UK and various European countries it's a little too late for that, the correct choice would be to follow Iceland's example and default.

With regards to private & public debt, while they're not equal, both have a similar effect on the economy as a whole in that excessive amounts of either will constrain spending by imposing large interest payments. In both cases, it means money which would be spent on capital investments to create wealth and improve the economy is instead sucked into the black hole of debt service. Interest payments are a net drain on the economy and once enough money is being siphoned off to service debts the economy no longer has the surplus to invest, innovate, and grow, and as debt service costs rise further the economy is forced to cannibalize itself or default.

The time for austerity is early, as was done by Canada in the early 90s. For the UK and various European countries it's a little too late for that, the correct choice would be to follow Iceland's example and default.

This post is a 100% natural organic product.

The slight variations in spelling and grammar enhance its individual character and beauty and in no way are to be considered flaws or defects

I'm not sure why people choose 'To Love is to Bury' as their wedding song...It's about a murder-suicide

- Margo Timmins

When it becomes serious, you have to lie

- Jean-Claude Juncker

The slight variations in spelling and grammar enhance its individual character and beauty and in no way are to be considered flaws or defects

I'm not sure why people choose 'To Love is to Bury' as their wedding song...It's about a murder-suicide

- Margo Timmins

When it becomes serious, you have to lie

- Jean-Claude Juncker

Re: So, how's austerity doing for the UK?

Is it possible to put a dollar value on the cost of defaulting, by taking into account the higher interest rates on borrowing in future?

Re: So, how's austerity doing for the UK?

Depends on the question. Private and public debt behave different. The government is immortal, and can regenerate an infinite amount of money by either raising taxes or printing money. Printing money is a bad thing since it might cause inflation, but it's better than breaking a contract*.UnderAGreySky wrote:Secondly, why add private debt to public debt to make a point? Aren't they two separate issues?

Private debt has the problem that people die, and thus at some point a person has to pay down it's debts. Also, real persons have liquidity constraints, since they don't have access to capital market. So the financing conditions for private households are always worse.

But it's important to remember that both public and private debt is paid by the same people, namely the taxpayer. Government takes part of their income as taxes, and pays interest with it, and then the taxpayer uses the rest to pay their private debt. So by shifting debt from private to public, you can reduce interest payment.

*that of course only works if your debt is in your own currency. If you're don't have your own currency, like Greece, you're screwed.

The study of R&R has it's problems. Just a quick example:UK's national debt as percentage of GDP:J wrote:If we look at historical precedent, a depression or debt default is almost guaranteed once the total debt to GDP ratio reaches 300% or thereabouts, or the government debt reaches 100$ of GDP. This was shown in many examples going back hundreds of years in This Time is Different: Eight Centuries of Financial Folly by Reinhart and Rogoff.

Britain's public debt reached around 250% GDP twice in the last 200 years, and neither triggered a default. And a number of western countries reached more than 100% without defaulting.

There's an error in your reasoning. The interest money isn't lost, it just changes owners**. Someone will receive that money and can spend and invest it. The main problem is, that now everyone tries to pay down it's debt at the same time, and too strong. If both private sector and public sector do that at the same time there's a net loss in consumption that depresses the economy. That can only work if exports increase to even this out, or if the central bank is nice and lowers the interest rates. Canada did that in the 90s, Germany did that in the 2000s.J wrote:With regards to private & public debt, while they're not equal, both have a similar effect on the economy as a whole in that excessive amounts of either will constrain spending by imposing large interest payments. In both cases, it means money which would be spent on capital investments to create wealth and improve the economy is instead sucked into the black hole of debt service. Interest payments are a net drain on the economy and once enough money is being siphoned off to service debts the economy no longer has the surplus to invest, innovate, and grow, and as debt service costs rise further the economy is forced to cannibalize itself or default.

The time for austerity is early, as was done by Canada in the early 90s. For the UK and various European countries it's a little too late for that, the correct choice would be to follow Iceland's example and default.

That can't work if every other country is in a depression and tries to pay down debt, too. Or if the interest rates are zero already.

**Of course that's only true if your debt is within your own country. If you have high foreign debt like Greece, you're screwed.

