Syriza wins Greece election

Moderators: Alyrium Denryle, Edi, K. A. Pital

- K. A. Pital

- Glamorous Commie

- Posts: 20814

- Joined: 2003-02-26 11:39am

- Location: Elysium

Re: Syriza wins Greece election

Considerably? To have 2,4% of the debt that is 175% of GDP suddenly be close to 2% of their GDP, the economy of Greece must have an annual growth rate exceeding 12% in the next 5 years.

You are clearly insane if you think this is feasible.

Spiegel is a lying rag.

You are clearly insane if you think this is feasible.

Spiegel is a lying rag.

Lì ci sono chiese, macerie, moschee e questure, lì frontiere, prezzi inaccessibile e freddure

Lì paludi, minacce, cecchini coi fucili, documenti, file notturne e clandestini

Qui incontri, lotte, passi sincronizzati, colori, capannelli non autorizzati,

Uccelli migratori, reti, informazioni, piazze di Tutti i like pazze di passioni...

...La tranquillità è importante ma la libertà è tutto!

Lì paludi, minacce, cecchini coi fucili, documenti, file notturne e clandestini

Qui incontri, lotte, passi sincronizzati, colori, capannelli non autorizzati,

Uccelli migratori, reti, informazioni, piazze di Tutti i like pazze di passioni...

...La tranquillità è importante ma la libertà è tutto!

Assalti Frontali

- J

- Kaye Elle Emenopey

- Posts: 5861

- Joined: 2002-12-14 02:23pm

Re: Syriza wins Greece election

Let's see what the spreadsheet says:mr friendly guy wrote:I don't see the contradiction, since the interest rate is for the average for the full term of the loan, and they have an interest free period. By which time they may have managed to make a dent in the principle (before the interest free period ends) and their GDP may have grown. This two factors would undoubtedly affect the amount of GDP needed to service the interest payments.

~180 billion Euros GDP x 175% is 315 billion Euros of debt at 2.4% interest, which is 4.2% of their GDP.

Let's give Greece a 10 year interest free grace period, assume a 2 year turnaround in their economy, and a 3% annual growth rate in GDP thereafter. And they run a 3% surplus that's used to pay down their debt. I've just worked out the numbers in a spreadsheet and at the end of 10 years it gives a GDP of 228 billion Euros against a remaining debt of 254.75 billion Euros.

At a blended rate of 2.4% interest that's just under 2.7% of their GDP going towards the interest alone.

So yes. Does anyone bother doing their math these days? This took me 5 minutes to check it with a spreadsheet. The numbers, even with a wholly unrealistic best case scenario still don't match what's claimed in the article. In the real world, as I've mentioned already, no EU country has ever managed a sustained GDP growth rate of over 2%. I gave Greece 3%. And it still doesn't work. My earlier conclusion stands: the debt is unpayable.

This post is a 100% natural organic product.

The slight variations in spelling and grammar enhance its individual character and beauty and in no way are to be considered flaws or defects

I'm not sure why people choose 'To Love is to Bury' as their wedding song...It's about a murder-suicide

- Margo Timmins

When it becomes serious, you have to lie

- Jean-Claude Juncker

The slight variations in spelling and grammar enhance its individual character and beauty and in no way are to be considered flaws or defects

I'm not sure why people choose 'To Love is to Bury' as their wedding song...It's about a murder-suicide

- Margo Timmins

When it becomes serious, you have to lie

- Jean-Claude Juncker

- K. A. Pital

- Glamorous Commie

- Posts: 20814

- Joined: 2003-02-26 11:39am

- Location: Elysium

Re: Syriza wins Greece election

Is 3% growth and simultaneously a 3% surplus that's used to repay the debt an even remotely feasible situation? No.

Lì ci sono chiese, macerie, moschee e questure, lì frontiere, prezzi inaccessibile e freddure

Lì paludi, minacce, cecchini coi fucili, documenti, file notturne e clandestini

Qui incontri, lotte, passi sincronizzati, colori, capannelli non autorizzati,

Uccelli migratori, reti, informazioni, piazze di Tutti i like pazze di passioni...

...La tranquillità è importante ma la libertà è tutto!

Lì paludi, minacce, cecchini coi fucili, documenti, file notturne e clandestini

Qui incontri, lotte, passi sincronizzati, colori, capannelli non autorizzati,

Uccelli migratori, reti, informazioni, piazze di Tutti i like pazze di passioni...

...La tranquillità è importante ma la libertà è tutto!

Assalti Frontali

- J

- Kaye Elle Emenopey

- Posts: 5861

- Joined: 2002-12-14 02:23pm

Re: Syriza wins Greece election

Of course it isn't. But that's not going to stop the lies and screeching from the EU supporters. It's just like arguing with an anti-vaxxer, they're ignorant liars and no amount of facts will get through to them.

This post is a 100% natural organic product.

The slight variations in spelling and grammar enhance its individual character and beauty and in no way are to be considered flaws or defects

I'm not sure why people choose 'To Love is to Bury' as their wedding song...It's about a murder-suicide

- Margo Timmins

When it becomes serious, you have to lie

- Jean-Claude Juncker

The slight variations in spelling and grammar enhance its individual character and beauty and in no way are to be considered flaws or defects

I'm not sure why people choose 'To Love is to Bury' as their wedding song...It's about a murder-suicide

- Margo Timmins

When it becomes serious, you have to lie

- Jean-Claude Juncker

- K. A. Pital

- Glamorous Commie

- Posts: 20814

- Joined: 2003-02-26 11:39am

- Location: Elysium

Re: Syriza wins Greece election

Not to mention Greece only has 5 years, not 10. That is for non-IMF debt, too.

Lì ci sono chiese, macerie, moschee e questure, lì frontiere, prezzi inaccessibile e freddure

Lì paludi, minacce, cecchini coi fucili, documenti, file notturne e clandestini

Qui incontri, lotte, passi sincronizzati, colori, capannelli non autorizzati,

Uccelli migratori, reti, informazioni, piazze di Tutti i like pazze di passioni...

...La tranquillità è importante ma la libertà è tutto!

Lì paludi, minacce, cecchini coi fucili, documenti, file notturne e clandestini

Qui incontri, lotte, passi sincronizzati, colori, capannelli non autorizzati,

Uccelli migratori, reti, informazioni, piazze di Tutti i like pazze di passioni...

...La tranquillità è importante ma la libertà è tutto!

Assalti Frontali

- Thanas

- Magister

- Posts: 30779

- Joined: 2004-06-26 07:49pm

Re: Syriza wins Greece election

So explain why Greece is currently paying 2% of their GDP to service debt then? Maybe, just maybe, Spiegel is not lying and the interest on most Greek loans are not having to be paid because the ECB transfers any interest paid on the portion of its loans back to Greece.Stas Bush wrote:Considerably? To have 2,4% of the debt that is 175% of GDP suddenly be close to 2% of their GDP, the economy of Greece must have an annual growth rate exceeding 12% in the next 5 years.

Don't slander Spiegel, they have a great record when it comes to facts. They certainly are not lying.Spiegel is a lying rag.

