Source

Trouble is, once again, brewing in the eurozone, and politicians, journalist and bureaucrats are doing their best to provide commentary and solutions to the ongoing crisis. Yet it seems that very few understand the root of the problem.

This is an explanation of problem with the Euro, and the 2 possible solutions.

Imagine a German and a Spanish carpenter shop. In 1999 they both proudly present their new line of wooden chairs – the Spanish chair being made from Olive trees and the German one made by precision machinery. Both chairs are sold for €100. They’re both spectacular successes and all is well in both carpenter shops. But the Germans with their precision machinery are good at improving their production process. They buy better machines, they optimise their processes and they cut down on scrap wood. The Spanish aren’t quite as good at the productivity game, so their production process doesn’t improve as much. It seems Germans just have a knack for clever solutions that make the chair-building process better and faster.

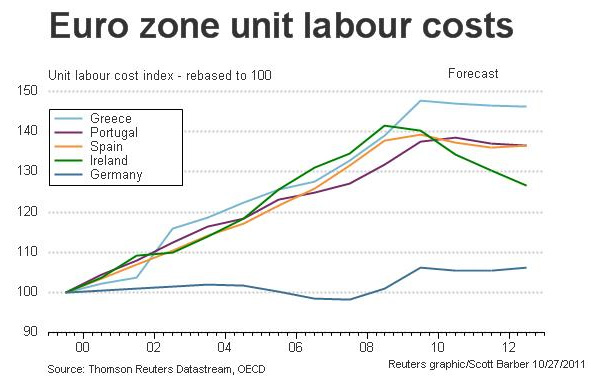

Because the Spanish workers aren’t as good as the German at optimising chair-making their chairs become more expensive over time. Let’s say that in 1999 a worker could make a chair for €75, and the carpenter shop made a neat profit of €25 – whether it was German or Spanish. As you can see in the graph below in 2005 a German worker could still produce a chair for €75, while a Spanish worker could produce it for €75*1.15 = €86. The German carpenter shop still makes a neat profit of €25 per chair, while the Spanish shop now only makes €14. All because of those pesky Germans and their knack for being ever more productive. For the Spanish shop things will only get worse, and in 2008 they start losing money on the chairs when they sell them for €100 since their unit labour cost has shot up. They just can’t compete with the Germans. Note that this isn’t necessarily because the Spanish workers are lazy, it’s just that the Germans have better machines, infrastructure and processes at their disposal.

As you can also see in the graph this is a trend that reverberates around all the southern periphery of the Eurozone. Greece, Spain, Italy and Portugal are all in trouble because they can’t follow the German growth in productivity. Their carpenter shops go broke while the Spanish consumers start buying German chairs because they are cheaper. The German carpenters make boatloads of money because they sell lots of chairs to the Southern European countries whose carpenter shops have gone out of business because they can’t make chairs as cheaply as the Germans. They’re still slaving away at manual lathes while the Germans push buttons on a CNC machine.

Before the Euro the Spanish central bank would catch the problem early on and pull some monetary policy levers to make the country competitive again. They could print more money, change the intrest rate or devalue the peseta. With these tools it was possible to make Spanish goods cheaper for Germans and other foreigners. For example, when the peseta was devalued by 24.6% in 1977 a German exchanging his D-mark for Pesetas would get 24.6% more pesetas, and thus be able to buy more Spanish wooden chairs for his D-marks, making Spain competitive again. This works the other way too of course, so a German chair (or a Japanese television) would become more expensive, which usually isn’t popular with the people that vote. This is why devaluing is a weapon that is only used in a crisis situation. A more common way of regaining competitiveness is printing money which raises inflation.

Of course with the euro this isn’t an alternative. One euro is one euro, whether it’s in Spain or Germany. There is no Spanish Central bank to control Spanish monetary policy. There is only the European Central Bank that controls the Euro, and it has to follow a monetary policy that will work for both low growth countries and high growth countries.