- UnderAGreySky

- Jedi Knight

- Posts: 641

- Joined: 2010-01-07 06:39pm

- Location: the land of tea and crumpets

Re: So, how's austerity doing for the UK?

There is precedent for countries having broached the 100% public debt mark and... nothing having happened. Japan has been there for a while now. Going back 100s of years is no use considering that 1) monetary policy was not used as a tool very well and 2) the gold standard threw a lot of tools out of the window.J wrote:If we look at historical precedent, a depression or debt default is almost guaranteed once the total debt to GDP ratio reaches 300% or thereabouts, or the government debt reaches 100$ of GDP. This was shown in many examples going back hundreds of years in This Time is Different: Eight Centuries of Financial Folly by Reinhart and Rogoff.

With regards to private & public debt, while they're not equal, both have a similar effect on the economy as a whole in that excessive amounts of either will constrain spending by imposing large interest payments. In both cases, it means money which would be spent on capital investments to create wealth and improve the economy is instead sucked into the black hole of debt service. Interest payments are a net drain on the economy and once enough money is being siphoned off to service debts the economy no longer has the surplus to invest, innovate, and grow, and as debt service costs rise further the economy is forced to cannibalize itself or default.

The time for austerity is early, as was done by Canada in the early 90s. For the UK and various European countries it's a little too late for that, the correct choice would be to follow Iceland's example and default.

As I have pointed out before, the Canadian situation in the 90s cannot be used as an example, and it was especially not done in the way that you suggest, in an early fashion.

Stephen Gordon writes:

It would appear that there is a significant constituency in both the US and in Europe agitating for immediate efforts to reduce their respective governments' deficits, and some are pointing to the Canadian experience of the 1990s. If Canada could make the swift transition from decades of large and chronic deficits to being the poster child of fiscal rectitude with no apparent ill effects, then why can't everyone else?

The answer is that Europe and the US in 2010 is not Canada in 1995, in pretty much every way that matters.

1) Canada waited until the recession was over before embarking on an austerity program. Here is a graph of public and private sector employment in the 1990s

2) The austerity program was not painless. Much of the federal austerity program took the form of cuts to transfer payments to the provincial governments, who in turn were obliged to close hospitals and schools.

3) Canada is a small open economy whose currency could depreciate dramatically against its largest trading partner. And boy, did it ever. Exports were the biggest contributor to Canadian GDP growth during the 1990s.

(also, Welf sniped me on my first point!

Can't keep my eyes from the circling skies,

Tongue-tied and twisted, just an earth-bound misfit, I

Tongue-tied and twisted, just an earth-bound misfit, I

Re: So, how's austerity doing for the UK?

A government may attempt to raise taxes to increase revenues but it only works to a point, there's a limit to how much money as a percentage of GDP which may be extracted by the government via taxation, regardless of tax rates. For the US this is around 20% while the Scandinavian countries manage around 30%. Attempting to further raise taxes or close loopholes results in tax evasion and capital flight, with no gains in revenue. This places a limit the amount of money which can be raised via taxation, and indirectly, on the total amount of debt which can be serviced if the rest of the nation's needs are to be provided.Welf wrote:Depends on the question. Private and public debt behave different. The government is immortal, and can regenerate an infinite amount of money by either raising taxes or printing money. Printing money is a bad thing since it might cause inflation, but it's better than breaking a contract*.

Private debt has the problem that people die, and thus at some point a person has to pay down it's debts. Also, real persons have liquidity constraints, since they don't have access to capital market. So the financing conditions for private households are always worse.

But it's important to remember that both public and private debt is paid by the same people, namely the taxpayer. Government takes part of their income as taxes, and pays interest with it, and then the taxpayer uses the rest to pay their private debt. So by shifting debt from private to public, you can reduce interest payment.

*that of course only works if your debt is in your own currency. If you're don't have your own currency, like Greece, you're screwed.

Which brings us to interest rates and the capital markets. The markets can and do recognize when a nation is unable to service its debts, and it will cut off further borrowing by demanding exorbitant interest rates before going "no bid".

Depression or default. What happened in Britain after 1812? That would be the post Napoleonic wars depression. And after WWII? That would be one of the very few exceptions, it was a time of austerity and mass reorganization.Britain's public debt reached around 250% GDP twice in the last 200 years, and neither triggered a default. And a number of western countries reached more than 100% without defaulting.