Whoever says "education does not matter" can try ignorance

------------

A decision must be made in the life of every nation at the very moment when the grasp of the enemy is at its throat. Then, it seems that the only way to survive is to use the means of the enemy, to rest survival upon what is expedient, to look the other way. Well, the answer to that is 'survival as what'? A country isn't a rock. It's not an extension of one's self. It's what it stands for. It's what it stands for when standing for something is the most difficult! - Chief Judge Haywood

------------

My LPs

------------

A decision must be made in the life of every nation at the very moment when the grasp of the enemy is at its throat. Then, it seems that the only way to survive is to use the means of the enemy, to rest survival upon what is expedient, to look the other way. Well, the answer to that is 'survival as what'? A country isn't a rock. It's not an extension of one's self. It's what it stands for. It's what it stands for when standing for something is the most difficult! - Chief Judge Haywood

------------

My LPs

- J

- Kaye Elle Emenopey

- Posts: 5861

- Joined: 2002-12-14 02:23pm

Re: Syriza wins Greece election

Prove it. Pull up the Greek government budgets for the years since the initial bailout along with their complete flow of funds and balance of payments. Prove that the payments were made from actual revenues as opposed to paying off existing debts with new ones. If you can't or refuse to do so then retract your claim. You've already made countless claims in this thread which have been proven false, and some of us are goddamn sick of doing your work for you.Thanas wrote:So explain why Greece is currently paying 2% of their GDP to service debt then? Maybe, just maybe, Spiegel is not lying and the interest on most Greek loans are not having to be paid because the ECB transfers any interest paid on the portion of its loans back to Greece.Stas Bush wrote:Considerably? To have 2,4% of the debt that is 175% of GDP suddenly be close to 2% of their GDP, the economy of Greece must have an annual growth rate exceeding 12% in the next 5 years.

This post is a 100% natural organic product.

The slight variations in spelling and grammar enhance its individual character and beauty and in no way are to be considered flaws or defects

I'm not sure why people choose 'To Love is to Bury' as their wedding song...It's about a murder-suicide

- Margo Timmins

When it becomes serious, you have to lie

- Jean-Claude Juncker

The slight variations in spelling and grammar enhance its individual character and beauty and in no way are to be considered flaws or defects

I'm not sure why people choose 'To Love is to Bury' as their wedding song...It's about a murder-suicide

- Margo Timmins

When it becomes serious, you have to lie

- Jean-Claude Juncker

- Crown

- NARF

- Posts: 10615

- Joined: 2002-07-11 11:45am

- Location: In Transit ...

Re: Syriza wins Greece election

Meh, conceded. I had already pointed out that that German views on Greek debt relief were polling high (as apposed to Eurozone crisis) earlier, should have kept internal consistency in my post.Thanas wrote:Of course there is. Took me less than two seconds of googling to find it, though to be fair I wrote in German.

<snip>

So it seems that every German party is against it and even the radical left parties are against it. So German voters seem to be even more against a debt haircut. Merkel's popular mandate is 4-5% stronger than that of Syriza.

They’re not begging for money, you know that right? They’re asking for time (which was offered to Samars in November but he turned down as he wanted to hold a gun to the head of the Greek electorate in order to win the election) in order to present a plan where they would seek to stop taking money.Thanas wrote:I do, I see people who are isolated in Europe, filled with hubris and think they have the right to dictate terms while begging for money.

He stopped the fire sale of Greek assets that was overseen by a former government every fucking man and his dog - including you agree was corrupt and ineffectual until such time as the current government can satisfy its self that selling off Greek assets is in the best interests of Greece. And he hired back cleaning ladies. The nerve of him!Thanas wrote:What claims? The claim that Syriza is rolling back reforms? He stopped the privatization of the power market and rehired thousands of former bureaucrats. Did you miss that part? It was all over the news. Do you really want me to source that?

That would include Paul Krugman (whom I've quoted many times but you refuse to acknowledge), Paul De Grauwe, Simon Wren-Lewis, Thomas Piketty, Philippe Legrain, Dani Rodrik and Wolfgang Münchau to name a few.Thanas wrote:None, except in the minds of people who think Greece cannot survive without a debt haircut.

He’s been using that terminology since at least 2012, and for good reason too. Stop being such a Miss Perfect Precious and open your eyes and read some of his work, he’s more of a Federalist than you. And for those that won’t bother to read any of his work let me provide the abridged version; he campaigned against Greece entering the Euro way back in the 90s for all of the self evident reasons now, but now that Greece is in it the only way the Eurozone can hope to function is if it integrates more, a Grexit in his eyes would be disastrous for Greece (and you should note that this is not a view shared by a lot of the members of Syriza - of which he actually isn’t an official member) and possibly catastrophic for Europe in general.Thanas wrote:Meanwhile, Greece continues being classy and respectful of dialogue by comparing the Troika to CIA torturers.

http://www.theguardian.com/business/liv ... 7a835034fc

You may trust it, but it's clear you couldn't fucking understand it. Or simple mathematics for that matter. All Speigel have done is reprint the offical Troika script, cover their arse by inserting "Whether Greece will ever be able to pay back its debts on its own is a question about which experts have been arguing since the beginning of the crisis."Thanas wrote:And this is a good article By the most trusted name in news I know of:

So which is it Thanas? Can Greece pay back it's debts or not, because Speigel didn't fucking say so one way or another.

And I would love to know what the fuck they mean by 'the IMF' isn't worried, since the IMF has already broken ranks with the other members of the Troika and has said it won't make austerity a condition on any future bailouts (small wonder too since they thought it was batshit crazy back in 2010 when confidential internal documents were leaked and eventually issued a mea culpa in 2013 or if you prefer here's Speigel's article on it, since you know they're the only ones you trust or something).

Η ζωή, η ζωή εδω τελειώνει!

"Science is one cold-hearted bitch with a 14" strap-on" - Masuka 'Dexter'

"Angela is not the woman you think she is Gabriel, she's done terrible things"

"So have I, and I'm going to do them all to you." - Sylar to Arthur 'Heroes'

- Vendetta

- Emperor's Hand

- Posts: 10895

- Joined: 2002-07-07 04:57pm

- Location: Sheffield, UK

Re: Syriza wins Greece election

Asking the media about economic issues, no matter how "trusted" they are in other areas, is like asking a Republican politician about climate change.

They've all bought into the con, because the people they actually ask about economic matters are in the pocket of city financial interests and way off the mainstream of academic economic opinion (and have, over the course of the financial crisis, been proven just as wrong as climate denialsts, but still control the media presentation of the issue).

They've all bought into the con, because the people they actually ask about economic matters are in the pocket of city financial interests and way off the mainstream of academic economic opinion (and have, over the course of the financial crisis, been proven just as wrong as climate denialsts, but still control the media presentation of the issue).

- Crown

- NARF

- Posts: 10615

- Joined: 2002-07-11 11:45am

- Location: In Transit ...

Re: Syriza wins Greece election

My favourite one was when he thought Iceland should be the model for Greece. I nearly fell of my chair; default on 85% of your debt, start criminal investigations and sentence bankers, financiers and government ministers to jail? Fucks sake he would have been made a Hero of the Hellenic Republic.J wrote:You've already made countless claims in this thread which have been proven false, and some of us are goddamn sick of doing your work for you.

Η ζωή, η ζωή εδω τελειώνει!

