But before I go on, I feel its worth taking a trip down memory lane. Specifically to

This thread in 2007 titled Chinese economy smaller than previously thought where the Chinese economy turned out to be smaller in Purchasing Power Parity terms. Thus there was much gloating because poverty is cool and all that. To be more specific instead of a 10 trillion international dollar economy, China had a 6 trillion international dollar economy. The figures were revised down by the World Bank. In fact the LA Times demonstrated classiness not seen with a totally awesome title such as The Great Fall of China (from which our previous thread linked to).

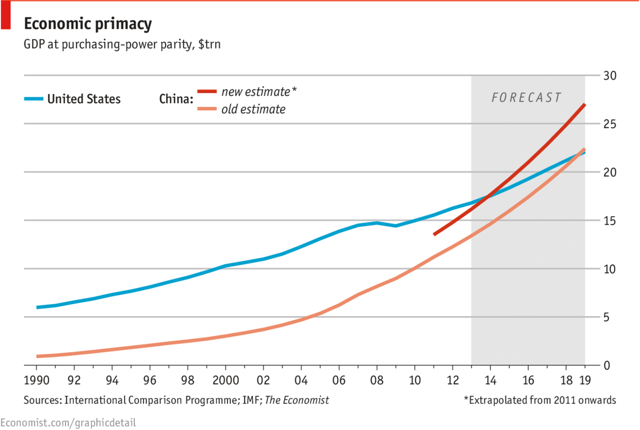

Before going on, its important to realise there are two ways to compare GDP. Nominal and Purchasing Power Parity (PPP). Now I should point out I like comparing GDP nominal, ie economy by exchange rates where we convert every non US countries GDP in their currency to the value in USD. It prevents the risk of overestimation just like how China's economy was overestimated in 2007 using PPP. PPP by comparison tries to take into account different costs in the countries. So countries with low cost, the same amount of USD go further. Its a complicated procedure and the final unit used is the international dollar. So you can see, PPP runs the risk of overestimation while nominal arguably underestimates (which is why I just compare nominal to be on the safe side). PPP also has other uses. Say if we wanted to compare US economy with the Soviet Union economy. The USSR unlike China doesn't engage in much international trade, so how useful are exchange rates in that case? Problem there. PPP is also useful for historical GDP. Say you want to know if the Qin dynasty had a larger economy than the Roman Empire, you would have to use some PPP terms.

Now since people in that previous thread obviously believed PPP was a decent indicator one would think they might want to know about this new information.

You see the world bank had listed China's economy in 2011 as 11.185 trillion international dollars. linky before they post the new revised figures in. Please also note that these figures are higher than the 10 trillion international dollars it was valued at in 2007 when it was revised down. In other words in 4 years it made up what it "lost". Well since its in PPP and merely reflects that China wasn't as cheap as previously thought, it wasn't actually a loss per se, but we can't let details get in the way of a good gloat.

Every few years the method to convert to PPP terms are updated. Recently the World Bank published their revised GDP PPP figures which can be found here. Long story short the World Bank revised China's GDP up by about 2.3 trillion international dollars. For 2011. Not for last year, for 2011 (which I assume is because it took a long time to gather the data). So fast forward to 2013 the Chinese economy is obviously going to be bigger once they start using this method and revising the GDP PPP figures from 2012 onwards.

What does this mean? Well the following article elaborates.

Financial Times

Does it change anything? Most probably just interesting if you are interested in economical milestones.In military terms? Well if you expect it to change thats like saying you expect the US Navy to be better than the Royal Navy the moment the US surpassed the British GDP. What about the PRC government? The Chinese government certainly use nominal rather than PPP (as witnessed by the fact they only declared themselves the second largest economy when they surpassed Japan in nominal terms, whereas they could have done so years earlier when they did so in PPP terms).April 30, 2014 1:01 am

China poised to pass US as world’s leading economic power this year

By Chris Giles, Economics Editor

The US is on the brink of losing its status as the world’s largest economy, and is likely to slip behind China this year, sooner than widely anticipated, according to the world’s leading statistical agencies.

The US has been the global leader since overtaking the UK in 1872. Most economists previously thought China would pull ahead in 2019.

The figures, compiled by the International Comparison Program hosted by the World Bank, are the most authoritative estimates of what money can buy in different countries and are used by most public and private sector organisations, such as the International Monetary Fund. This is the first time they have been updated since 2005.

After extensive research on the prices of goods and services, the ICP concluded that money goes further in poorer countries than it previously thought, prompting it to increase the relative size of emerging market economies.

The estimates of the real cost of living, known as purchasing power parity or PPPs, are recognised as the best way to compare the size of economies rather than using volatile exchange rates, which rarely reflect the true cost of goods and services: on this measure the IMF put US GDP in 2012 at $16.2tn, and China’s at $8.2tn.

In 2005, the ICP thought China’s economy was less than half the size of the US, accounting for only 43 per cent of America’s total. Because of the new methodology – and the fact that China’s economy has grown much more quickly – the research placed China’s GDP at 87 per cent of the US in 2011.

For 2011, the report says: “The US remained the world’s largest economy, but it was closely followed by China when measured using PPPs.”

With the IMF expecting China’s economy to have grown 24 per cent between 2011 and 2014 while the US is expected to expand only 7.6 per cent, China is likely to overtake the US this year.

The figures revolutionise the picture of the world’s economic landscape, boosting the importance of large middle-income countries. India becomes the third-largest economy having previously been in tenth place. The size of its economy almost doubled from 19 per cent of the US in 2005 to 37 per cent in 2011.

Russia, Brazil, Indonesia and Mexico make the top 12 in the global table. In contrast, high costs and lower growth push the UK and Japan further behind the US than in the 2005 tables while Germany improved its relative position a little and Italy remained the same.

The findings will intensify arguments about control over global international organisations such as the World Bank and IMF, which are increasingly out of line with the balance of global economic power.

When looking at the actual consumption per head, the report found the new methodology as well as faster growth in poor countries have “greatly reduced” the gap between rich and poor, “suggesting that the world has become more equal”.

The world’s rich countries still account for 50 per cent of global GDP while containing only 17 per cent of the world’s population.

Having compared the actual cost of living in different countries, the report also found that the four most expensive countries to live in are Switzerland, Norway, Bermuda and Australia, with the cheapest being Egypt, Pakistan, Myanmar and Ethiopia.

However for those who love gloating over this stuff with China bashing and dick waving, your dicks just got chopped.

Edit - I would love to see the faces of Gordon Chang, Michael Petis and a few China bears when they hear this.