Yes, and no. In an ideal frictionless economy with plenty of headroom the money does indeed change hands to be invested in productive ways to create more wealth. However, we do not have a frictionless economy, someone takes a slice from the pie every time money changes hands, money movers do not work for free. Furthermore, we're now in a situation where all major players owe large amounts to other majors, and various debts & collateral have been pledged & re-pledged multiple times (see rehypothecation). It's much like paying off one credit card with another, then continuing the cycle another dozen times. The money changes hands but all it's doing is shifting debts around rather than being invested in productive assets.There's an error in your reasoning. The interest money isn't lost, it just changes owners**. Someone will receive that money and can spend and invest it. The main problem is, that now everyone tries to pay down it's debt at the same time, and too strong. If both private sector and public sector do that at the same time there's a net loss in consumption that depresses the economy. That can only work if exports increase to even this out, or if the central bank is nice and lowers the interest rates. Canada did that in the 90s, Germany did that in the 2000s.

That can't work if every other country is in a depression and tries to pay down debt, too. Or if the interest rates are zero already.

**Of course that's only true if your debt is within your own country. If you have high foreign debt like Greece, you're screwed.

Early, meaning we did it before debt levels got out of hand. Public debt topped out at around 70% of GDP and went down from there until the current downturn, total debt was a bit under 270%, and also fell until 2007. My point is the time for the UK and other countries to implement austerity was 10-20 years ago, not right now or after the current downturn, whenever it ends.UnderAGreySky wrote:As I have pointed out before, the Canadian situation in the 90s cannot be used as an example, and it was especially not done in the way that you suggest, in an early fashion.

This post is a 100% natural organic product.

The slight variations in spelling and grammar enhance its individual character and beauty and in no way are to be considered flaws or defects

I'm not sure why people choose 'To Love is to Bury' as their wedding song...It's about a murder-suicide

- Margo Timmins

When it becomes serious, you have to lie

- Jean-Claude Juncker

The slight variations in spelling and grammar enhance its individual character and beauty and in no way are to be considered flaws or defects

I'm not sure why people choose 'To Love is to Bury' as their wedding song...It's about a murder-suicide

- Margo Timmins

When it becomes serious, you have to lie

- Jean-Claude Juncker

- UnderAGreySky

- Jedi Knight

- Posts: 641

- Joined: 2010-01-07 06:39pm

- Location: the land of tea and crumpets

Re: So, how's austerity doing for the UK?

And I'm still not convinced with your examples from 1812 - a time with ineffective or absent central banking, metallic standards backing the money and lack of safety nets that lead to mass unemployment and starvation. The one post-gold-standard example we have you dismiss as "an exception". Today the UK can borrow money at negative real rates over long periods, not a sign that all is lost.

Yes, I would have liked it if they'd pursued austerity in the 90s a bit more or at least done something to bring the debt even lower. But to say that "all is lost now" is silly.

Yes, I would have liked it if they'd pursued austerity in the 90s a bit more or at least done something to bring the debt even lower. But to say that "all is lost now" is silly.

Can't keep my eyes from the circling skies,

Tongue-tied and twisted, just an earth-bound misfit, I

Tongue-tied and twisted, just an earth-bound misfit, I

Re: So, how's austerity doing for the UK?

They can, for now, but for how long? The UK, Japan, and many other countries' economies depend on their being able to borrow at near zero interest rates, indefinitely, and their policies are based on this assumption. In some cases such as Japan it can work for quite some time, years, even decades, but the goose is cooked as soon as the market raises interest rates on them. In the long run, the market always wins, it's larger & more powerful than any central bank or government. It's a system which moves trillions every day, if and when it starts a run on your bonds, you are going the way of Iceland despite everything your government & central bankers can do.

This post is a 100% natural organic product.

The slight variations in spelling and grammar enhance its individual character and beauty and in no way are to be considered flaws or defects

I'm not sure why people choose 'To Love is to Bury' as their wedding song...It's about a murder-suicide

- Margo Timmins

When it becomes serious, you have to lie

- Jean-Claude Juncker

The slight variations in spelling and grammar enhance its individual character and beauty and in no way are to be considered flaws or defects

I'm not sure why people choose 'To Love is to Bury' as their wedding song...It's about a murder-suicide

- Margo Timmins

When it becomes serious, you have to lie

- Jean-Claude Juncker

-

Dr. Trainwreck

- Jedi Knight

- Posts: 834

- Joined: 2012-06-07 04:24pm

Re: So, how's austerity doing for the UK?