"Science is one cold-hearted bitch with a 14" strap-on" - Masuka 'Dexter'

"Angela is not the woman you think she is Gabriel, she's done terrible things"

"So have I, and I'm going to do them all to you." - Sylar to Arthur 'Heroes'

- Crown

- NARF

- Posts: 10615

- Joined: 2002-07-11 11:45am

- Location: In Transit ...

Re: Syriza wins Greece election

So about that 'it was all Greece's fault and the EU were tricked' meme;

Jub, Thanas and all the other puritan misanthropes rejoice! Greece's current Finance Minster was a whistle blower back in 2005.

Jub, Thanas and all the other puritan misanthropes rejoice! Greece's current Finance Minster was a whistle blower back in 2005.

Η ζωή, η ζωή εδω τελειώνει!

"Science is one cold-hearted bitch with a 14" strap-on" - Masuka 'Dexter'

"Angela is not the woman you think she is Gabriel, she's done terrible things"

"So have I, and I'm going to do them all to you." - Sylar to Arthur 'Heroes'

- Thanas

- Magister

- Posts: 30779

- Joined: 2004-06-26 07:49pm

Re: Syriza wins Greece election

In what world is "give us a bridging loan financed by you" not asking for money? They "promise" to eventually stop asking for money. I don't trust them.Crown wrote:They’re not begging for money, you know that right? They’re asking for time (which was offered to Samars in November but he turned down as he wanted to hold a gun to the head of the Greek electorate in order to win the election) in order to present a plan where they would seek to stop taking money.

Or, in other words, stopping much needed privatization and reforms. Can you really say with a straight face that there is any guarantee such reforms will ever happen?He stopped the fire sale of Greek assets that was overseen by a former government every fucking man and his dog - including you agree was corrupt and ineffectual until such time as the current government can satisfy its self that selling off Greek assets is in the best interests of Greece.

Again, I very much doubt that thousands of people he wants to rehire are all cleaning ladies.And he hired back cleaning ladies. The nerve of him!

Others dealt with that, I see no need to parrot them unlike some other people on this board.Thanas wrote:That would include Paul Krugman (whom I've quoted many times but you refuse to acknowledge)

Oh great, I can google and pull up names as well. What is this supposed to prove?, Paul De Grauwe, Simon Wren-Lewis, Thomas Piketty, Philippe Legrain, Dani Rodrik and Wolfgang Münchau to name a few.

He and his master are doing a great job of that so far, antagonizing everybody in sight. Oh, and I assume you agree with me that the constant comparisons to Nazi Germany are indeed what they want, now that it is stated policy to seek reparations?He’s been using that terminology since at least 2012, and for good reason too. Stop being such a Miss Perfect Precious and open your eyes and read some of his work, he’s more of a Federalist than you.

That being said, if somebody thinks this is waterboarding then he is off his rocker. We all know what he is doing, he is trying to frame the debate in his own terms so that anything associated with a programme he opposes has a pejorative touch to it.

If he thinks a Grexit would be disastrous, then he should do a better job not threatening it in every interview.And for those that won’t bother to read any of his work let me provide the abridged version; he campaigned against Greece entering the Euro way back in the 90s for all of the self evident reasons now, but now that Greece is in it the only way the Eurozone can hope to function is if it integrates more, a Grexit in his eyes would be disastrous for Greece (and you should note that this is not a view shared by a lot of the members of Syriza - of which he actually isn’t an official member) and possibly catastrophic for Europe in general.

Prove it. Pull up the Troika script they have used.You may trust it, but it's clear you couldn't fucking understand it. Or simple mathematics for that matter. All Speigel have done is reprint the offical Troika script, cover their arse by inserting "Whether Greece will ever be able to pay back its debts on its own is a question about which experts have been arguing since the beginning of the crisis."

No modern nation can realistically pay back all its debts. Not even Germany can, most people agree that even were we to levy extra taxes at best we would have paid it back in 2150, most likely 2200. Japan currently has a debt of 250% of GDP - do you see them paying that back? All that matters is if they can service the debt. And considering they are paying below 2.6% for 2014 and most likely 2% for 2015 I don't see how that is unfair.So which is it Thanas? Can Greece pay back it's debts or not, because Speigel didn't fucking say so one way or another.

I don't have access to that data. However, I assume the FT can be trusted. It shows a figure of 2.6% of GDP for 2014.J wrote:Prove it. Pull up the Greek government budgets for the years since the initial bailout along with their complete flow of funds and balance of payments.

BTW, this seems to be a related publication where the 2% figure Spiegel is citing might come from. I would assume that Bruegel has access to the data.Whatever government emerges after Greece’s parliamentary election, Athens will soon lock horns with its international creditors over its mountain of public debt, which stands at about 175 per cent of gross domestic product.

Eurozone governments have already made commitments to further debt relief for Athens, as long as it sticks to reform and austerity. Alexis Tsipras, leader of the leftwing, anti-austerity Syriza, wants to go much further and cut Greece’s debt pile by a third, arguing that the burden is “unsustainable”.

But is it?

Other eurozone governments, who hold directly or via the European Financial Stability Facility, approximately two-thirds of Athens’ €317bn liabilities, are more sceptical. They argue that Greece has already benefited from two rounds of relief that have significantly cut the burden of the debt.

The terms on Greece’s debt pile have become progressively more manageable. The maturity on the bilateral loans provided by eurozone member states in May 2010 has been extended to 2041 and the interest rate cut from between 300 and 400 basis points over the three-month Euribor rate, to just 50.

The EFSF loans, whose yield is just one basis point over the average borrowing cost of the EFSF itself, now have an average maturity of more than 30 years. In 2012, the eurozone finance ministers agreed on a grace period of 10 years over which Athens will have to make no principal repayment.

As a result of these changes, the average maturity of Greece’s debt is now 16.5 years, double that of Germany and Italy, according to data compiled by Joakim Tiberg, a strategist at UBS. Portugal and Ireland, which also benefit from favourable terms for their own bailout loans, have average maturities of 11 and 12.5 years, respectively.

Furthermore, the amount Greece pays each year to service its debts has steadily come down. Zsolt Darvas, a research fellow at Bruegel, a think-tank, has calculated that Greece’s nominal interest spending in 2014 was 4.3 per cent of gross domestic product, less than Italy or Portugal.

In fact, this is probably an overestimate of the real interest burden. Greece did not have to pay any interest on its EFSF loans and received back the yield it pays to the European Central Bank and other national central banks, which hold just under one-tenth of its debt. Taking this into account, Mr Darvas calculates that total interest expenditure in 2014 was 2.6 per cent, only marginally above France’s 2.2 per cent.

On the basis of these figures, many economists and European policy makers are questioning whether Greece’s raw debt-to-GDP figure is a meaningful measure of the burden of past liabilities on the economy.

“A ratio of 170 per cent does not mean anything,” said Lorenzo Bini Smaghi, a former executive board member of the European Central Bank. “The debt has a very low interest rate and a maturity of over 15 years. Its impact on the economy is much lower than in Portugal or Italy,” he added.

A new round of restructuring could also create political problems for eurozone governments, many of which, as a percentage of GDP, face a higher interest bill than Greece.