So Spain was screwed. Businesses started going bankrupt, people were fired and tax revenues dwindled. This, of course was a double whammy since unemployed people not only don’t pay taxes, they also cost the state money in social services. So the southern countries started borrowing money, amongst others from Germany which had plenty of them since their chair-making business was doing rather well. Germany also had an interest in keeping the southern countries afloat since they were it’s main export market, so they gladly spewed money to the south. Money flowed from Spanish consumers buying German wooden chairs, and back to the Spanish in the form of loans that they could then use to buy even more wooden chairs. This worked well because investors that lent money to the Southern European countries knew that the Euro was a safe currency – it was backed by rock-solid Germany after all. The Germans felt rich because their exports were stellar, and the Spanish felt rich because they could borrow unlimited amount of money at low interest. Nobody seemed to realise the problem until the Euro crisis broke out in 2010. Then everyone seemed to notice – and panic – at the same time. Greek and Italian borrowing costs went through the roof, Spanish unemployment went straight up, and everyone blamed Greece, Italy and Spain for spending too much money. Which was of course only half truthful since Germany had been making boatloads of money from selling wooden chairs and audis to the Southern countries for more than ten years. Nobody seems to talk about that though, it’s much easier to just blame those lazy Greeks (who by the way have longer working hours than Germans).

In 2010 it was obvious that there was a divide between the North that had been gaining competitiveness and the south that had been losing competitiveness. As you would expect the southerne countries moved into deep recession, had massive debt and unemployment worse than during the great depression. Spain currently has unemployment levels exceeding 25% and youth unemployment of more than 50%. The Spanish carpenters can only stand and watch as the cheaper German chairs are imported.

This disaster was entirely avoidable if the Euro bureaucrats had bothered to read Robert Mundall and Marcus Flemming’s seminal paper from 1962 which stated that according to well established macro economic models it was impossible to have domestic fiscal autonomy, fixed exchange rates, and free capital flows: no more than two of those objectives could be met. They won the nobel prize in economics for this in 1992, so it’s not exactly an obscure crackpot theory.

Since the euro is, by definition, the currency used in the eurozone the exchange rates must be fixed. One euro in Greece is the same as one euro in Germany. The same goes for free capital flows, if you have one euro in Spain and can’t spend it in Germany the eurozone doesn’t make much sense. So if it has to work the Euro zone members must give up their fiscal autonomy. What does this mean?

Fiscal policy is how a country taxes and spends it’s money. Tax rates, social spending, VAT, healthcare spending and infrastructure spending are all parts of fiscal policy. It’s basically a nations budget. According to the the Mundell-Fleming model, as it’s called, the only way forward is fiscal integration. A united States of Europe. There has been some talk of this in Buxelles, but few voters realise what it actually means. A fiscal union means that a substantial part of taxing and spending will be done from a central authority in Bruxelles – the EU. This means a loss of sovereignty for individual nations in the euro, and it also means pemanent fiscal transfers between member states.

Fiscal transfers may sound innocent, but it is at its core an acceptance of the fact that countries like Greece and Spain are less competitive than Germany and need a permanent and continued handout of money every year to compensate for that. The Germans will need to pay the Greeks. Not once, not as a loan but as a steady flow of money year after year until Greece eventually becomes competitive. If they ever do. If trends reverse and Greek productivity starts to rise faster than German productivity the flow of money is reversed. Basically the rich countries pay for the poor.

This may sound preposterous, but it’s actually quite common. Every nation has poor rural areas that need to be subsidised. Far-outish-upon-Grandalf with 1000 inhabitants and a closed factory in the North of England just isn’t a good business for England. But the government still pays for social services, public pensions, roads and schools because the British voters accept that even though far-outish-upon-Grandalf is pretty screwed up, they are after all British and you can’t just throw the poor bastards out of the Commonwealth.