J, the market is far from omnipotent and far from a singular entity. It is also more powerful than a government only because of globalization and the abiility to buy stocks in China and Jamaica at the same time (random example).

As to some countries' infinite borrowing, the fact they can do it proves that "the market" thinks they will repay it, so no harm considered done; besides, the symbiotic relationship the state has with the market is beneficial to both. This isn't an ironclad argument, of course, but come on... would you have heard anything different before 2007?

I understand, of course, that it makes no long-term sense to keep borrowing like this, but I'm getting more and more convinced that the current financial system is at best incohorent. This might explain the situation.

As to some countries' infinite borrowing, the fact they can do it proves that "the market" thinks they will repay it, so no harm considered done; besides, the symbiotic relationship the state has with the market is beneficial to both. This isn't an ironclad argument, of course, but come on... would you have heard anything different before 2007?

I understand, of course, that it makes no long-term sense to keep borrowing like this, but I'm getting more and more convinced that the current financial system is at best incohorent. This might explain the situation.

Ποταμοῖσι τοῖσιν αὐτοῖσιν ἐμϐαίνουσιν, ἕτερα καὶ ἕτερα ὕδατα ἐπιρρεῖ. Δὶς ἐς τὸν αὐτὸν ποταμὸν οὐκ ἂν ἐμβαίης.

The seller was a Filipino called Dr. Wilson Lim, a self-declared friend of the M.I.L.F. -Grumman

The seller was a Filipino called Dr. Wilson Lim, a self-declared friend of the M.I.L.F. -Grumman

Re: So, how's austerity doing for the UK?

Actually, you're wrong here - Britain ceased to convert its currency to metals in 1797, only adopting bullion standard again between 1816-1820, after massive war loans in Bank of England (which quadrupled national debt in loans) caused inflation of British Pound. Both belie statements about ineffective central banking and metallic standards. If anything, post war recession was caused by austerity and by sudden tightening of monetary policy needed to change inflated fiat money to gold standard, making it a lot like situation today.UnderAGreySky wrote:And I'm still not convinced with your examples from 1812 - a time with ineffective or absent central banking, metallic standards backing the money and lack of safety nets that lead to mass unemployment and starvation. The one post-gold-standard example we have you dismiss as "an exception". Today the UK can borrow money at negative real rates over long periods, not a sign that all is lost.

But the money movers don't burn the money to lit cigars, they also take it so they can spend/invest it otherwise, no? We can discuss if they don't introduce too much friction by charging too much, but regardless, that money isn't lost either, and generates wealth, too, if not exactly the needed kind.J wrote:Yes, and no. In an ideal frictionless economy with plenty of headroom the money does indeed change hands to be invested in productive ways to create more wealth. However, we do not have a frictionless economy, someone takes a slice from the pie every time money changes hands, money movers do not work for free.

- UnderAGreySky

- Jedi Knight

- Posts: 641

- Joined: 2010-01-07 06:39pm

- Location: the land of tea and crumpets

Re: So, how's austerity doing for the UK?

If so, I take that back. Thanks, Irbis.

Now, Jonathan Portes of the National Institute of Economic and Scientific Research (NIESR) writes:

The Austerity Delusion

Now, Jonathan Portes of the National Institute of Economic and Scientific Research (NIESR) writes:

The Austerity Delusion

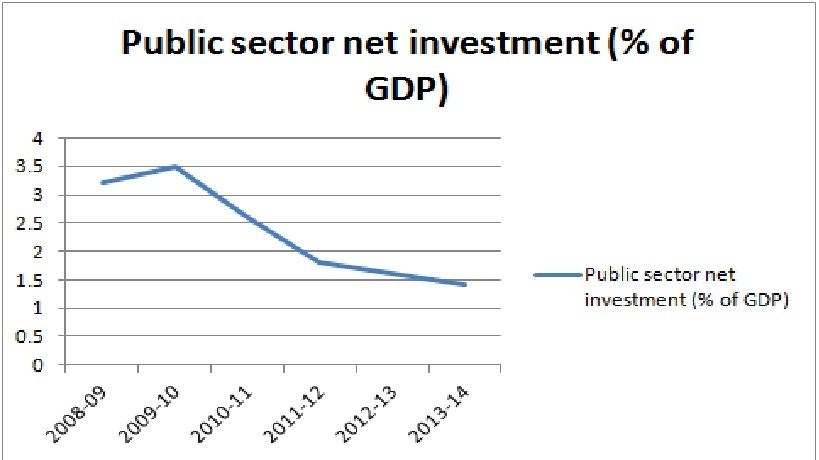

(not sure what to quote exactly, the article is massive and well-detailed).But this does not mean there has been no austerity. As we all know, public sector capital spending has been slashed in half, while taxes (VAT on everybody, some taxes on higher earners) have risen significantly. According to the OBR, between 2009-10 and 2011-12 taxes went up by more than 1 percent of GDP, while public investment fell by 1.7 percent of GDP. Only in some alternate universe is this not "austerity", still less Mr Redwood's "stimulus". Claiming that, for example, reductions in spending on new social housing and increases in VAT do not represent "cuts" [in spending and in the deficit] makes no sense.

So what happens if we look at what the government has actually done? Probably the easiest way to see this is to look at this graph from the IMF, which more or less corresponds to the simple FT definition of stimulus (or, in this case, its opposite, fiscal consolidation):

This shows what the Fund rightly describes as a "large and frontloaded" fiscal consolidation. I am not aware of any serious economic analysis that challenges these figures in broad terms (they differ slightly, but not massively, from those of the OBR, for various technical reasons). So on the fundamental point Messrs Redwood and Nelson are simply wrong. The chart does however, show a marked reduction in the pace of consolidation in 2012-13, which leads on to..

Can't keep my eyes from the circling skies,

Tongue-tied and twisted, just an earth-bound misfit, I

Tongue-tied and twisted, just an earth-bound misfit, I

Re: So, how's austerity doing for the UK?

Public sector capital spending has been cut in half. What about total public spending? I've heard that while public sector capital spending has fallen, spending on transfers has risen pretty steadily.

A Government founded upon justice, and recognizing the equal rights of all men; claiming higher authority for existence, or sanction for its laws, that nature, reason, and the regularly ascertained will of the people; steadily refusing to put its sword and purse in the service of any religious creed or family is a standing offense to most of the Governments of the world, and to some narrow and bigoted people among ourselves.

F. Douglass

Re: So, how's austerity doing for the UK?

Well, it seems the rate of increase has slowed, according to the new math it means spending is going down.Surlethe wrote:Public sector capital spending has been cut in half. What about total public spending? I've heard that while public sector capital spending has fallen, spending on transfers has risen pretty steadily.

Austerity? Hmmm...

This post is a 100% natural organic product.

The slight variations in spelling and grammar enhance its individual character and beauty and in no way are to be considered flaws or defects

I'm not sure why people choose 'To Love is to Bury' as their wedding song...It's about a murder-suicide

- Margo Timmins

When it becomes serious, you have to lie

- Jean-Claude Juncker

The slight variations in spelling and grammar enhance its individual character and beauty and in no way are to be considered flaws or defects

I'm not sure why people choose 'To Love is to Bury' as their wedding song...It's about a murder-suicide

- Margo Timmins

When it becomes serious, you have to lie

- Jean-Claude Juncker

- Dominarch's Hope

- Village Idiot

- Posts: 395

- Joined: 2013-01-25 01:02am

Re: So, how's austerity doing for the UK?

Its not really austerity unless you are literally cutting exactly enough or more to prevent yourself from having to borrow money. Otherwise, its just political pandering.

Because, Murrica, thats why.

Re: So, how's austerity doing for the UK?

Undoubtedly, but for better or worse, there are things that even the Tories dimly realise they can't cut without dire consequences.Dominarch's Hope wrote:Its not really austerity unless you are literally cutting exactly enough or more to prevent yourself from having to borrow money. Otherwise, its just political pandering.

There are hardly any excesses of the most crazed psychopath that cannot easily be duplicated by a normal kindly family man who just comes in to work every day and has a job to do.