“How can the Spanish or Italian prime minister tell voters that Greece has a lower interest burden than we have, but we still need to give them debt forgiveness?” said Mr Darvas. He argues that rather than providing Athens outright relief, eurozone governments should give Greece assurances that they are ready to further extend maturities and cut rates were growth to disappoint in the future.

Let me just stop there for a second - Greece gets 2.9% of its GDP from the EU. That is more than they pay for Interest on all their debt (see below).In the days ahead of the Greek snap elections on 25 January 2015 a huge range of opinions has appeared on what Greece and its lenders should do. A large group of people are saying that Greek public debt is unsustainable and a significant part of it should be written off. In their view, the Troika is responsible for the deep crisis, austerity has failed, and the fiscal space gained from the debt write-off should be used to stimulate growth.

Another group says that irresponsible pre-crisis Greek policies, as well as the extremely large, 15% of GDP budget deficit in 2009, necessitated the bail-out in 2010. Implementation of the bail-out conditionality was incomplete and the Geek public sector is so inefficient and so much depends on cronyism that it is not surprising that the Greek crisis became so deep.

As always, both sides have some truths but none of these explanations is complete. One could write a lot on what happened, who is responsible for desperate social hardship and what should have been done differently. But after the elections, both Greece’s new leaders and euro-area partners should look ahead: given the status quo, what are the real choices?

Exit is not an option.

Greece would enter another deep recession, which would push unemployment up further and reduce budget revenues, requiring another round of harsh fiscal consolidation: exactly what opposition parties want to avoid. (This effect is forgotten by those who argue that since Greece has a primary budget surplus, it has now the option to default and exit.) Euro-area creditors would lose a lot on their Greek claims and private claims on Greece would also suffer (see our earlier post here). Moreover, exit would also risk the stopping of EU-budget related inflows to Greece (cohesion and structural funds, agricultural subsidies): in 2013 Greece received a net payment of 2.9 % of GDP from the EU budget. This was a transfer (not a loan) and the country would receive similar transfers in the future too.

The publication suggest another few options to alleviate the Greek problem which I would also be fine with.Debt write-down is extremely unlikely – and unnecessary as well. Any level of debt is sustainable if it has a very low interest rate. Japan is a prime example: gross public debt is almost 250 % of GDP, while the average interest rate is 0.9 percent per year. Despite the very high Japanese public debt, there is no talk about its restructuring.

Loans from euro-area partners to Greece carry super-low interest rates and also have very long maturities. The lending rate from the European Financial Stability Facility (EFSF) is a mere 1 basis point over the average borrowing cost of the EFSF, which is around 0.2 percent per year currently. The average maturity of EFSF loans is over 30 years with the last loan expiring in 2054. Moreover, in 2012 the Eurogroup agreed on a deferral of interest payments of Greece on EFSF loans by 10 years, implying zero cash-flow interest cost on EFSF loans during this period. The interest rate charged on bilateral loans from euro-area partners is Euribor plus 50 basis points, which is currently about 0.56 % per year: another very low value (which could be lowered further, as we argued here). Bilateral loans have a long maturity too: they should be gradually repaid between 2020-2041.

One can say that yields will not remain so low forever and if ever growth and inflation will pick up in the euro area, interest rates will increase. Unfortunately, this is in the distant future and therefore the cash-flow gain for Greece from stopping interest payments to euro-area partners would be very low in the next few years.

In fact, according my calculations, one of the demands of Syriza leader Alexis Tsipras will be likely met this year, even without any change in bail-out terms: actual interest service costs of Greece will likely be below 2% of GDP in 2015. Table 1 shows the situation in 2014. Total interest expenditures of Greece amounted to 4.3 % of GDP. However, interest paid to the ECB and euro-area national central banks (NCBs) is returned to Greece (if Greece meets the conditions of the bail-out programme) and interest payments on EFSF loans are deferred. If we subtract these, interest payments were only 2.6% of GDP in 2014, well below the values of other periphery countries. Given that interest rates have fallen significantly from 2014, actual interest expenditures of Greece will be likely below 2% of GDP in 2015, if Greece will meet the conditions of the bail-out programme.

Since the actual debt servicing cost of Greece is low, it is extremely unlikely that parliaments and governments of euro-area lending countries would decide to cancel their Greek loans and raise taxes at home to cover the losses.

Whoever says "education does not matter" can try ignorance

------------

A decision must be made in the life of every nation at the very moment when the grasp of the enemy is at its throat. Then, it seems that the only way to survive is to use the means of the enemy, to rest survival upon what is expedient, to look the other way. Well, the answer to that is 'survival as what'? A country isn't a rock. It's not an extension of one's self. It's what it stands for. It's what it stands for when standing for something is the most difficult! - Chief Judge Haywood

------------

My LPs

------------

A decision must be made in the life of every nation at the very moment when the grasp of the enemy is at its throat. Then, it seems that the only way to survive is to use the means of the enemy, to rest survival upon what is expedient, to look the other way. Well, the answer to that is 'survival as what'? A country isn't a rock. It's not an extension of one's self. It's what it stands for. It's what it stands for when standing for something is the most difficult! - Chief Judge Haywood

------------

My LPs

- Crown

- NARF

- Posts: 10615

- Joined: 2002-07-11 11:45am

- Location: In Transit ...

Re: Syriza wins Greece election

Don't be a simpleton; they're asking for the original deal that was offered Samaras last year - which I already explained he rejected in order to scare an electorate - that was already agreed Greece could have since it had met all the previous criteria.Thanas wrote:In what world is "give us a bridging loan financed by you" not asking for money? They "promise" to eventually stop asking for money. I don't trust them.

I'm loving the irony of you claiming people wanting to 'frame the debate' later, while just assuming that privatisation is 'much needed' as an accepted fact.Thanas wrote:Or, in other words, stopping much needed privatization and reforms. Can you really say with a straight face that there is any guarantee such reforms will ever happen?

Quick question; what do you call 25% unemployment in economic terms?Thanas wrote:Again, I very much doubt that thousands of people he wants to rehire are all cleaning ladies.

Not a single person has 'dealt with' Krugman's - now vindicated - position.Thanas wrote:Others dealt with that, I see no need to parrot them unlike some other people on this board.

I'll give you a hint; they're all highly respected economists who aren't being bank rolled by the financial sector.Thanas wrote:Oh great, I can google and pull up names as well. What is this supposed to prove?

He congratulated Germany for getting rid of its Nazi's and lamented the fact that he shares a parliament where the third most popular party are Nazis. And I also congratulate him on being courteous to Europe's serial defaulter of the past century. I also congratulate him for keeping his civility in a room full of fraudsters, liars and crooks who attempted to scare the Greek electorate prior to the recent elections, and are quite simply either incompetent or complicit in Greece's current woes since every single one of their 'predictions' were wrong with catastrophic repercussions for Greek society.Thanas wrote:He and his master are doing a great job of that so far, antagonizing everybody in sight. Oh, and I assume you agree with me that the constant comparisons to Nazi Germany are indeed what they want, now that it is stated policy to seek reparations?

Lets refresh our memories shall we;Thanas wrote:That being said, if somebody thinks this is waterboarding then he is off his rocker. We all know what he is doing, he is trying to frame the debate in his own terms so that anything associated with a programme he opposes has a pejorative touch to it.