A better example is the United States. As the name implies it’s a collection of states, but they all consider themselves Americans first and New Yorkers, or South Carolinan’s second. They pay federal tax to the United States and state tax to New York or South Carolina. Because there is a strong social cohesion around being part of the greatest county on earth they accept that South Carolina is a piss-poor state that needs handouts from the federal government year after year. Last year South Carolina spent $2.34 for every $1 they collected in taxes. Courtesy of the federal government. The rich New Yorkers are OK with that because, hey they may be poor and not have a major league baseball team but they are Americans – just like us. We stand united! MURICA!

So if the Euro is to survive in its current form fiscal integration is a necessity. There’s just one problem. Those damned voters. European voters aren’t Europeans first and Germans second. They’re Germans or spaniards or Greeks that happen to be members of this euro-thing they don’t quite understand, but it means they don’t have to change to pesetas when they go on holiday in Spain so it’s probably a good thing. But none of them fly the European flag with pride from their homes like the Americans do. None of them proudly announce that they’re Europeans when they go abroad like Americans do, and none of them feel like they have much in common with people from other countries in the eurozone. They aren’t really Europeans, and there is no way German, Finnish or Belgian voters will accept yearly handouts counted in billions of euro to Spain, Portugal and Greece. They don’t even speak the same language. It’s just not going to happen. The social cohesion isn’t there.

The rhetoric of Angela Merkel captures the essence perfectly. “Those lazy euro-borrowing Greeks need to pay up. They also need to impose austerity, fire public workers, cut their budgets, spend less money and get their act together. Noway we’re going to pay for them” It’s pretty obvious that she, or maybe her voters, aren’t European enough to accept the fact that Greece will never be able to repay it’s debt, no matter how much they cut their spending. They’ve cut their spending by 25% since 2010, a staggering and unprecedented cut, but it isn’t enough for Germany. Because of the lacking growth in productivity it will never be enough. Meanwhile Greece is falling apart, a whole generation of youth is lost, poverty is rampant and Golden Dawn, a nazi party where half of the elected politicians are in jail for violent crimes, will likely rise to power at the next general elections if the current leader of the governing coalition Syriza doesn’t get a break.

It’s also a trend that has been repeatedly shown in referendums around the eurozone – when put to a national vote the voters tend to say no to the Euro and European union. Most famously when the Danes, to the surprise of everyone, voted no to joining the euro in 2000 even though almost all parties endorsed it. A second referendum has been on the drawing board ever since, but has never been held because the polls clearly show that the Danes will vote no again. There’s just no popular support for it.

It’s pretty obvious that the voting public of the Eurozone is lightyears away from considering themselves Europeans first. It’s just not going to happen. At least not within the foresseable future. There is noway the tides of public opinion can be swayed towards love of the union, especially not with the current crisis and accompanying finger pointing rhetoric used by almost all politicians. The Germans hate the Greeks because they can’t pay their loans, the Spanish hate the Finns because they impose ever more austerity on them, the Greeks hate the Germans because they think Merkel is trying to run their country. Everyone hate Cyprus because they do banking for Russian Oligarchs. It’s a total clusterfuck.

This leaves one last option.

A breakup of the Euro.

The take away paragraph for me was:

Well, that's not going to happen.This disaster was entirely avoidable if the Euro bureaucrats had bothered to read Robert Mundall and Marcus Flemming’s seminal paper from 1962 which stated that according to well established macro economic models it was impossible to have domestic fiscal autonomy, fixed exchange rates, and free capital flows: no more than two of those objectives could be met. They won the nobel prize in economics for this in 1992, so it’s not exactly an obscure crackpot theory.

Since the euro is, by definition, the currency used in the eurozone the exchange rates must be fixed. One euro in Greece is the same as one euro in Germany. The same goes for free capital flows, if you have one euro in Spain and can’t spend it in Germany the eurozone doesn’t make much sense. So if it has to work the Euro zone members must give up their fiscal autonomy.