-- (Terry Pratchett, Small Gods)

Replace "ginger" with "n*gger," and suddenly it become a lot less funny, doesn't it?

-- fgalkin

Like my writing? Tip me on Patreon

I Have A Blog

-- (Terry Pratchett, Small Gods)

Replace "ginger" with "n*gger," and suddenly it become a lot less funny, doesn't it?

-- fgalkin

Like my writing? Tip me on Patreon

I Have A Blog

- UnderAGreySky

- Jedi Knight

- Posts: 641

- Joined: 2010-01-07 06:39pm

- Location: the land of tea and crumpets

Re: So, how's austerity doing for the UK?

Total spending will always show a balancing out between declining government purchases and increased spending on the safety net. This is austerity:J wrote:Well, it seems the rate of increase has slowed, according to the new math it means spending is going down.Surlethe wrote:Public sector capital spending has been cut in half. What about total public spending? I've heard that while public sector capital spending has fallen, spending on transfers has risen pretty steadily.

Austerity? Hmmm...

(edited to remove chart out of quote)

Can't keep my eyes from the circling skies,

Tongue-tied and twisted, just an earth-bound misfit, I

Tongue-tied and twisted, just an earth-bound misfit, I

- Dominarch's Hope

- Village Idiot

- Posts: 395

- Joined: 2013-01-25 01:02am

Re: So, how's austerity doing for the UK?

Yup.Zaune wrote:Undoubtedly, but for better or worse, there are things that even the Tories dimly realise they can't cut without dire consequences.Dominarch's Hope wrote:Its not really austerity unless you are literally cutting exactly enough or more to prevent yourself from having to borrow money. Otherwise, its just political pandering.

Back here, reducing military expenditures would be the best way. Then comes old people health care.

But food stamps and such have to stay. They are a massively net gain for the economy. And...well riots with guns.

Because, Murrica, thats why.

Re: So, how's austerity doing for the UK?

Riots? Try car bombs, snipers and the odd mortar attack.

Huh. Maybe that's why County Sheriff's Departments are buying all those surplus APCs.

Huh. Maybe that's why County Sheriff's Departments are buying all those surplus APCs.

There are hardly any excesses of the most crazed psychopath that cannot easily be duplicated by a normal kindly family man who just comes in to work every day and has a job to do.

-- (Terry Pratchett, Small Gods)

Replace "ginger" with "n*gger," and suddenly it become a lot less funny, doesn't it?

-- fgalkin

Like my writing? Tip me on Patreon

I Have A Blog

-- (Terry Pratchett, Small Gods)

Replace "ginger" with "n*gger," and suddenly it become a lot less funny, doesn't it?

-- fgalkin

Like my writing? Tip me on Patreon

I Have A Blog

Re: So, how's austerity doing for the UK?

Unless the Tories are planning to completely or virtually eliminate the kind of working-age benefits that jobless young people tend to receive, I don't see that level of violence happening in the UK in the foreseeable future, unless the Tories are so blunderingly incompetent that they manage to put a lot of people off the idea of being governed by posh school graduates and their rich friends (no matter what colour their rosette).

Although more riots like in 2011 seems somewhat likely, especially given that the underlying factors behind their occurrence have not been seriously addressed.

Although more riots like in 2011 seems somewhat likely, especially given that the underlying factors behind their occurrence have not been seriously addressed.

Does it follow that I reject all authority? Perish the thought. In the matter of boots, I defer to the authority of the boot-maker - Mikhail Bakunin

Capital is reckless of the health or length of life of the laborer, unless under compulsion from society - Karl Marx

Pollution is nothing but the resources we are not harvesting. We allow them to disperse because we've been ignorant of their value - R. Buckminster Fuller

The important thing is not to be human but to be humane - Eliezer S. Yudkowsky

Nova Mundi, my laughable attempt at an original worldbuilding/gameplay project

Capital is reckless of the health or length of life of the laborer, unless under compulsion from society - Karl Marx

Pollution is nothing but the resources we are not harvesting. We allow them to disperse because we've been ignorant of their value - R. Buckminster Fuller

The important thing is not to be human but to be humane - Eliezer S. Yudkowsky

Nova Mundi, my laughable attempt at an original worldbuilding/gameplay project