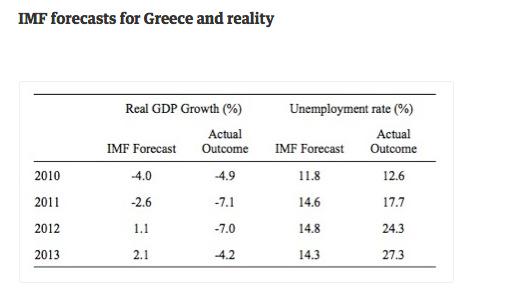

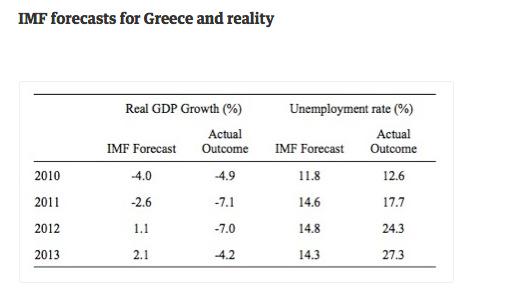

What the Troika predicted regarding Austerity spending versus what actually happened.

What the Troika predicted regarding Greece's GDP versus what actually happened.

What the Troika predicted regarding GDP and unemployment versus what actually happened.

Did you miss that he thinks it would be catastrophic (and I admit I didn't post this, but unnecessary and completely avoidable) for Europe as a whole?Thanas wrote:If he thinks a Grexit would be disastrous, then he should do a better job not threatening it in every interview.

What other than the fact they were starting every sentence with; 'The IMF believes', or 'The ECB says' and didn't print a single argument in negation didn't clue you in from the onset? Exactly how many times were you dropped on your head as a child?Thanas wrote:Prove it. Pull up the Troika script they have used.

It's unfair because is being asked forced to swallow a voodoo economic policy in order to receive financing which it wouldn't have to do if it wasn't part of the Euro. Do you get that? Sovereign default and debt restructuring is nothing new, the only thing unique here is that Greece's primary means of doing so are being denied it because it's part of the Euro. If being part of the Euro has resulted in a situation where Greece's current crisis is worse than the Great Depression you have to be the dumbest fuck nut on the planet to say 'I don't see how that is unfair'.Thanas wrote:No modern nation can realistically pay back all its debts. Not even Germany can, most people agree that even were we to levy extra taxes at best we would have paid it back in 2150, most likely 2200. Japan currently has a debt of 250% of GDP - do you see them paying that back? All that matters is if they can service the debt. And considering they are paying below 2.6% for 2014 and most likely 2% for 2015 I don't see how that is unfair.

No, it can't for all the reasons Vendetta outlined.Thanas wrote:I don't have access to that data. However, I assume the FT can be trusted. It shows a figure of 2.6% of GDP for 2014.

Η ζωή, η ζωή εδω τελειώνει!

"Science is one cold-hearted bitch with a 14" strap-on" - Masuka 'Dexter'

"Angela is not the woman you think she is Gabriel, she's done terrible things"

"So have I, and I'm going to do them all to you." - Sylar to Arthur 'Heroes'

- J

- Kaye Elle Emenopey

- Posts: 5861

- Joined: 2002-12-14 02:23pm

Re: Syriza wins Greece election

Guess what? You're wrong again. It's like you have a learning disability. Literally.Thanas wrote:Let me just stop there for a second - Greece gets 2.9% of its GDP from the EU. That is more than they pay for Interest on all their debt (see below).

You still haven't learned that others will check your numbers to see if they add up.

Current transfers balance, from the Bank of Greece

http://www.bankofgreece.gr/BogDocumentE ... y_data.xls

It's ranged from effectively zero to about 2.5% of GDP in the past 10 years or so, though it was higher in the early days of EU integration.

This post is a 100% natural organic product.

The slight variations in spelling and grammar enhance its individual character and beauty and in no way are to be considered flaws or defects

I'm not sure why people choose 'To Love is to Bury' as their wedding song...It's about a murder-suicide

- Margo Timmins

When it becomes serious, you have to lie

- Jean-Claude Juncker

The slight variations in spelling and grammar enhance its individual character and beauty and in no way are to be considered flaws or defects

I'm not sure why people choose 'To Love is to Bury' as their wedding song...It's about a murder-suicide

- Margo Timmins

When it becomes serious, you have to lie

- Jean-Claude Juncker

- mr friendly guy

- The Doctor

- Posts: 11235

- Joined: 2004-12-12 10:55pm

- Location: In a 1960s police telephone box somewhere in Australia

Re: Syriza wins Greece election

Firstly Aerius made a statement without even considering GDP growth and deferred interest. If he did it certainly wasn't clear in his post. One can't complain about one side not showing numbers when one only uses half the numbers so to speak. Which is sort of amusing for me as the neutral observer here.J wrote: So yes. Does anyone bother doing their math these days? This took me 5 minutes to check it with a spreadsheet. The numbers, even with a wholly unrealistic best case scenario still don't match what's claimed in the article. In the real world, as I've mentioned already, no EU country has ever managed a sustained GDP growth rate of over 2%. I gave Greece 3%. And it still doesn't work. My earlier conclusion stands: the debt is unpayable.

Secondly as you like to point out, its not my job to do your homework for you, even if it takes only 5 minutes.

Thirdly from reading this thread, you haven't put in the following into your spreadsheet - "However, interest paid to the ECB and euro-area national central banks (NCBs) is returned to Greece (if Greece meets the conditions of the bail-out programme) and interest payments on EFSF loans are deferred." And no, I am not going to do your homework for you.

Never apologise for being a geek, because they won't apologise to you for being an arsehole. John Barrowman - 22 June 2014 Perth Supernova.

Countries I have been to - 14.

Australia, Canada, China, Colombia, Denmark, Ecuador, Finland, Germany, Malaysia, Netherlands, Norway, Singapore, Sweden, USA.

Always on the lookout for more nice places to visit.

Countries I have been to - 14.

Australia, Canada, China, Colombia, Denmark, Ecuador, Finland, Germany, Malaysia, Netherlands, Norway, Singapore, Sweden, USA.

Always on the lookout for more nice places to visit.

- J

- Kaye Elle Emenopey

- Posts: 5861

- Joined: 2002-12-14 02:23pm

Re: Syriza wins Greece election

The blended rate of 2.4% includes everything which is paid back to Greece for meeting the loan conditions. Every single article that's been posted states that the effective rate is 2.4%, give or take a couple tenths of a percent.mr friendly guy wrote:Thirdly from reading this thread, you haven't put in the following into your spreadsheet - "However, interest paid to the ECB and euro-area national central banks (NCBs) is returned to Greece (if Greece meets the conditions of the bail-out programme) and interest payments on EFSF loans are deferred." And no, I am not going to do your homework for you.

Also, I should clarify that my statements on "doing your homework" refer mostly to Thanas, who continually posts articles with brazen errors that need to be fact checked and debunked.

This post is a 100% natural organic product.

The slight variations in spelling and grammar enhance its individual character and beauty and in no way are to be considered flaws or defects

I'm not sure why people choose 'To Love is to Bury' as their wedding song...It's about a murder-suicide

- Margo Timmins

When it becomes serious, you have to lie

- Jean-Claude Juncker

The slight variations in spelling and grammar enhance its individual character and beauty and in no way are to be considered flaws or defects

I'm not sure why people choose 'To Love is to Bury' as their wedding song...It's about a murder-suicide

- Margo Timmins

When it becomes serious, you have to lie

- Jean-Claude Juncker

-

BabelHuber

- Padawan Learner

- Posts: 328

- Joined: 2002-10-30 10:23am

Re: Syriza wins Greece election

Vindicated? Krugman is the typical ivory tower "expert" whose "solutions" would ultimatively fail if applied to the real world.Crown wrote:Not a single person has 'dealt with' Krugman's - now vindicated - position.

Basically, his main arguments are:

1.) Germany is too competitive. This bleeds out the neighbouring countries.

1. a.) Germany needs to become less competitive, so that the other European countries can recover.

1. b.) Germany's trade surplusses are bad. You cannot trade with martians, so one country's trade surplus has to be another country's trade deficit. So if Germany reduces this surplus, the other European countries will benefit.

2. Greece needs an ongoing flow of foreign money, so that its economy can recover. At the same time, reforms should be applied to its economy. Only afterwards, the flow of money can be reduced

This is so far from reality that it is not even funny.

Point 1 is easily addressed:

1 a.) If Germany becomes less competitive, who says that other European economies will profit?

China also could profit instead. Then you would have severely weakened the European economy and strengthened the Chinese one. Now this would be good for the EU, wouldn't it?

The EU is not a closed economy, if one member gets weaker, it does not necessarily mean that another member gets stronger. The EU as a whole also could become weaker.

And do you honestly believe German voters would vote for a politician who wants to make the country weaker?

1 b.)

Now this is pure theoretic bullshit. There will always be countries with a trade deficit, and there will always be countries with a trade surplus. It is completely unrealistic to have close to 200 countries, and every single one has a balanced trade.

If you factor this in, a trade surplus is always better then a balanced trade in real life. Of course not necessarily in Krugman's ivory tower, but this doesn't bother me at all.

Also, Krugman doesn't seem to know that other EU countries do profit from German's exports. Just ask the automotive suppliers in Belgium, Hungary, Poland and the Czech republic how they would like Krugman's approach of weakening the German industry.

Also, German corporations heavily invest in the EU. But they again don't usually invest much in Greece. Instead they invest in Poland, the Czech republic and Romania.

Perhaps Greece should become competitive to these countries, then they would get a piece of the cake. But of course it is much easier to demand foreign money for free.

And no, the fact that these other countries don't have the Euro does not count. Greece wanted the Euro, now they have to live with it or leave.

For numbers, see here: http://www.tradingeconomics.com/germany ... e-of-trade

From January to December 2014, exports and imports reached record highs: shipments rose 3.7 percent to €1133.6 billion while imports grew 2.0 percent to € 916.5 billion.

Compared with 2013, sales to the EU countries increased by 5.4 percent to €657.3 billion and arrivals from those countries increased 3.6 percent to €599.9 billion. Goods to the value of €414.2 billion (2.7 percent) were dispatched to the Euro area countries in 2014, while the value of the goods received from those countries was €411.4 billion

So regarding the Euro area, in 2014 we had German exports of €414.2 billion and imports of €411.4 billion.Exports to countries outside the European Union amounted to €476.2 billion (1.5 percent) in 2014, while imports from those countries totaled €316.6 billion (-0.9 percent).

Is this a trade surplus to speak of? Or is this roughly balanced? Are these €3 billion the cause of Greece's problems?

2.

Greece "bought" its standard of living by living beyond its means. They loaned money which they directly spent to pay the wages of civil servants, retirees etc. On top of it, the bureaucracy was inefficient and fraud was common (e.g islands where almost everybody was officially blind, so they received the according subsidies).

To keep the flow of money into Greece while at the same time reforming the country has to fail in real live: This concept is almost impossible to sell to the voters in the other EU countries, especially in those which have a lower standard of living then Greece in the first place.

These countries would have every right to demand the same concept for them. Who would pay for this?

On top of it, Greece was unwilling to reform during the last decades, so how would you force them to reform their country without putting pressure on them? Who would believe a promise from Greece anymore?

Ladies and gentlemen, I can envision the day when the brains of brilliant men can be kept alive in the bodies of dumb people.

- Crown

- NARF

- Posts: 10615

- Joined: 2002-07-11 11:45am

- Location: In Transit ...

Re: Syriza wins Greece election

Yes, vindicated. As in he made predictions during the crisis relating to austerity policies which proved to be correct.BabelHuber wrote:Vindicated?Crown wrote:Not a single person has 'dealt with' Krugman's - now vindicated - position.

LOLBabelHuber wrote:Krugman is the typical ivory tower "expert" whose "solutions" would ultimatively fail if applied to the real world.

An actual empirical factual study of pundits claims versus real world outcomes Krugman was shown to be the most reliable. You're funny. I like you.

I warned you last time you simpleton little fuck that I will not engage in your strawman bullshit. You have failed to provide any quotes or sources for your claims of what Krugman’s arguments are. And worse you are not addressing anything that Krugman has said about austerity at all, you know that thing we're discussing in this thread? Austerity, heard of it? However just for shits and giggles I’m gonna entertain myself thusly;BabelHuber wrote:Basically, his main arguments are:

How the FUCK can you compare Greece’s competitiveness to non-Euro member countries (Poland, Romania, Hungary and the Czech Republic) and then state ‘the fact that these other countries don't have the Euro does not count’. In what reality do we just get to ignore what affect a currency has on a country's economic competitiveness? Do you also compare the top speed between a cheetah and a peregrine falcon and just ignore one can fly?

Remarkable claims require remarkable evidence. Source this bullshit.BabelHuber wrote:Greece "bought" its standard of living by living beyond its means. They loaned money which they directly spent to pay the wages of civil servants, retirees etc. On top of it, the bureaucracy was inefficient and fraud was common (e.g islands where almost everybody was officially blind, so they received the according subsidies).

Just like Iceland did? How was the decision to write off all of Germany's debt sold to all it's creditors last century?BabelHuber wrote:To keep the flow of money into Greece while at the same time reforming the country has to fail in real live: This concept is almost impossible to sell to the voters in the other EU countries, especially in those which have a lower standard of living then Greece in the first place.

Of course other periphery countries should renegotiate the completely stupid and punitive austerity bullshit economics. And they should do so regardless on the Greek situation. They can just point out that Germany was last century's serial defaulter so they should be the last nation on the planet to lecture on economic responsibility if we want to turn and economic argument into a moral one.BabelHuber wrote:These countries would have every right to demand the same concept for them. Who would pay for this?

Well to begin with, the current Finance Minster of Greece was a whistleblower in 2005 to Eurostat regarding Greece's dodgy accounting;BabelHuber wrote:On top of it, Greece was unwilling to reform during the last decades, so how would you force them to reform their country without putting pressure on them? Who would believe a promise from Greece anymore?

https://www.youtube.com/watch?v=07-hA9D ... tu.be&t=7m

And this 'unwilling to reform' bullshit is just another way of saying 'austerity would work if they did it right' despite every single factual empirical analysis showing that every austerity champion got it wrong on austerity. I have posted numerous times in this thread showing that the IMF has admitted culpability in insisting austerity be the medicine for Greece and having predictions so far of the mark they can only be labeled as catastrophic.

And yet here you are again ignoring all the evidence, all the realities and setting up scenarios where you just get to ignore pesky things like currency when discussing a country's economic woes. Well Don Quixote, those aren't giants you're fighting; they're windmills.

Η ζωή, η ζωή εδω τελειώνει!

"Science is one cold-hearted bitch with a 14" strap-on" - Masuka 'Dexter'

"Angela is not the woman you think she is Gabriel, she's done terrible things"

"So have I, and I'm going to do them all to you." - Sylar to Arthur 'Heroes'

-

BabelHuber

- Padawan Learner

- Posts: 328

- Joined: 2002-10-30 10:23am

Re: Syriza wins Greece election

About the German trade surplus:Crown wrote:I warned you last time you simpleton little fuck that I will not engage in your strawman bullshit. You have failed to provide any quotes or sources for your claims of what Krugman’s arguments are.

http://krugman.blogs.nytimes.com/2013/1 ... many-does/

http://www.nytimes.com/2013/11/04/opini ... .html?_r=0

Are you joking? Krugman calls the current EU policiy "austerity". This is because he believes that there is not enough money floating into Greece to make up for the structural problems the country has!Crown wrote:And worse you are not addressing anything that Krugman has said about austerity at all, you know that thing we're discussing in this thread? Austerity, heard of it? However just for shits and giggles I’m gonna entertain myself thusly;

This is his main point - the EU has to spend more on Greece despite everything what has happened. And as I've outlined, this is not feasible in the real world.

If Greece wants to lure investors into the country, then it is a direct competitor to other eastern European countries, like Poland, the Czech Republic and Romania.Crown wrote:How the FUCK can you compare Greece’s competitiveness to non-Euro member countries (Poland, Romania, Hungary and the Czech Republic) and then state ‘the fact that these other countries don't have the Euro does not count’. In what reality do we just get to ignore what affect a currency has on a country's economic competitiveness? Do you also compare the top speed between a cheetah and a peregrine falcon and just ignore one can fly?

Do you honestly believe Greece could cry a river to investors because it is unfair to have the Euro, and then have success with this strategy? They have to be competitive to achieve something, and if they think the Euro is hampering their efforts, they are free to quit.

But as long as they have the Euro, they have to deal with it.

http://www.worldcrunch.com/culture-soci ... ODRUPmG-CwCrown wrote:Remarkable claims require remarkable evidence. Source this bullshit.

This is a link I have quickly found - it was all over the press back then.

That’s the post card. This winter, this island the Venetians dubbed “the Flower of the East” acquired a new, equally exotic nickname: “The Island of the Blind.” On Mar. 19, Stelios Bozikis, the mayor of Zakynthos (Zante in Greek) convened television crews to confirm that the island was under investigation from the Greek Health Ministry. The reason was the abnormally high number of blind and visually impaired people: 682 people were receiving up to 325 euros in government benefits. Each. According to the World Health Organization, that’s nine times the average in developed countries.

“I discovered this anomaly at the start of 2011, when the responsibility to distribute the benefits shifted from the prefecture to the town hall,” says Mayor Bozikis. “I wrote to Athens, but in the central administration they were dragging their feet. I was afraid that they wanted to bury the story, so I made it public.”

We've already outlined time and time again in this thread the Iceland is not comparable to Greece here - in Iceland the state was healthy, "only" the banks went bancrupt. In a state with 300,000 inhabitants or so. In Greece, the state itself went bancrupt.Crown wrote:Just like Iceland did? How was the decision to write off all of Germany's debt sold to all it's creditors last century?

The condition regarding Germany was different back then. There is no point in repeating the same bullshit again and again.

So you are saying the periphery countries should demand that Germany and the other northern European countries simply pay for their wellbeing?BabelHuber wrote:Of course other periphery countries should renegotiate the completely stupid and punitive austerity bullshit economics. And they should do so regardless on the Greek situation. They can just point out that Germany was last century's serial defaulter so they should be the last nation on the planet to lecture on economic responsibility if we want to turn and economic argument into a moral one.

This has not turned out well in the case of Greece, moron. Greece got already paid €90 Billion by the EC/ EU for free (IIRC from 1982 to 2008, without taking inflation into account).

This did not work, now your "solution" is to repeat it! This is idiotic, really.

Yeah right, spending money left and right did not work, so we spend more money to solve the problems. Brilliant plan, and totally easy to realize in the real world.Crown wrote:And this 'unwilling to reform' bullshit is just another way of saying 'austerity would work if they did it right' despite every single factual empirical analysis showing that every austerity champion got it wrong on austerity. I have posted numerous times in this thread showing that the IMF has admitted culpability in insisting austerity be the medicine for Greece and having predictions so far of the mark they can only be labeled as catastrophic.

You can as well spare us the bullshit-without-substance part of your posts.Crown wrote:And yet here you are again ignoring all the evidence, all the realities and setting up scenarios where you just get to ignore pesky things like currency when discussing a country's economic woes. Well Don Quixote, those aren't giants you're fighting; they're windmills.

Ladies and gentlemen, I can envision the day when the brains of brilliant men can be kept alive in the bodies of dumb people.

- Crown

- NARF

- Posts: 10615

- Joined: 2002-07-11 11:45am

- Location: In Transit ...

Re: Syriza wins Greece election

EDIT :: Premature posting!

Will amend and repost.

Will amend and repost.

Η ζωή, η ζωή εδω τελειώνει!

"Science is one cold-hearted bitch with a 14" strap-on" - Masuka 'Dexter'

"Angela is not the woman you think she is Gabriel, she's done terrible things"

"So have I, and I'm going to do them all to you." - Sylar to Arthur 'Heroes'

- Terralthra

- Requiescat in Pace

- Posts: 4741

- Joined: 2007-10-05 09:55pm

- Location: San Francisco, California, United States

Re: Syriza wins Greece election

682 people out of 40,759! You're right, that is "almost everybody!"

Oh, wait. No, it isn't. Well, shit, there goes that argument for you.

Oh, wait. No, it isn't. Well, shit, there goes that argument for you.

- Crown

- NARF

- Posts: 10615

- Joined: 2002-07-11 11:45am

- Location: In Transit ...

Re: Syriza wins Greece election

So back in 2013 Krugman was saying that a German surplus was creating a deflationary bias within the Eurozone, eh? Wonder if he was wrong or not;BabelHuber wrote:About the German trade surplus:

http://krugman.blogs.nytimes.com/2013/1 ... many-does/

http://www.nytimes.com/2013/11/04/opini ... .html?_r=0

Oh look at that, it was creating a deflation, wow, how wrong he was!

There isn't, 80% of the money 'floated into Greece' floated its way straight out to the banks! Did it escape your notice that the 'myth' of austerity has caused a shrinkage of 25% of Greece's GDP which was completely avoidable? Did it escape your notice that Greece is suffering a depression that has now outlasted the Great Depression? Do you remember how the Great Depression was made worse and how it was made better?BabelHuber wrote:Are you joking? Krugman calls the current EU policiy "austerity". This is because he believes that there is not enough money floating into Greece to make up for the structural problems the country has!

It does and it is. They can dress it anyway they want; growth package, stimulus package, hair cut, payment restructuring, etc.BabelHuber wrote:This is his main point - the EU has to spend more on Greece despite everything what has happened. And as I've outlined, this is not feasible in the real world.

How the FUCK does your internal logic work? You say that Greece having the Euro and the others not having it 'doesn't count' and then claim that Greece having the Euro means 'they have to deal with it'? You're internally self-contradictory. The only way that Greece can compete with these nations is by drastically slashing wages, which it did. But that is still not enough if its unemployment continues to grow. Hey, I've seen this scenario before; unemployment rising coupled with falling wages, wanna guess when?BabelHuber wrote:If Greece wants to lure investors into the country, then it is a direct competitor to other eastern European countries, like Poland, the Czech Republic and Romania.

Do you honestly believe Greece could cry a river to investors because it is unfair to have the Euro, and then have success with this strategy? They have to be competitive to achieve something, and if they think the Euro is hampering their efforts, they are free to quit.

But as long as they have the Euro, they have to deal with it.

Right so a possible 700 people committing fraud on an island of 40,000 is, and I quote; "islands where almost everybody was officially blind". I think we've discovered the root cause of our disagreement; you are arithmetically illiterate! If you believe 700 out of a population of 40,000 is 'almost everybody' then I can understand why you're having difficulty in understanding why Greece needs its debt restructured.BabelHuber wrote:This is a link I have quickly found - it was all over the press back then.

And you've been told, time and time again that this is simply because Iceland allowed its banks to fail while Greek banks (along with French and German banks) weren't since Greece was 'rescued' by the Troika buy increasing it's debt with a 'bailout'.BabelHuber wrote:We've already outlined time and time again in this thread the Iceland is not comparable to Greece here - in Iceland the state was healthy, "only" the banks went bancrupt. In a state with 300,000 inhabitants or so. In Greece, the state itself went bancrupt.

I'll bring it up every time you try and make this as some kind of moral argument; i.e. 'they deserve it', 'they're thieves', 'they're lazy', 'they're fraudsters' etcBabelHuber wrote:The condition regarding Germany was different back then. There is no point in repeating the same bullshit again and again.

No I'm saying that the periphery countries should tell Germany; we're happy you're doing well but we're drowning here. Our unemployment is over 20% (with youth at around 50%) and we would really like an end to what is made up austerity bullshit which has extended a recession beyond a time frame of the Great Depression. If the creditors want to insist on reforms (crack down on tax evasion, corruption, etc) fine, but you cannot continue to contract an economy year after year and claim 'working as intended'.BabelHuber wrote:So you are saying the periphery countries should demand that Germany and the other northern European countries simply pay for their wellbeing?

Because while the core economies (and their citizens) will find it unpalatable, the periphery will revolt. As it did in Greece; be thankful (as am I) that they voted for the left and not the right.

I'm not going to claim that Greece between early 1980s to late 1990s was a shining example of a vibrant economy, but only a blind ideologue with an axe to grind can completely ignore what happened post Euro entry and not see a connection between the introduction of the single currency and absurdly cheap credit to what eventually transpired. However just because this happened doesn't mean we should continue with a policy which is so obviously discredited by every measurable index known to economists. When the goddamned IMF goes 'oops, we fucked up' it's time to re-asses.BabelHuber wrote:This has not turned out well in the case of Greece, moron. Greece got already paid €90 Billion by the EC/ EU for free (IIRC from 1982 to 2008, without taking inflation into account).

This did not work, now your "solution" is to repeat it! This is idiotic, really.

Remind me again what do you call it when cut wages and unemployment soars?BabelHuber wrote:Yeah right, spending money left and right did not work, so we spend more money to solve the problems. Brilliant plan, and totally easy to realize in the real world.

BabelHuber wrote:You can as well spare us the bullshit-without-substance part of your posts.

Η ζωή, η ζωή εδω τελειώνει!

"Science is one cold-hearted bitch with a 14" strap-on" - Masuka 'Dexter'

"Angela is not the woman you think she is Gabriel, she's done terrible things"

"So have I, and I'm going to do them all to you." - Sylar to Arthur 'Heroes'

- aerius

- Charismatic Cult Leader

- Posts: 14825

- Joined: 2002-08-18 07:27pm

Re: Syriza wins Greece election

Hey man, get with the times, it's the new math.Terralthra wrote:682 people out of 40,759! You're right, that is "almost everybody!"

Oh, wait. No, it isn't. Well, shit, there goes that argument for you.

682/40,759 = 98%

Also

2.4 x 1.75 = 2

The answer is whatever you want it to be!

Lusankya: Deal!

Say, do you want it to be a threesome with your wife? Or a foursome with your wife and sister-in-law? I'm up for either.

- Vendetta

- Emperor's Hand

- Posts: 10895

- Joined: 2002-07-07 04:57pm

- Location: Sheffield, UK

Re: Syriza wins Greece election

To be fair, that's how economic policy has been set since basically the 1980s.aerius wrote:Hey man, get with the times, it's the new math.Terralthra wrote:682 people out of 40,759! You're right, that is "almost everybody!"

Oh, wait. No, it isn't. Well, shit, there goes that argument for you.

682/40,759 = 98%

Also

2.4 x 1.75 = 2

The answer is whatever you want it to be!

- Tribble

- Sith Devotee

- Posts: 3152

- Joined: 2008-11-18 11:28am

- Location: stardestroyer.net

Re: Syriza wins Greece election

Keeping Greece within the Euro is a lost cause, and always has been. Greece should have never been allowed to join the Euro. Failing that, it should have been required to leave the moment the failures in its economy became apparent. The bailouts and austerity measures were never going to work in the long run. Not necessarily because the bailouts and measures were bad, but rather because the Greek voters weren't going to tolerate it for long.

The one thing the EU seems to fail to understand is that unless the EU is willing to invade and occupy the country the Greek voters are ultimately the ones in charge of Greece. Why they didn't see this one coming is beyond me.

IMO in the long run it's far better for everyone involved if Greece leaves the Euro sooner rather than later. The EU's belief that the status quo can be maintained is simply unrealistic, as is Greece's belief that it can negotiate a better deal. While leaving the Euro would definitely be harsh for Greece in the short run, and may cause some instability to the Eurozone, isn't it better to have the EU and Syriza pull the plug now rather than wait for the Greek voters to turn to parties like Golden Dawn?

The one thing the EU seems to fail to understand is that unless the EU is willing to invade and occupy the country the Greek voters are ultimately the ones in charge of Greece. Why they didn't see this one coming is beyond me.

IMO in the long run it's far better for everyone involved if Greece leaves the Euro sooner rather than later. The EU's belief that the status quo can be maintained is simply unrealistic, as is Greece's belief that it can negotiate a better deal. While leaving the Euro would definitely be harsh for Greece in the short run, and may cause some instability to the Eurozone, isn't it better to have the EU and Syriza pull the plug now rather than wait for the Greek voters to turn to parties like Golden Dawn?

"I reject your reality and substitute my own!" - The official Troll motto, as stated by Adam Savage